What Is an Angel Investor and Where Can You Find One for Your Business?

Angel investors are individuals who provide financial support to early-stage startups and entrepreneurs in exchange for equity or convertible debt. They are typically high-net-worth individuals with a keen interest in investing in innovative business ideas.

Angel investors play a crucial role in funding and nurturing promising ventures that may not yet be eligible for traditional financing options. Their investments can provide the necessary capital and expertise to help startups grow and succeed.

This article explores the concept of angel investors, their characteristics, and how they differ from other types of investors. It also discusses the pros and cons of getting funding from angel investors, as well as strategies to attract them to fund your business.

What Are Angel Investors?

Angel investors, sometimes referred to as private or seed investors, are individuals who invest their personal funds in startup businesses. Unlike venture capitalists who pool money from multiple investors, angel investors typically use their own money. While angel investors are often individuals, the funds can be provided through various entities such as limited liability companies (LLCs), businesses, trusts, or investment funds.

These structures are established by the investor for tax purposes or legal protection. Angel investors not only offer financial support but also provide valuable industry knowledge, guidance, and networking opportunities to the startups they invest in.

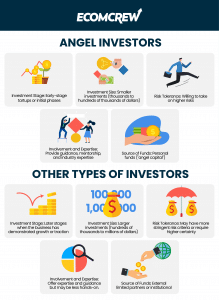

There are several key differences between angel investors and other types of investors. Here are some notable distinctions:

Investment Stage: Angel investors typically invest in early-stage startups or businesses that are in their initial phases. They are often the first external investors in a company, providing seed funding or early-stage capital. In contrast, other types of investors, such as venture capitalists or private equity firms, may invest at later stages when the business has already demonstrated some level of growth or traction.

Investment Size: Angel investors typically make smaller investments compared to other types of investors. Their investments can range from a few thousand dollars to several hundred thousand dollars. This is because angel investors are often investing their own personal funds rather than pooled funds like venture capitalists or institutional investors.

Involvement and Expertise: Angel investors often bring more than just capital to the table. They can provide valuable guidance, mentorship, and industry expertise to the entrepreneurs they invest in. They may actively participate in the business by offering strategic advice, making introductions to their networks, and even taking on advisory or board roles. Other types of investors may also offer expertise and guidance but may be less hands-on in their involvement.

Risk Tolerance: Angel investors are generally willing to take on higher risks compared to other types of investors. They understand that early-stage startups have a higher likelihood of failure but are willing to take the risk in exchange for the potential for significant returns. Other types of investors may have more stringent risk criteria or require a higher level of certainty before investing.

Source of Funds: Angel investors typically invest their personal funds, often referred to as “angel capital.” They may have accumulated wealth through previous entrepreneurial ventures or other successful investments. In contrast, other types of investors, such as venture capitalists or private equity firms, raise funds from external limited partners or institutional investors to invest in startups or businesses.

Pros and Cons of Getting Funding from Angel Investors

Understanding the potential benefits and drawbacks of this funding source can help entrepreneurs make informed decisions that align with their business goals.

Pros

- Financial Support: Angel investors provide capital to startups, helping them launch or grow their business.

- Expertise and Mentorship: Angel investors often have experience and industry knowledge, offering valuable guidance and advice to entrepreneurs.

- Networking Opportunities: Angel investors usually have extensive networks, which can help startups connect with other investors, partners, or potential customers.

- Validation and Credibility: Having an angel investor on board can enhance a startup's credibility, making it easier to attract additional funding or partnerships.

- Flexibility in Deal Structure: Angel investors may offer more flexible terms and conditions compared to traditional lenders, accommodating unique startup needs.

Cons

- Equity Dilution: Angel investors typically require equity in the company in exchange for their investment, which means giving up a portion of ownership and control.

- Interference and Influence: Some angel investors may want to have a say in business decisions or operational matters, potentially conflicting with the founder's vision.

- Pressure for Quick Returns: Angel investors may have high expectations for returns on their investment, putting pressure on startups to achieve rapid growth and profitability.

- Limited Funding Capacity: Angel investors typically provide smaller funding amounts compared to venture capital firms, limiting the scale of investment available.

- Risk of Misalignment: There can be a mismatch in expectations between entrepreneurs and angel investors, leading to conflicts or disagreements down the line.

How Do You Find an Angel Investor?

Securing adequate funding is crucial for the success and growth of any business venture. One effective way to acquire the necessary financial support is through angel investors.

Angel investors are individuals or groups who provide capital, guidance, and expertise to early-stage startups in exchange for equity. We will explore effective strategies to find an angel investor and obtain the much-needed business funding.

Define Your Funding Needs. Before embarking on the search for an angel investor, it is essential to have a clear understanding of your funding requirements. Determine the amount of capital you need, how it will be utilized, and the expected timeframe for achieving your business milestones. This clarity will help you present a compelling case to potential investors.

Research Angel Investor Networks. To find angel investors, begin by researching and identifying relevant angel investor networks. These networks consist of groups or platforms that connect investors with entrepreneurs seeking funding. Prominent examples include AngelList, Gust, and FundingPost. Explore their websites, review their investor profiles, and assess their investment preferences and criteria.

