Use Product Opportunity Explorer to Find Competitor Keywords & Data

In 2021, Amazon released Product Opportunity Explorer which finally gave access to real search volume for different keywords. Since then Amazon has made numerous improvements to the tool, including in the summer of 2023, by giving sellers access to competitor ASIN keyword and sales data. In this article, we'll break down how to exactly access this data.

How to Access Product Opportunity Explorer

To access it within the Seller Central menu, go to Growth > Product Opportunity Explorer or go to this link: sellercentral.amazon.com/opportunity-explorer.

Related Reading: Best Amazon Software of 2022

What Does Product Opportunity Explorer Do and Not Do?

The Amazon Product Opportunity Explorer is very similar to third-party product discovery tools like Jungle Scout and Helium 10. The biggest difference is that Product Opportunity Explorer uses real search data on Amazon, whereas third-party tools use keyword estimates to determine product opportunities for sellers.

So what exactly does Product Opportunity Explorer do and not do?

- Product Opportunity Explorer DOES tell you the top 27 keywords a product ranks for over the last 30/90 days

- Product Opportunity Explorer DOES tell you the total search volume for keywords in niches

- Product Opportunity Explorer DOES tell the Sales Rank of a product over the last 30/90 days

What It Doesn't Do:

- Product Opportunity Explorer DOES NOT allow you to figure out how many sales a competitor ASIN got for a specific keyword

- Product Opportunity Explorer DOES NOT allow you to use specific dates for keyword data (you're limited to the previous 30/90 days)

- Product Opportunity Explorer DOES NOT allow you to figure out keyword volume for any keyword you want (you have to narrow it down by niche)

- Product Opportunity Explorer DOES NOT give unlimited keywords for a niche (it limits it to 25) and therefore is not great for long tail keywords

- Product Opportunity Explorer DOES NOT give you keyword ranking data

So in other words, Product Opportunity Explorer replaces many of the tools of Jungle Scout and Helium 10 (and in fact, does many things better than them) but it does not replace them all.

How to See a Competitor's Keywords on Amazon

So how exactly do you see Competitor Keyword Data on Amazon?

To do this, you copy the ASIN (you can get this from any product page) and paste it into the search field with Product Opportunity Explorer. You will need to actually click through to your target ASIN (at the top of the page).

You will note when you search for the target product, Amazon will give you keywords into buckets divided into “customer needs” and only over the last 90 days (you cannot specify date ranges). For example, for this Amazon camping chair, Amazon has broken the keyword data into buckets with three keywords each (camping chairs, beach chairs, bag chairs). So while it aggregates keyword click data across three keywords, it's still very valuable and insightful.

How to See Your Product Keyword Rankings

Product Opportunity Explorer is great for seeing your competitor's keywords. And in fact, you can plug your own ASIN into Product Opportunity Explorer and see some of the keywords you're getting clicks for. But does that mean you should use Product Opportunity Explorer to get keyword data for your own products? No!

You should not use Product Opportunity Explorer to find out what your own products are ranking for and getting clicks for. Instead, you should be using Brand Analytics. Brand Analytics will tell you every keyword you're ranking for along with the volume. To access Brand Analytics go to Brands -> Brand Analytics

