The 2025 New User’s Guide to Alipay

AliPay, a third-party mobile and online payment platform established by Jack Ma’s Alibaba Group, enjoys the title of the world’s largest digital payment platform since 2013.

Widely recognized and almost unanimously trusted, Alipay offers seamless and secure online transactions for both the individual and the business owner. Through AliPay, people can conveniently and efficiently make payments, transfer funds, and manage finances.

In this AliPay user guide, we’ll give much-needed guidance to the first time AliPay user. From downloading the app to making online transactions, we’ll prepare you to use AliPay with step-by-step instructions and easy-to-understand explanations of this platform’s many features.

How to Sign Up for an AliPay

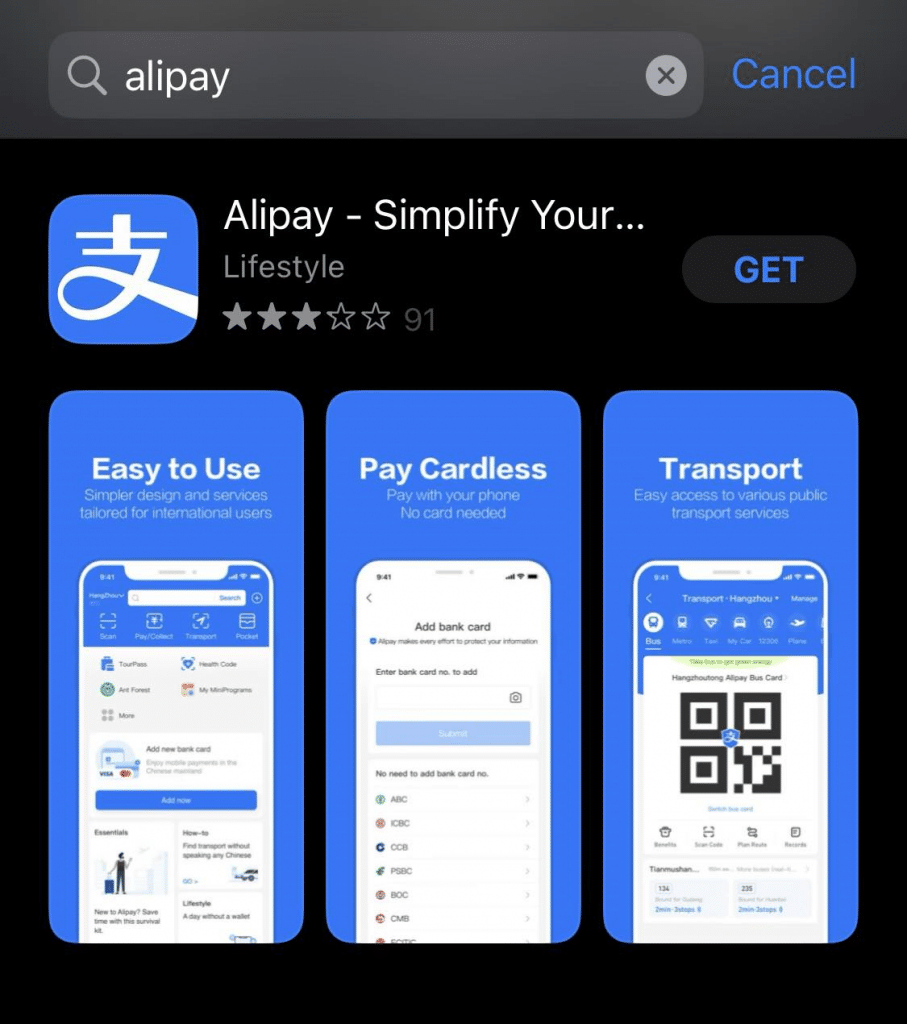

1 Download the AliPay App

To begin using AliPay, you'll need to download the official AliPay app onto your smartphone or tablet. Here’s how you download the app:

- Visit your device's app store, such as the App Store or Google Play.

- Type in “AliPay” in the search bar.

- Locate the official AliPay app and click on “Download” or “Install.”

- Once your download is complete, open the app.

