5 Best Payment Gateways for E-Commerce

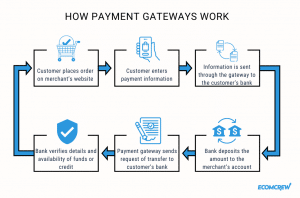

E-commerce comes with the convenience of completing purchases completely online. This led to the introduction of multiple secure payment gateways that help process transactions and make buying online that much easier.

But how exactly do you choose which payment gateway to use? We’ll answer this question and introduce the 5 best choices you can consider.

What Is a Payment Gateway?

A payment gateway is a kind of technology that allows merchants to collect payments from customers. It enables credit card or direct payments for online purchases. It is the checkout portal where customers can enter their payment information for processing. You can think of a payment gateway like a POS machine in brick-and-mortar stores.

What Are the Best Payment Gateways for E-Commerce Businesses?

We’ve rounded up five of the most trusted payment gateway options available to e-commerce business owners. Here’s an overview:

|

|

|

|

|

|

|---|---|---|---|---|---|

| Year launched | 1998 | 2010 | 2009 | 2006 | 1996 |

| Minimum fee per transaction | 2.59% + fixed fee | 2.9% + 30¢ | 2.6% + 10¢ | 0.50% + 25¢ | 2.9% + 30¢ |

| Link to List of Fees | PayPal | Stripe | Square | Helcim | Authorize.Net |

| No. of currencies supported | 25 | 135+ | 6 | 2 | 11 |

| Supports recurring fees | Yes | Yes | Yes | Yes | Yes |

| Set up fees | None | None | None | None | None |

| Monthly fees | None | None | None | None | Yes |

#1Paypal

Best for increasing conversions

Launched in 1998, PayPal is one of the most popular and trusted payment processing tools in the world. It supports 26 currencies and has no setup or recurring fees, making it perfect for both new and established businesses.

And because it is available in more than 200 countries and regions, you don’t have to worry about expanding your business.

Pros of Using Paypal

- Known to most customers

- Proven track record

- No hidden monthly charges

- No set up fees

- Can send payment using email address

- Integrates with Xero

Cons of Using PayPal

- High chargeback fees

- Charges for currency conversion

#2Stripe

Best for International Payments

Stripe may be more than a decade younger than PayPal, but it already made a name for itself in the payment gateway industry.

Stripe easily integrates into Shopify, WordPress, Mailchimp, and BigCommerce and allows merchants to customize the checkout page, providing a more brand-aware checkout experience.

Stripe has also partnered with Amazon, so it’s becoming a more popular and trusted payment platform. On top of that, Stripe also has Stripe Radar that helps e-commerce business owners decrease fraudulent purchases. It works by using machine learning technology to provide real-time fraud protection.

Another notable advantage of using Strip is its global capabilities. It accepts all major debit and credit cards around the world. It accepts SEPA Direct Debit (for euro-using countries), iDEAL (for the Netherlands), and Alipay (for Chinese consumers).

Pros of Using Stripe

- Easy to integrate with e-commerce sites

- Offers a prebuilt, hosted payment page

- Identifies card brands

- Offers Link, Apple Pay, and Google Pay

- Supports more than 135 currencies

- Customizable checkout page

Cons of Using Stripe

- Has a lot of optional additional features that can get overwhelming to deal with

- Has a reputation for suspending accounts for misunderstanding their terms

#3Square

Best for new and small businesses

Square’s relatively cheaper fees are perfect for those who are just starting out. It’s ideal for small businesses that won’t be expanding to another country anytime soon. As of writing, Square is available only in the United States, UK, Japan, Canada, Australia, and Ireland, and does not support cross-border payments.

If you still want to use Square in any of the other countries listed, you can create another account. However, there’s no universal dashboard where you can manage all your existing Square accounts.

Pros of Using Square

- Easy to set up

- Cheaper fees and no monthly fees

- Generate sales reports and track inventory

- User-friendly interface

Cons of Using Square

- You cannot accept card payments while outside the country where you activated your account.

- No universal dashboard

- Can send invoices only in one currency

- Can be expensive for larger businesses because of flat-rate pricing

#4Helcim

Best for mid-sized companies

Helcim offers merchants the chance to lower their fees as they engage in more transactions. For example, if the monthly credit card volume is from $0 to $25,000 per month, the rate is 0.50% + 25¢. If you reach the $25,001 to $50,000 per month, however, the rate is 0.45% + 20¢. Thus, instead of a flat rate, you can save more as you rake in more transactions.