Related Reading: How to Use Amazon Brand Analytics

Get Niche/Category Keywords and Volume

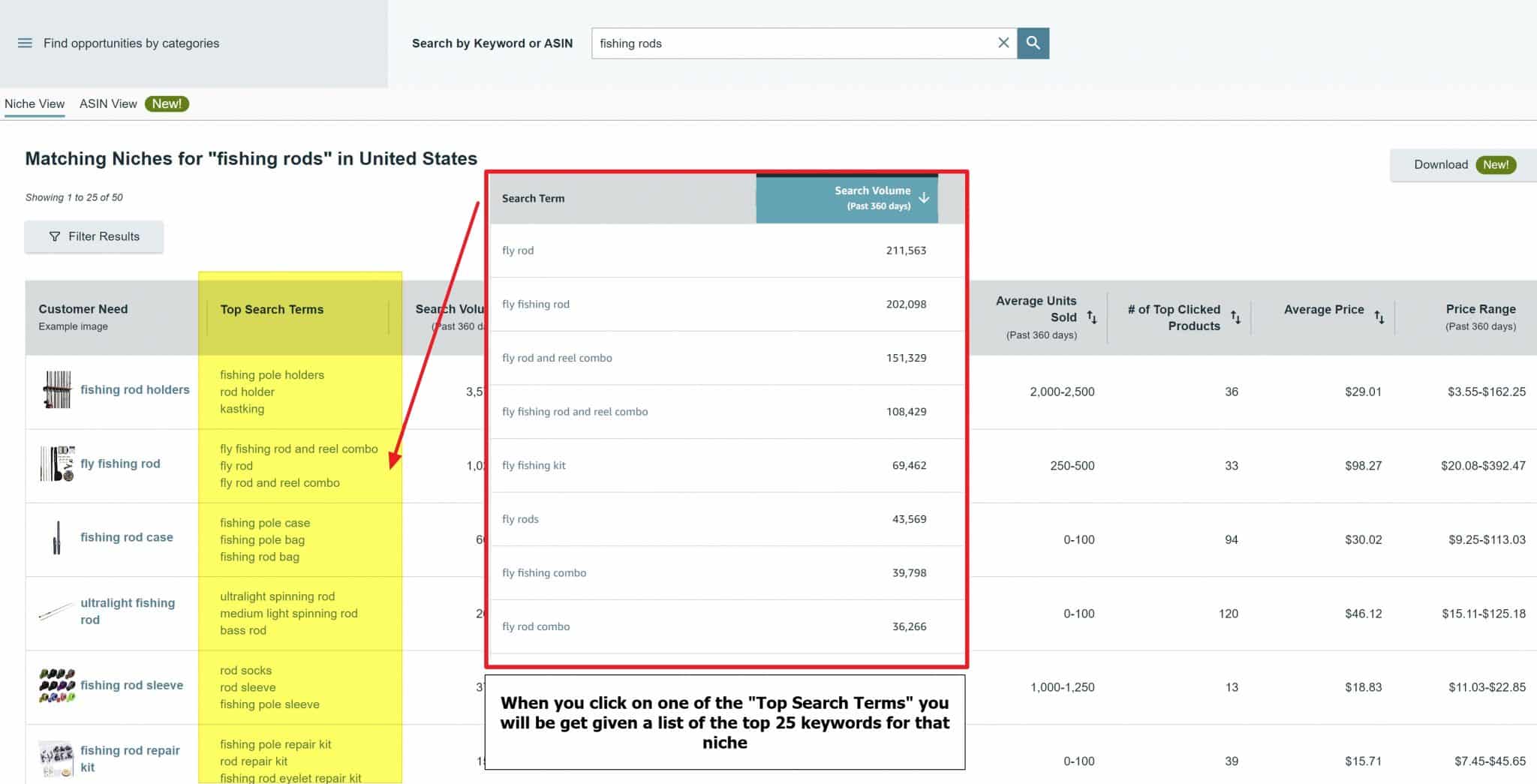

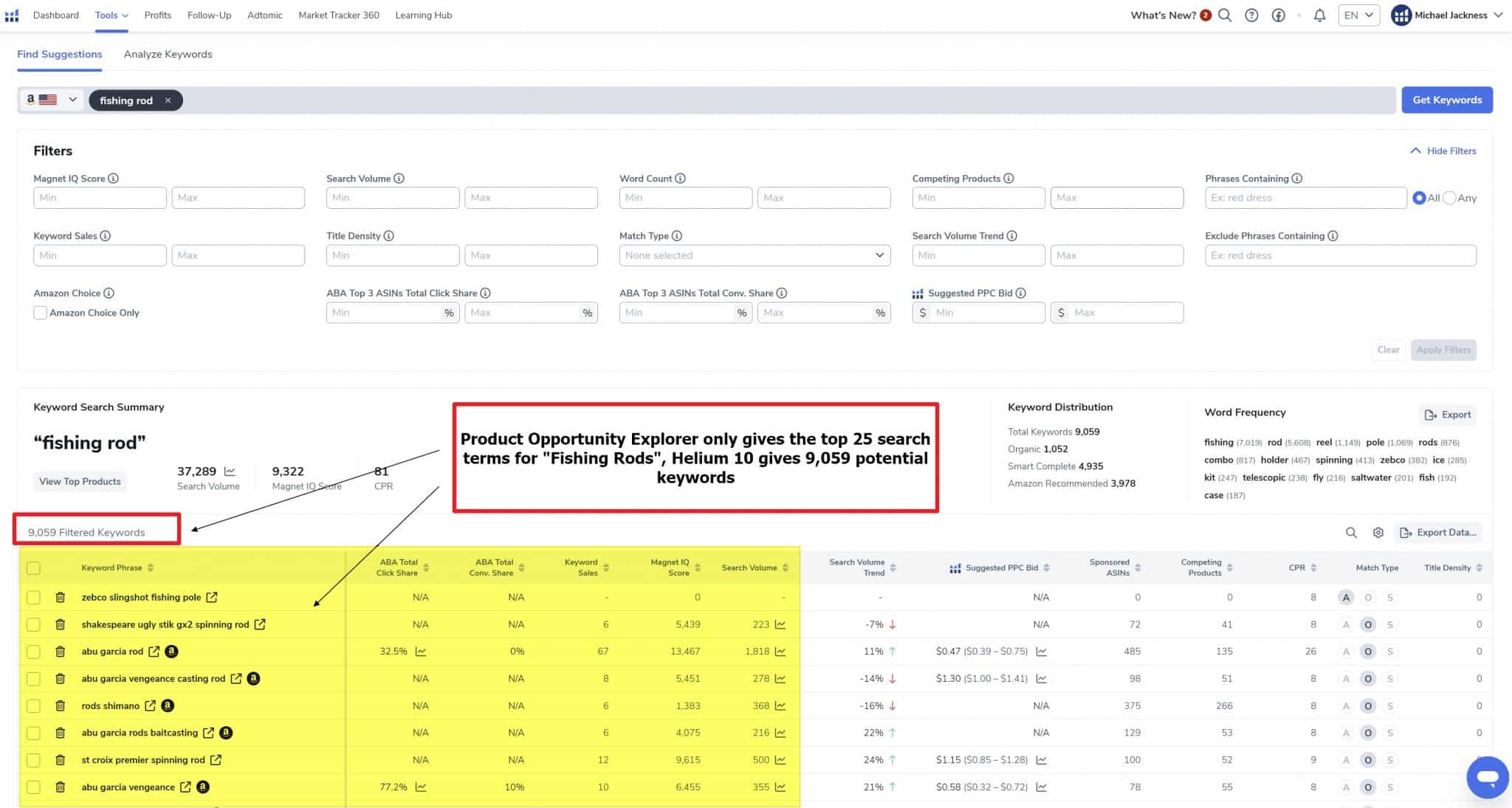

You can also get the keyword volume in a particular category or niche. If you're looking for products, this is probably more useful for you than finding competitor keywords. However, this aspect of Product Opportunity Explorer is slightly less useful than Helium 10 or Jungle Scout because you can only get the top 25 keywords per niche. This kind of makes sense because the goal of Product Opportunity Explorer is to help you discover new products to source, now how to discover keywords to optimize your listing for.