Attend Networking Events. Networking events present excellent opportunities to meet potential angel investors face-to-face. Look for events and conferences specifically focused on entrepreneurship, startups, and investment. Attend these gatherings, engage in conversations, and make connections. Be prepared to succinctly present your business idea and funding requirements to pique investor interest.

Leverage Online Platforms. Online platforms dedicated to connecting entrepreneurs with investors have gained significant popularity in recent years. Create a compelling profile on platforms like AngelList, Gust, or SeedInvest. Highlight your business concept, growth potential, and funding requirements. Actively engage with the platform's community, participate in forums, and explore opportunities to directly reach out to interested investors.

How to Attract Angel Investors to Fund Your Business

Unlocking the potential for entrepreneurial growth requires tapping into the vast resources of angel investors who are eager to fuel promising ventures. By understanding the art of attracting these financial catalysts, businesses can secure the crucial funding needed to propel their visions forward.

Here are a few strategies you can implement to attract angel investors to take a risk on your business.

1. Prepare a Solid Business Plan

A comprehensive and well-thought-out business plan is essential to attract angel investors. It should clearly outline the market opportunity, business model, revenue potential, and growth strategy.

2. Demonstrate Market Potential and Scalability

Angel investors are looking for startups with significant market potential and scalability. Presenting a compelling case for growth and demonstrating a deep understanding of the target market, competition, and customer needs can attract angel investors.

3. Build a Strong Team

Angel investors not only invest in the business idea but also in the team behind it. Assembling a talented and experienced team with a track record of success can increase the appeal to angel investors.

4. Establish a Compelling Pitch and Presentation

Craft a compelling pitch that clearly communicates the unique value proposition of your business. Presentations should be concise, persuasive, and highlight the key aspects that differentiate your startup from others in the market.

5. Highlight the Value Proposition and Competitive Advantage

Clearly articulate the value proposition of your product or service and emphasize the competitive advantage it offers. Angel investors are interested in startups that can disrupt industries or solve pressing problems in innovative ways.

6. Develop a Realistic Financial Forecast

A realistic and well-supported financial forecast demonstrates your understanding of the market dynamics and your ability to generate returns on investment. Include detailed projections of revenue, expenses, and milestones, showing a clear path to profitability. There are specialized companies and freelancers available to assist businesses with financial forecasting, such as ForecastRx. They provide expert guidance in analyzing market trends, assessing financial data, and formulating accurate forecasts, ensuring your business has a comprehensive and reliable plan for success. Collaborating with professionals can enhance the accuracy and effectiveness of your financial forecast.

Where Can I Find Angel Investors for My Business?

Here are the websites and places where you can look for angel investors who would be willing to fund your business.

- AngelList. This is a popular online platform that connects startups with angel investors. It allows entrepreneurs to create a profile, showcase their business, and connect with potential investors.

- Gust. This is another online platform that connects startups with angel investors, venture capitalists, and other funding sources. It also provides tools for entrepreneurs to manage their fundraising process.

- SeedInvest. It is an equity crowdfunding platform that connects accredited investors with startups. It allows entrepreneurs to showcase their business and raise capital from a large network of investors.

SeedInvest helps entrepreneurs find angel investors to support their business ventures.

- Local and regional angel investor groups. Research local and regional angel investor groups in your area. These groups often have regular meetings or pitch events where entrepreneurs can present their business ideas and connect with potential investors. These groups are often interested in supporting local businesses and startups.

- Business incubators and accelerators. Consider applying to business incubators and accelerators. These organizations provide mentorship, resources, and sometimes investment to startups. They often have connections with angel investors and can facilitate introductions.

- Industry-specific events and conferences. Attend industry-specific events and conferences where angel investors may be present. These events provide opportunities to network and build relationships with potential investors who have an interest in your industry.

- Personal networks and referrals. Leverage your personal networks and ask for referrals. Reach out to mentors, advisors, friends, and colleagues who may have connections to angel investors or who can introduce you to potential investors.

Tips for Approaching and Engaging with Angel Investors

When approaching and engaging with angel investors, it is crucial to thoroughly research and understand their investment preferences and portfolio. Craft a compelling and concise pitch that highlights your unique value proposition and demonstrates a clear path to profitability.

Clearly communicate what your business does, why it's unique, and why you believe it's a good investment opportunity. Personalize your message to show that you have chosen the investor specifically for their interests and expertise.

You can also attend networking events, pitch competitions, and industry conferences to build relationships with angel investors. Be genuine, listen to their feedback, and take the opportunity to learn from their experiences. Building a rapport over time can increase the likelihood of securing investment.

After initial contact, follow up with potential investors and maintain regular communication. Keep them updated on your progress, milestones achieved, and any major developments in your business. This demonstrates your commitment and professionalism.

Conclusion

Securing angel investment requires proactive efforts. Don't wait for investors to come to you; actively seek out opportunities to connect with potential investors. Be prepared, persistent, and adaptable in your approach. Building relationships and leveraging available resources can increase your chances of finding the right angel investor for your business.