Its pricing model is not the only place where merchants can save though. While most payment gateways charge for chargebacks whether you win or not, Helcim offers a $0 chargeback fee if you win your case.

However, Helcim does have a list of prohibited content and businesses, so check this first before signing up. For example, Helcim doesn’t deal with wonder drugs and hateful material (you might be wary of this if you’re selling books).

Pros of Using Helcim

- The higher the credit card volume, the lower the rates

- Accepts ACH and EFT Payments

- Uses an Interchange Plus pricing model instead of a flat rate

- Accepts global payments

- $0 to $15 chargeback fee

- Customizable checkout

Cons of Using Helcim

- You cannot accept card payments while outside the country where you activated your account.

- No universal dashboard

#5Authorize.Net

Best for integration

This is the only payment gateway in this list that has a monthly fee, but it’s still a popular option or add-on to any e-commerce business payment solution. This is because Authorize.Net is partnered with around 160 software development platforms. Its developer-friendly API makes it easy to integrate and customize.

Pros of Using Authorize.Net

- Offers discounted rates for non-profits

- Has advanced fraud detection features

- Accepts payments in over 33 countries

- Developer-friendly API

Cons of Using Authorize.Net

- Has monthly gateway fee

- Outdated user interface

Types of Payment Gateways

When choosing a payment gateway for your e-commerce business, consider the following types and whether you’re willing to deal with the downsides of each.

| Payment Gateway | How It Works | Who It’s For |

| Hosted | Directs customers away from the checkout page | Those who don’t want to deal with the complications and details of the integration |

| Local Bank Integration | Customers are redirected to a bank’s page. The bank then processes the payment and returns the result to the business’ page. | Those who want to set up the gateway fast. But take note that you may have problems with returns and refunds if you choose this. |

| API-Hosted | All data connected to the payment transaction as well as the processing are all done on the seller’s website. | Those who want complete control of the payment process and are willing to pay extra to ensure compliance with the Payment Card Industry Data Security Standards |

| Self-Hosted | The payment details are collected on the e-commerce site and are then encrypted and sent to the processing gateway company. | Those who want to be in control of user experience without necessarily processing the payments themselves |

How Do You Choose an Online Payment Processing Software?

You can use one or multiple payment options for your e-commerce business. No matter how many you use, make sure each of your chosen payment gateway following:

The basics: cost and security. Consider what you can afford as a business and what makes sense economically. More importantly, make sure you and your customers are protected by using only payment gateways that keep your sensitive information safe. Most of the well-known and widely used payment gateways are generally safe, but it doesn’t hurt to check if they have been involved in a data breach before.

It should be able to integrate into your site. It makes no sense to choose a payment gateway that can’t be used on your chosen platform. For example, you can’t use PayPal on Amazon.

Stick to what your customers use. It’s important to know how the majority of your customers choose to pay. You’ll have more chances of making a sale if you choose payment gateways that have more users. For example, PayPal has significantly more users than Stripe.

Make it simple for the customer. A 2018 study by Splitit reveals that as much as 87% of customers abandon their cart when they find the payment process too difficult. When choosing a payment processing software, make sure that the overall process is simple enough for customers to check out. This prevents unnecessary friction.

Consider the pros and cons of hosted vs. non-hosted gateways. In simple terms, hosted gateways are checkout systems that redirect your customers to the payment service provider’s page. This means that the customer will have to leave your site to process the payment.

On the other hand, in a non-hosted gateway, customers can complete the checkout process on your site, i.e., they won’t have to go to another site to enter their payment information.

Hosted Payment Gateways

- Enhanced data protection because the payment provider handles the transaction

- Easy to set up

- A lot of payment gateways allow brands to customize the checkout page.

- Redirecting the customer to another website may stop them from completing the checkout process

- The payment provider has the overall control of the process

Non-Hosted Payment Gateways

- You will have complete control of the customer experience.

- It builds trust with customers because they don’t have to be redirected to another site to complete the transaction.

- Is better for tracking customer data for future marketing efforts

- You are largely responsible for data protection since the whole transaction is happening within your site

- Sellers take care of troubleshooting, and if you don’t know how to do it yourself, you may need to hire a professional, which translates to additional cost

Final Thoughts

Choosing the right payment gateway for your e-commerce business is crucial because it can make or break transactions. Checkout is the final leg of the buyer’s journey, so it’s important that you choose a payment processing system that you and your customers can trust.

What payment gateway do you think should make it to the list?