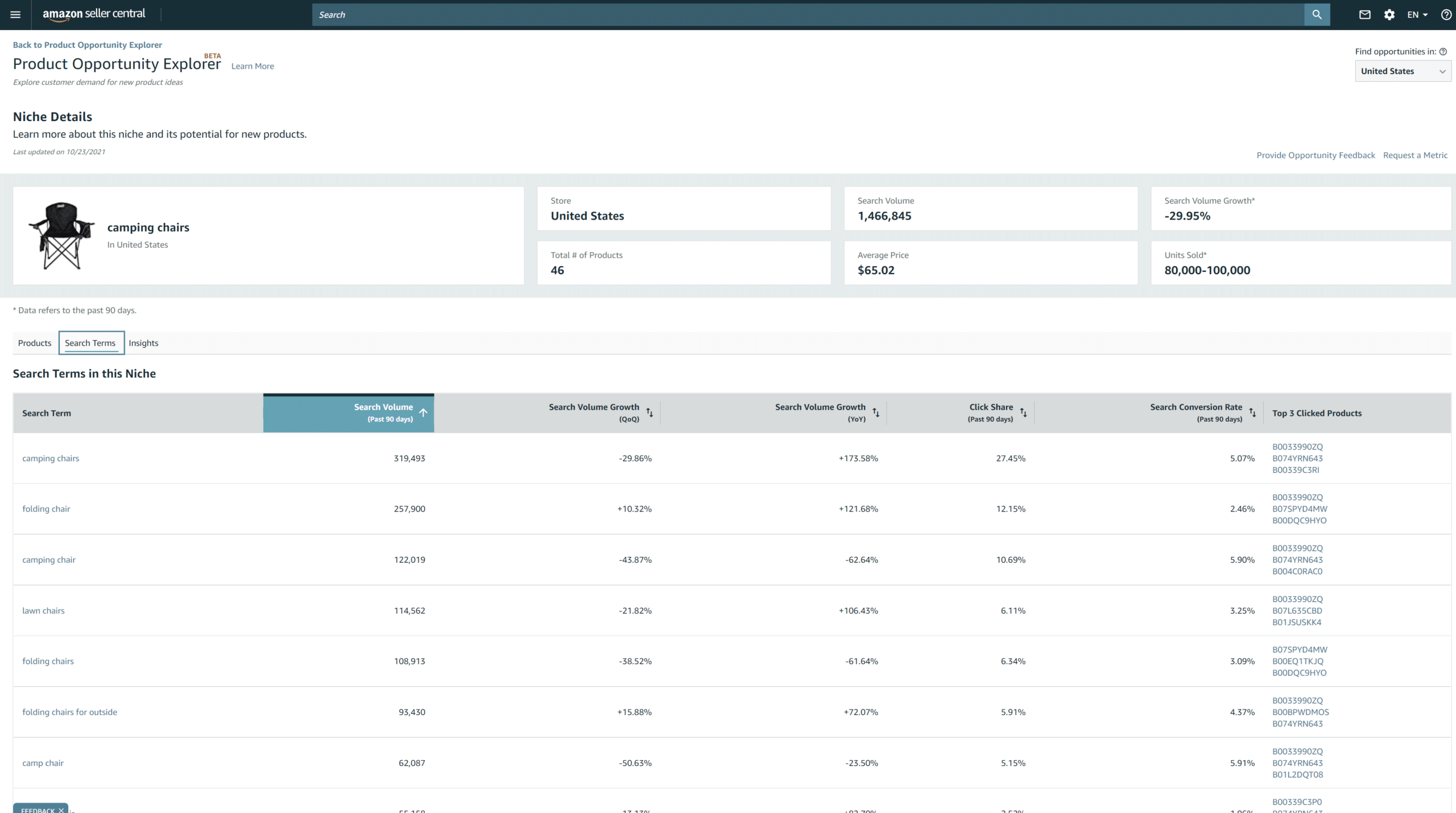

To get the keywords for a particular niche, search for a keyword and then click one of the Top Search Terms. This will then pull up a page with the top 25 search terms.