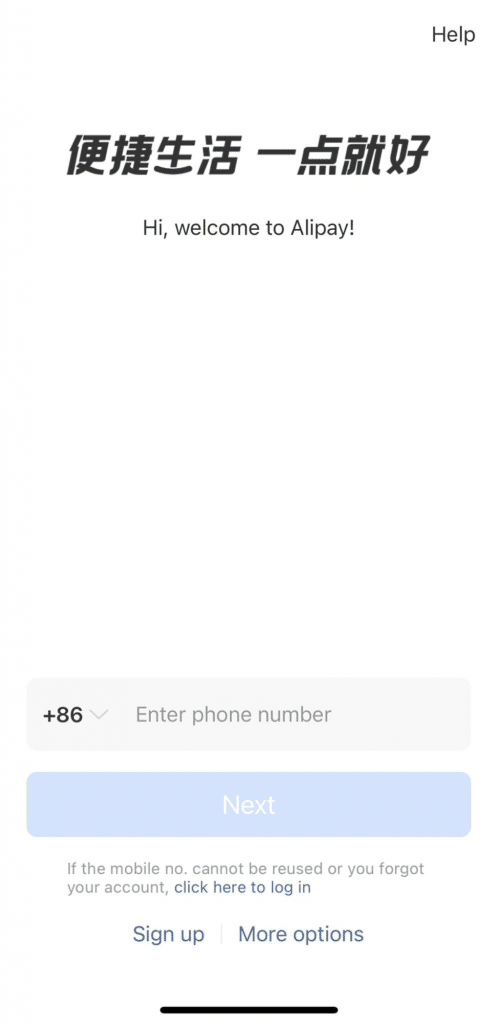

2 Create an AliPay Account

After downloading the app, you'll need to create an AliPay account to start using the platform and its features. Here's how you do the AliPay sign up process:

- Click on the AliPay app to open it on your device.

- Click on the “Sign Up” or “Register” button.

- Provide the required information, including your mobile number and email address.

- Create a secure password for your AliPay account.

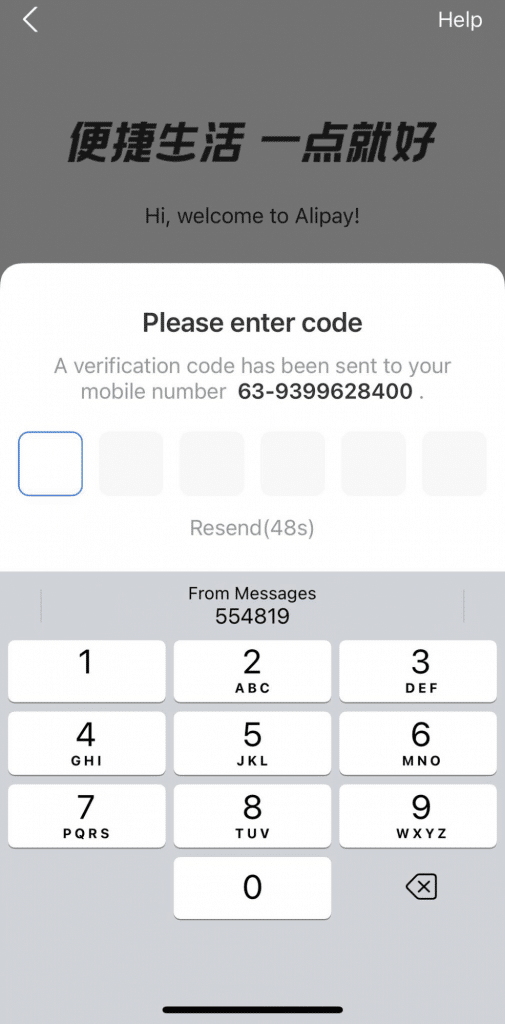

- Verify your account by entering the verification code sent to your mobile number or email.

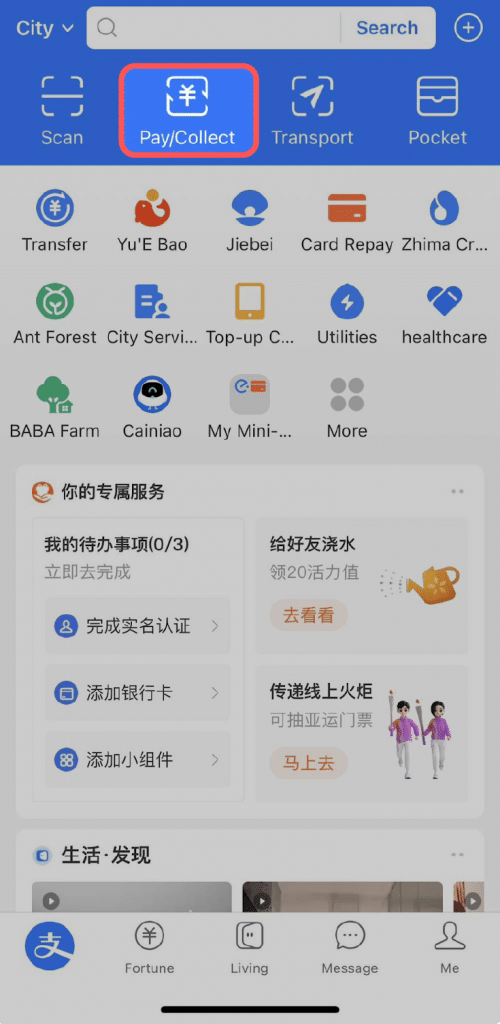

3 Link Your Bank Account or Credit Card

To facilitate seamless transactions, you can link your bank account or credit card to your AliPay account. These are the steps:

- Access the “Card Repay” section within your AliPay account dashboard.

