Amazon PPC Overhaul for 5 Brands – Real Numbers Breakdown

This is an Amazon PPC series on overhauling the PPC for multiple 7-figure brands.

Over the last year, there have been two major trends in Amazon advertising: rising ACoS and a hoard of new advertising options.

This will be a three-month series where Mike and I look to overhauling our advertising campaigns and use extensive testing and experimenting to answer some of the most common Amazon PPC questions that we have and many in our audience have.

This series will be broken down into six parts:

- An overview of our current account performance and goals (May 1, 2021)

- Sponsored Products Strategies, Experiments and Results

- Sponsored Brands Strategies, Experiments and Results

- Sponsored Display Strategies, Experiments and Results

- Choosing the best Amazon PPC Software

- Three-month PPC performance and goals results

Current Benchmarks and Goals

As part of this series, we need to establish some clear benchmarks from the beginning and also some goals. We looked at our last 12 months of data to see where each brand stands.

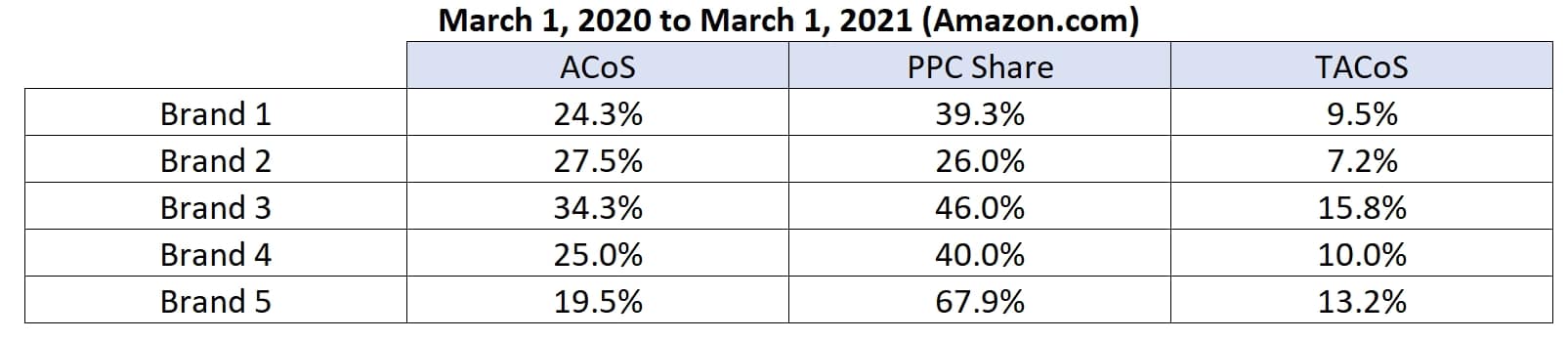

Last 12 months Amazon PPC Performance of Our Brands

Below is the performance of our five brands over the last 12 months (February 28, 2020 to March 1, 2021). As you can see, ACoS has ranged between 19.5% to 34.5% which is generally fairly healthy.

The metric I pay most attention to for PPC is Total Overall ACoS, or TACoS. TACoS is calculated as: ACoS * Percentage of Sales from PPC. Normally, we target below 10% overall TACoS and as you can see from above, two of our brands are now above 10%.