With Helium 10, by comparison, we get over 9,000 different potential keywords when we search for “Fishing Rods.” For this reason, in my opinion, Helium 10/Jungle Scout are still much better tools for generating keywords for product listing optimization.

Product Insights Gives Some Very Valuable Data

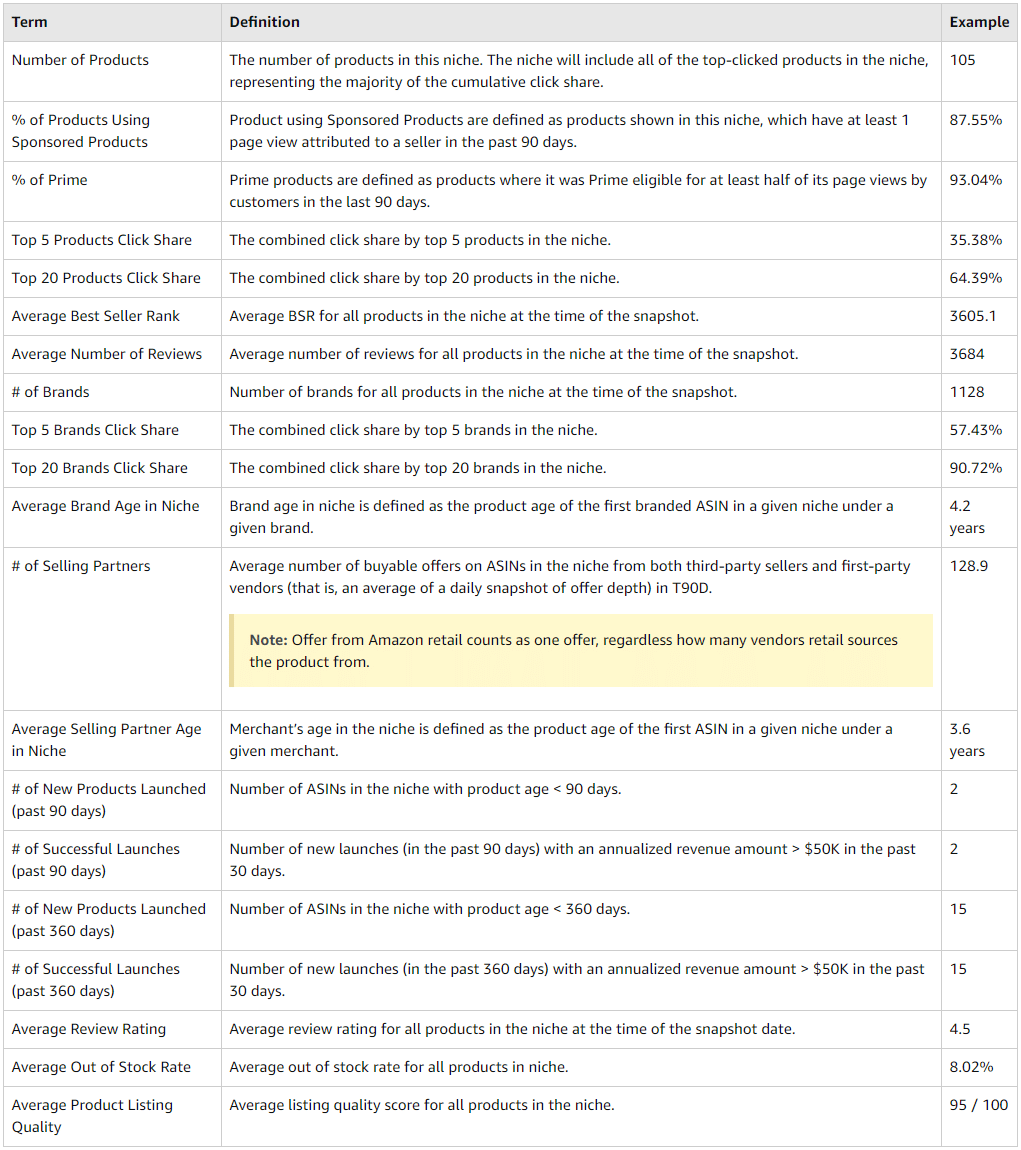

Along with real search data, Product Opportunity Explorer gives some extremely valuable information for product research.

