Is Shark Tank Amazon Brand “Nature’s Wild Berry” Legit?

Each episode of Shark's Tank seems to have one common feature: there's always at least one Amazon brand on the show looking to land an investment. In the May 5 episode (Season 14, Episode 21 for those keeping track) that company was Nature's Wild Berry.

Entrepreneurs on the Shark Tank reveal a lot of numbers, but of course, we don't need them—we have Helium 10. In this post, we'll do a breakdown of Nature's Berry to see if their numbers add up and to see if you should be in or out on this company.

What Is Nature's Wild Berry?

The lack of a diversified product catalog is often a major problem on Amazon and something I'll address later.

Nature's Wild Berry—$340,000 in sales and $50,000 in Profit

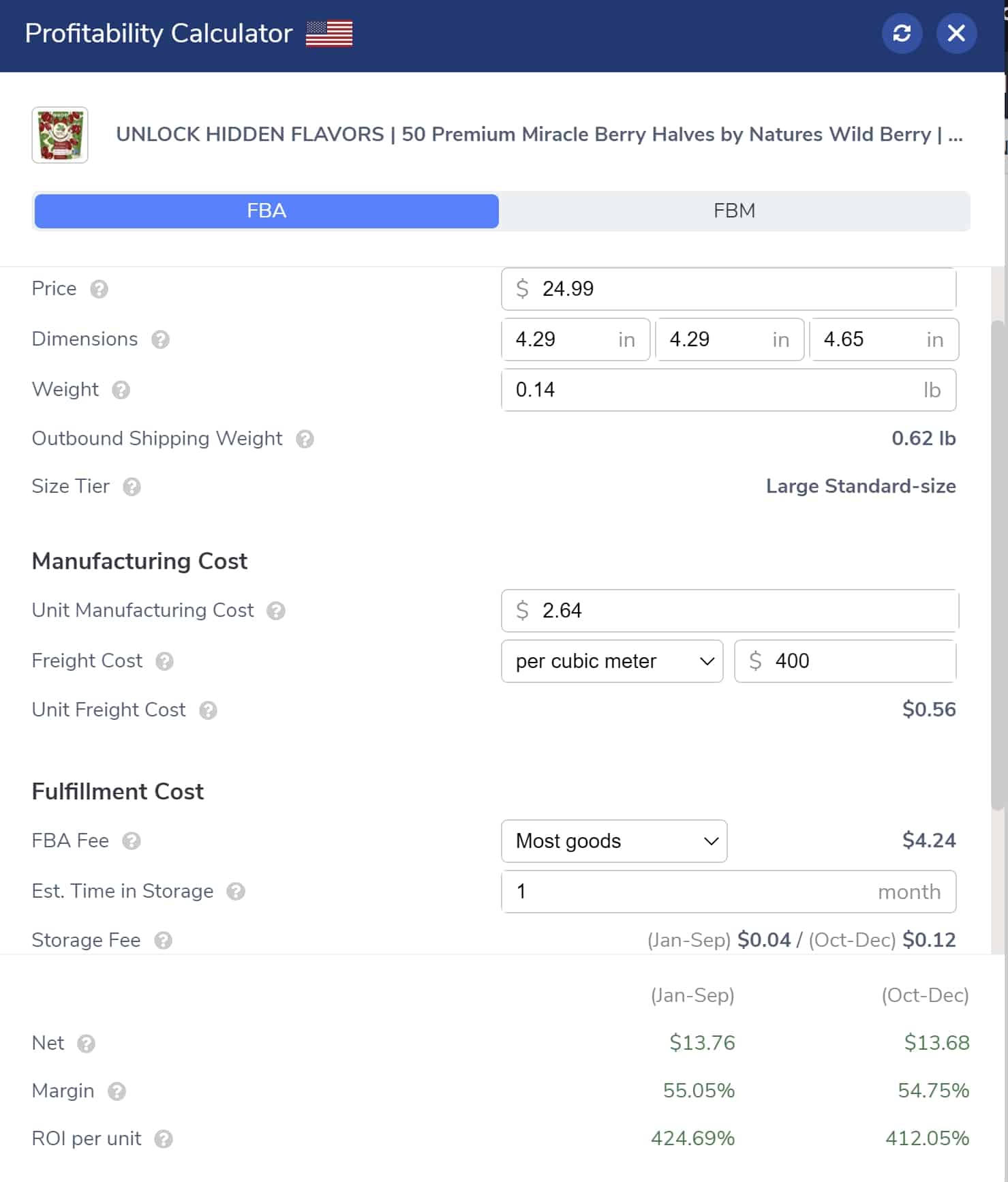

Nature's Wild Berry claimed to have $340,000 in sales and made $50,000 in profit or a 14.7% margin. They claimed their cost was $2.64 but that each package of miracle berries sold for around $30 to $35.

| Sales: | $340,000 |

| Profit: | $50,000 |

| Net Margin: | 14.7% |

| Sales Source: | Majority Amazon |

Based on these Helium 10 numbers, the claimed income of $340,000 more or less checks out. The real concern is the low net margin, 14.7%, even though they have gross margins of nearly 90%.