- Choose the option to add a bank account or credit card.

- Enter the required banking details, including your account number, card number, and other relevant information.

- Verify your account and set it as the default payment method for convenient transactions.

How to Use AliPay for Online Transactions

The bread and butter of online payment platforms, online transactions form the bulk of Alipay’s day-to-day services. Here’s a quick and easy breakdown on Alipay online transactions.

How to Use AliPay for Making Purchases on E-commerce Platforms

AliPay is widely accepted on various e-commerce platforms such as Shopify, allowing you to make purchases with ease. Follow these steps for easy transactions:

- Browse through the products or services on an e-commerce platform that accepts AliPay.

- Select the items you wish to purchase and add them to your cart.

- Proceed to the checkout page and choose AliPay as your preferred payment method.

- Review the transaction details, including the total amount to be paid.

- Confirm the transaction and follow any additional instructions to complete the payment.

How to Send and Receive Money Through AliPay

AliPay offers a convenient way to send and receive money to/from other AliPay users. Here's how you transfer and receive money:

- Open the AliPay app on your device.

- Locate the “Transfer” or “Send/Receive Money” feature within the app.

- Enter the recipient's AliPay ID, mobile number, or scan their QR code.

- Specify the amount you wish to send and add an optional note.

- Review the transaction details and confirm the transfer.

- Authenticate the transaction using your preferred verification method, such as a password or fingerprint.

Guide To Alipay's Additional Features

Aside from the usual functionality of online payment platforms, Alipay aims to become a one-stop shop for foreseeable customer needs. Here are some of our favorite additional features on Alipay.

AliPay Wallet: Managing Your Finances

AliPay provides a range of features within its Wallet section to help you manage your finances effectively. Some of our favorite key functionalities include:

- Tracking Expenses: Use the AliPay Wallet to monitor your expenses, view transaction history, and categorize your spending.

- Budgeting Tools: Set budgets for different categories and receive notifications when you approach your limits.

- Bill Payments: Make utility bill payments, such as electricity, water, and internet, directly through the AliPay app.

- Account Balance Inquiry: Check your AliPay account balance to receive real-time information about your available funds.

AliPay International: Making Cross-Border Payments

For users engaging in international transactions, AliPay offers the AliPay International feature, enabling secure cross-border payments. Here's how to make the best of it:

- Enable the AliPay International feature within your AliPay account settings.

- Link your international bank account or credit card to facilitate transactions in foreign currencies.

- Explore international e-commerce platforms that accept AliPay and pay with ease in your chosen currency.

Is AliPay Secure?

With the rise of online scams and fraudsters, any payment platform worth its salt needs strong cybersecurity and countermeasures. Here are some of Alipay’s most effective methods to protect its customers.

How to Secure Your AliPay Account

To ensure the safety of your AliPay account, it is important to implement security measures. Consider implementing the following tips:

- Enable Two-Factor Authentication (2FA): Enhance account security by enabling 2FA, which adds an additional layer of protection.

- Regularly Update Password: Change your password periodically and ensure it meets recommended security standards, including a combination of uppercase and lowercase letters, numbers, and symbols. You can choose to follow the NIST password guidelines too.

- Access Official AliPay Platforms: Only download the official AliPay app from trusted sources, and avoid clicking on suspicious links or entering your AliPay credentials on unverified websites.

AliPay Buyer Protection and Dispute Resolution

AliPay provides buyer protection and a dispute resolution process to safeguard your transactions. Keep these points in mind:

- Buyer Protection: AliPay offers protection for eligible transactions, ensuring that you receive the goods or services as described. In case of non-delivery or misrepresentation, you may be deemed eligible for a refund to your AliPay account.

- AliPay Resolution Center: If you encounter any issues with a transaction, utilize the AliPay Resolution Center to file complaints or request refunds. Provide all necessary details and evidence to support your claim, such as receipts or communication records for a faster, hassle-free transaction.

Final Thoughts

We hope that by following this comprehensive guide, first-time users can confidently navigate AliPay, from downloading the app to making transactions.

AliPay's seamless and secure digital payment platform offers a convenient way to make purchases, send and receive money, and manage your finances effectively.

Remember to take advantage of AliPay's additional features, prioritize account security, and leverage the buyer protection and dispute resolution processes for a safe and enjoyable user experience.