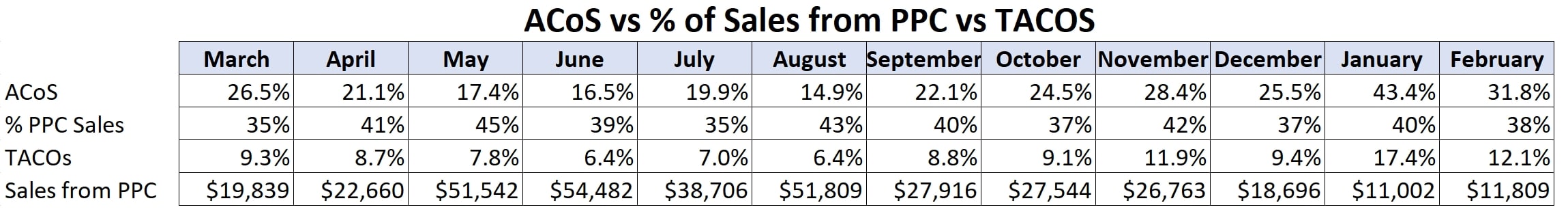

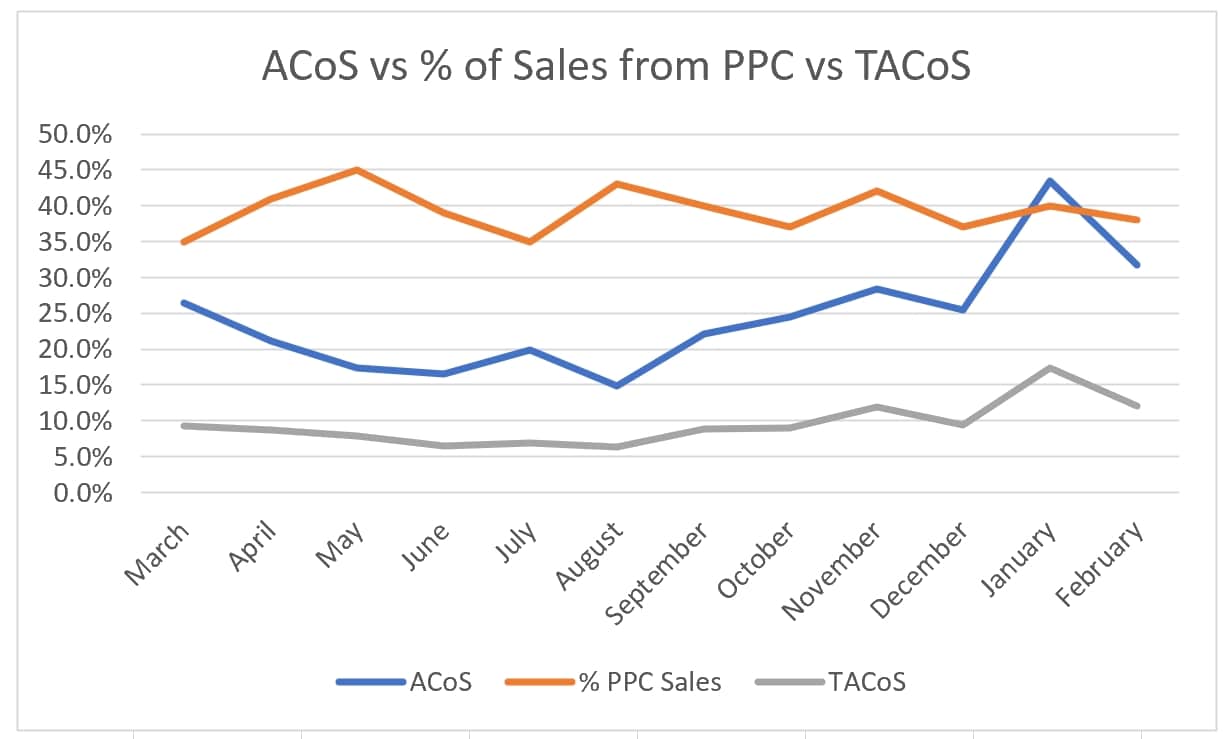

However, looking at a twelve-month period, unfortunately, does not tell the full story. Over the last several months, ACoS has generally been trending upwards, which is a combination of rising Amazon PPC costs overall, seasonality, and poor management. Below is a snapshot from one of our brands demonstrating this rising trend.

January and February had an overall TACoS of 17.4% and 12.1%, respectively. There is a lot of seasonal variation there as January and February are our slowest months, and we also experience a lot of stock shortages. However, there has been a clear upwards trend no matter how you look at that data.

The culprit for this brand is undeniably a rising ACoS because the percentage of sales from PPC, the other component of TACoS, has actually been trending downwards (which is a good thing).

Our 3-Month Amazon PPC Goal – Reduce TACoS to Below 10%

Our three-month goal is to decrease our overall ACoS (TACoS) to below 10%.

Improving organic rankings is a component of this, but the most significant component will be to reduce our ACoS. For example, assuming that 40% of our revenue comes from PPC, this means that to move TACoS to 9.9%, we would have to have a 24.9% ACoS or less.

Improving PPC Performance – 10 Questions

In order to improve our PPC performance, we have 10 questions that we're going to seek to answer via testing and experimenting. Those questions are as follows:

Sponsored Products

- What is the best performing placement and should we isolate our ads for that placement? (top of search, rest of search, product pages)

- Do bid adjustments ever work and, if so, what is the best bid adjustment? (dynamic down, dynamic up, dynamic up/down)

- Does product category targeting work?

- Should you target only your best selling variation or all variations?

Sponsored Brands/Sponsored Display

- Which performs better: Sponsored Brand Videos or Top of Search Sponsored Brands?

- Can quickly and cheaply produced videos perform well?

- Should sponsored brands go to a custom product search page or to a store page?

- Is views remarketing a profitable PPC campaign for Sponsored Display and how does it rank compared to other advertising options?

Software

- What's the most robust Amazon PPC software available?

- What's the best value Amazon PPC software available?

Conclusion

In conclusion, by seeking to give answers to the above questions, we hope this will overall help improve the performance of our campaigns and decrease our overall TACoS to below 10%. Much of our focus over the next several months will be trying to figure out many of the new ad types that Amazon has rolled out recently, specifically Sponsored Display and Sponsored Videos.

Hi guys,

Fan of the podcast here.

Did this thread get killed? If not, where are the following posts? Can’t locate them by searching PPC Overhaul.

Thanks!

Jerry

Great idea, look forward to following this series!

Glad to hear you like it!