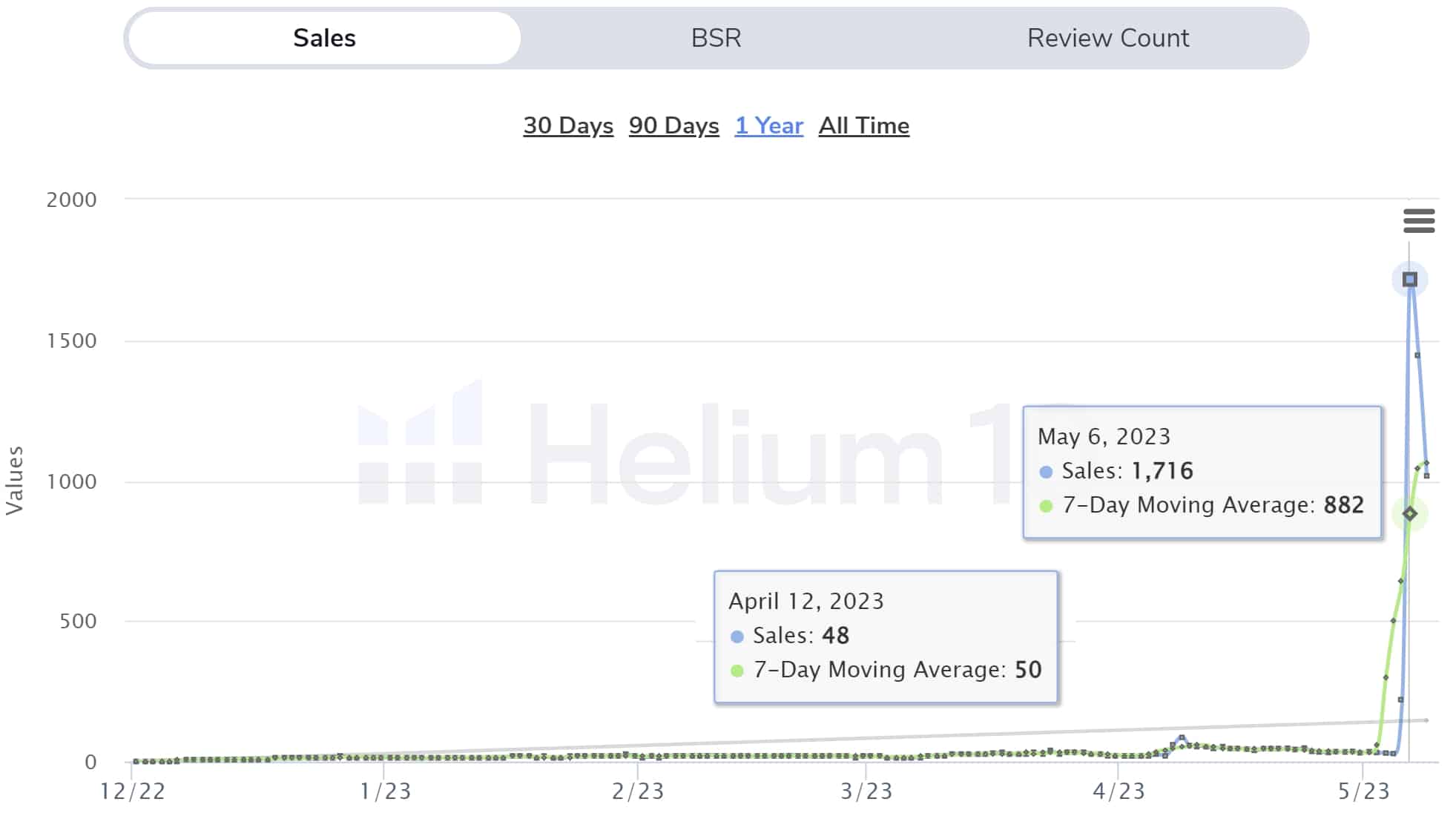

Nature's Berry Ran Out of Stock Almost Immediately After Airing

We all know stock-outs are bad news for Amazon and Nature's Wild Berry experienced the full brunt of this.