For example, under the Product Insights table, you can see what percentage of advertisers are using Sponsored Products. A niche where a sizable number of sellers aren’t using sponsored ads gives new sellers an opportunity to essentially buy their way to the top, and often at lower prices than more competitive product categories.

Two other valuable data points, not available in any other tool, are the Average Brand Age in the product niche and Average Stock Out Rate.

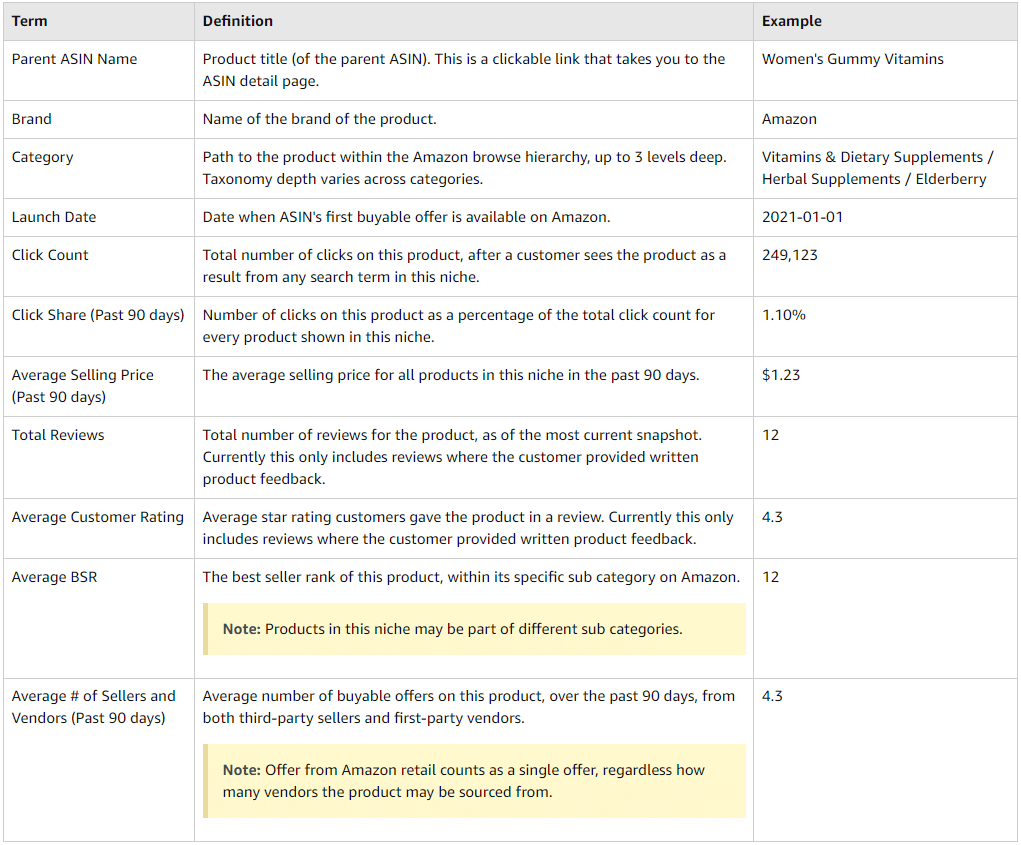

A complete list of the data points available is shown in the table below.

Was Product Opportunity Explorer Released in Response to Congressional Inquiries?

