Three Taxes and Duties That Can Burn Importers

On a recent Friday, my company got a call from the IRS.

Gulp.

An agent from the Excise Tax division was calling to ask why we hadn't paid excise tax on a particular product we had been importing for the previous three years. We had imported over $100,000 of these items. Have you ever heard of excise tax? Because I sure hadn't!

We were facing the prospect of over $10,000 in back taxes, plus interest, and plus penalties. I let the IRS agent know that I would get back to him the following week. Over the weekend I went into frantic ‘research mode' figuring out everything I could about Excise Tax. I'll follow up on how our experience ended further down in this post.

When you're importing into the United States there are three taxes and duties that many importers don't know about. Here's a summary of some of these things that you should be aware of:

Anti Dumping Tariffs

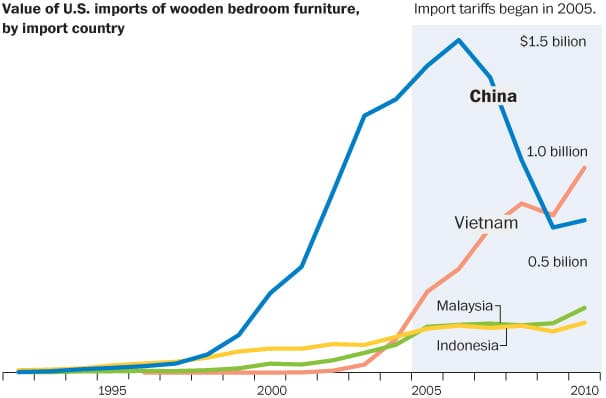

We all know about customs duties and most of us simply bake the 5-20% cost of duties into our price. But U.S. customs also has a list of products they target under “anti-dumping” measures. Basically, the U.S. believes certain countries sell particular products at unreasonably low prices and subsequently imposes HUGE duties on these products (normally in excess of 100%). Customs Brokers say importers ignorantly importing a product subject to anti-dumping duties is one of the most common mistakes they see. In fact, a friend of mine recently imported a large quantity of pencil crayons, assuming he could make big margins, only to find out they were subject to 115% duties.

There's around 100 items subject to anti-dumping duties from China but many of these are chemical products most of us won't be importing. Here's a complete list of all of the items subject to anti-dumping measures and below are some of the most common products subject to anti-dumping duties:

Common Items Subject to Anti-dumping Measures

- Wooden bedroom furniture

- Folding Gift Boxes

- Wooden bedroom furniture

- Bristle paint brushes

- Wax candles

- Sparklers

- Cased pencils

- Folding metal tables and chairs

- Ironing tables

- Hand trucks

- Tissue Paper

- Kitchen Appliance Shelving and Racks

Excise Tax

Ah yes, Excise Tax. The tax I found myself being subject to unknowingly.

If you live in the United States, you almost certainly pay excise tax unknowingly. Gasoline, alcohol, and cigarettes all have excise tax baked into their costs. It's basically a tax the government charges, normally on products which have perceived negative effects on society and/or the environment. The catch is, these taxes are collected by the manufacturer, retailer, or importer (not paid directly by the consumer).

Again, most of us aren't importing gas or booze, but fishing and hunting items are subject to excise tax (approximately 10% of the sale price) along with many types of tires. If you're not importing anything that falls into the categories below, you likely won't ever have to worry about Excise Tax.

Common Items Subject to Excise Tax

- Fishing Equipment

- Hunting Equipment

- Tires

- Alcohol/Cigarettes

Sales Tax

Here's the 10,000 lbs elephant in the Amazon FBA room. Any state which you ship your products out of, you are responsible for collecting and remitting sales tax in (on every sale you ever make in that state).

This means that if you use Amazon FBA you're supposed to collect tax in every state Amazon has a warehouse in (all 10+ of them).

The reality is that almost no small businesses currently do this and I've never heard of any state going after a small business using FBA for unpaid sales tax. The truth is, most state sales tax codes are so out of date they it would impose an undue hardship on most small businesses to file it (some states require you to remit sales tax to multiple jurisdictions within that state!).

Ideally, at some point the U.S. will impose a simplified nationwide internet sales tax that is applied equitably among all businesses. And technically until then, if you're using FBA you could be racking up a huge tax bill with various states unknowingly. Will they ever go after small businesses for this tax? The answer might be no, but you should still be aware of the law.

Conclusion (and What Happened to Us)

After getting the call from the IRS, all of that weekend I researched everything I could that has to do with Excise Sales Tax. After reading hours worth of information and paying several hundred dollars to my U.S. based accountant for their advice, I determined that over half of our products were actually exempt (the exemption was buried way in some government fine print). There also turned out to be a number of eligible discounts you could take, mainly for things such as shipping costs and advertising costs. All in all, it boiled down to around $3000 in taxes over the course of three years.

The $3000 I could live with, but having to back file 3 years of quarterly returns terrified me (along with potential interest and penalties). I gave a call to the IRS agent the following week, and after chatting about skiing in Whistler, he let me know of a couple of other exemptions we were eligible for (for internet sales). He ultimately surmised the back taxes were immaterial and simply told us to file going forward. What a relief! Somehow I walked away unscathed after my first encounter with the infamous IRS (in Canadian schools we're read horror stories about evil IRS agents).

Have you had any sticker shock when importing products from? Did I miss any other surprise fees and costs that importers should be aware of? If so, please comment below.

Hello,

The link above with the list of items subject to anti-dumping duties isn’t working. Could you provide the correct link?

Thanks in advance!

Hi Dmitriy, the link should be working now. Thanks for the heads-up!