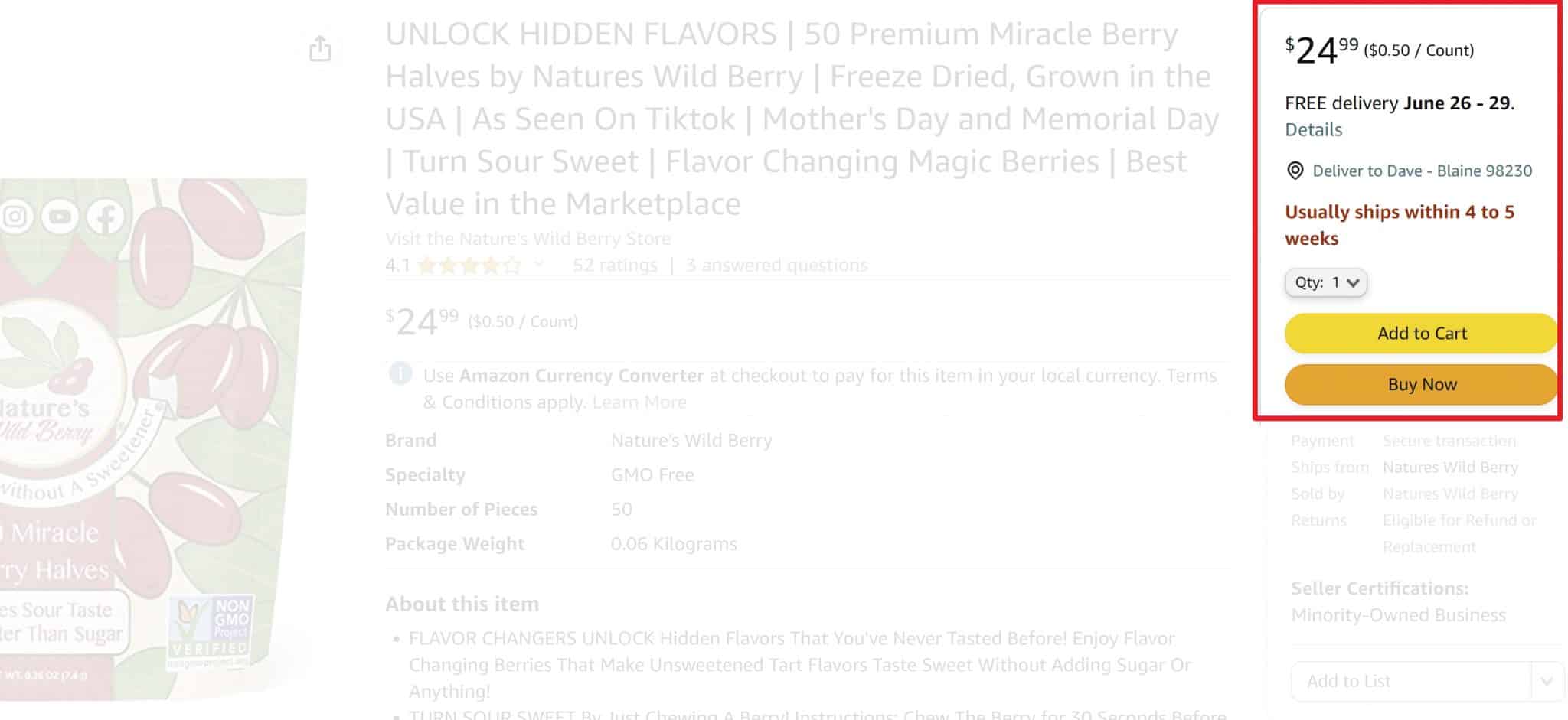

Nature's Wild Berry ran out of stock almost immediately after airing on Shark's Tank. Clearly, they never imagined unit sales would go from 40 units a day to 1,700 units a day (roughly a 40x increase). They're now doing merchant fulfillment with orders, taking 4 to 6 weeks to process.

Even three days after airing, Nature's Wild Berry was still on track to sell over 1,000 units a day just of their bagged version. It's not unreasonable to assume that this trend would have kept up for a few days after airing and they could have expected 5,000 to 10,000 in additional units sold had they been in stock, or roughly $175,000 to $350,000 in additional sales—ouch!

The good news for Nature's Wild Berry's competitors (and potentially bad news for Nature's Wild Berry itself) is that many of these customers bought their competing products once Nature's Wild Berry ran out of stock.

Unfortunately, as many of us know, running out of stock can be quite punitive, especially when those lost sales go to a competitor. Time will tell if Nature's Wild Berry can recover.

Where Is Nature's Wild Berry Losing Money?

Nature's Wild Berry claimed an income of $340,000. Based on the Helium 10 numbers, these more or less check out. However, they claimed only $50,000 in profits or roughly 14.7%. They also claimed to have COGS of $2.46 even though their product sells for $25 to $45.

Based on Helium 10's numbers, the bagged version of the “miracle berry” should have a net profit of 55%, which is nowhere close to the 14.7% they're claiming. Entrepreneurs rarely understate profitability (especially on Shark's Tank!) so the chances are good that these numbers are accurate.

There are some possible ways Nature's Wild Berry is losing money that wasn't stated on Shark Tank:

- They have a very high TACoS – A healthy Total ACoS (Total Advertising Cost of Sale) for an Amazon Brand is about 10%. The chances are good that Miracle Berry has a TACoS way above this, potentially around 15%.

- Other Manufacturing Costs – While it wasn't mentioned during the episode, it appears Nature's Wild Berry has some ownership both in the equipment and the actual land where the berries are produced. Often, costs such as these would not be included in regular net income calculations and it's unknown whether or not their profits include these costs.

- Other marketing costs – There could be other marketing costs outside of Amazon advertising such as using a brand agency for their packaging, trade shows, etc.

The likely answer to the lack of profitability, like most Amazon brands struggling with profitability, is they have high advertising costs.

Nature's Wild Berry—I'm Out

Nature's Wild Berry has some decent opportunities. Their imagery on Amazon is downright bad, and they're only selling on Amazon.com and no other Amazon marketplaces let alone channels like Walmart. Moreover, depending on what extent they actually own the entire manufacturing process, it could provide a moat against competitors on Amazon, especially cheap overseas competitors.

Nature's Wild Berry has some serious weaknesses. Their implied TACoS is a major concern and it's only likely to worsen as PPC costs rise overall on Amazon. Next, it's a relatively uncompetitive niche right now but it will likely get only more competitive in the coming months as “miracle berries” become more of a fad. However, the biggest weakness of Nature's Wild Berry is its lack of a diversified product catalog. They have only one SKU essentially and not a lot of obvious opportunities to expand. As most of us know, the easiest way to grow an Amazon business is to grow your catalog, something Nature's Wild Berry will seem to struggle with. And for that reason, I'm out.