Amazon has had an on-again/off-again relationship with giving sellers real search data—and now it seems to be on again. The timing seems convenient for Amazon, as it has been facing antitrust pressure from Congress throughout the year, one point of contention being its willingness (or lack thereof) to share customer search data with third-party sellers and rig its algorithm to favor Amazon-owned products.

Giving sellers more access to relevant information could take some heat off Amazon, but it could be ultimately good for third-party sellers who’ve been aching for a level playing field with Amazon for years.

Just last week, Amazon’s Small Business Empowerment Report revealed that third-party sellers now account for over 60% of the company’s total retail sales.

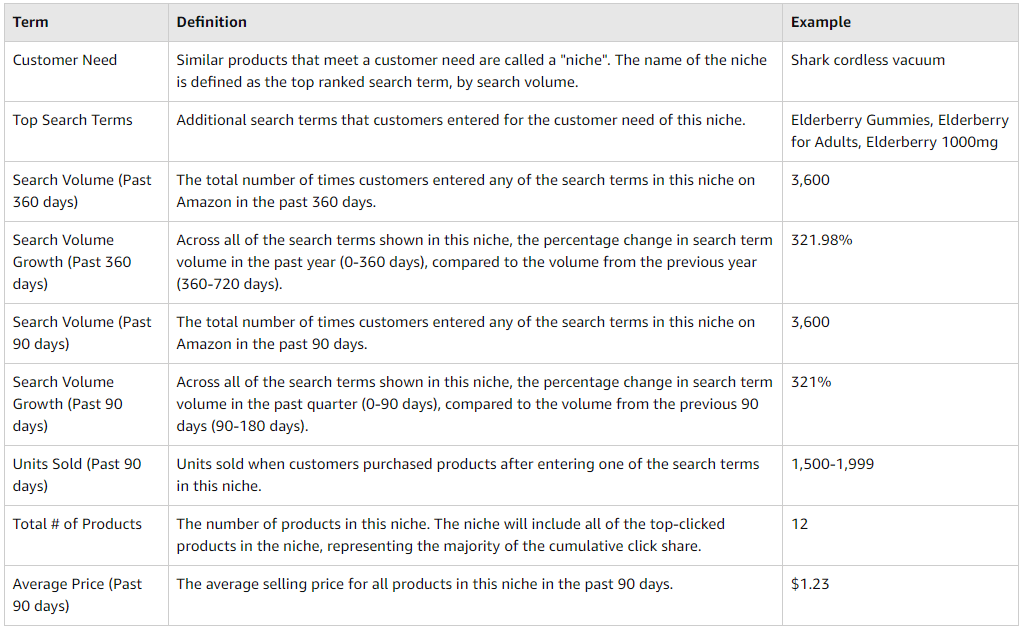

Customer Needs and Sales Data Selection are Bundled Into Niches

Amazon bundles customer search data into niches, which they define as “collections of customer search terms and products representing a customer need”. Niches include the top related Amazon customer search terms and the top related clicked or purchased products. This means that it’s possible to find products and keywords that meet more than one customer need and can thus be found in multiple niches.

Using the search function of Product Opportunity Explorer yields high-level information like Top Search Volume, Search Volume, Units Sold, and the Total # Of Products within a particular niche.

From there, you can drill down into ASIN-level data, which include valuable information such as Click Share, Average BSR, and Average # Of Sellers and Vendors.

Perhaps the most important tab is the Insights Tab, which shows you niche-level stats to help determine the launch potential and profitability of new products.

Conclusion

Product Opportunity Explorer is extremely valuable. In fact, it is slowly becoming my used tool for product research. No third-party tool gives the same exact keyword volume that Product Opportunity Explorer gives. However, Helium 10 and Jungle Scout still have a place in a seller's software arsenal, for their ability to generate long tail keywords, especially important for product listing optimization.

Has Product Opportunity Explorer replaced Helium 10 or Jungle Scout for you? If so, let me know in the comments section below.

Hello,

Do you know why search volume is different in Product Opportunity Explorer and Brand Analytics?