May 2022 Brand Report – ($811,617)

Welcome to the April edition of Brand Report! Each month, we’ll break down our monthly revenue so you can see what’s working and what’s not.

We’ll give you aggregated numbers across the eight brands we either own or have significant equity in. In our exclusive Secret Sauce Brand Report, you’ll get our numbers broken down brand by brand. We’ll also give you a 60-minute class each month detailing one particular thing we’re working on right now that you can use to start and grow your own business. Our next class is on June 29 (incidentally, also my cake day!). We'll share how we do keyword research in order to identify the easiest articles to write and get traction for. Get the Secret Sauce for your brand.

May's revenue was $811,617, up from $742,947 in April. It was largely fueled by higher seasonal sales for our offroading and boating brands.

Compared to 2021, our revenue was up about 10% (from $771,926). However, that was largely fueled by a big gain in IceWraps. Offroading Gear and BTG Gear were down roughly 10% year-over-year from May 2021.

I credit myself with having the foresight to realize that last year's late spring sales for Offroading Gear and BTG Gear were likely an anomaly because as some may remember, we were just entering another COVID wave around that time and people were buying more boating and camping products once again. I also realized those huge revenue numbers were masking some big profitability issues, largely around advertising expenditures. I spent a big chunk of the earlier part of this year working on getting our TACoS down resulting in roughly a decrease from 12% to 9.5%. That reduction in TACoS combined with higher prices meant profits were actually a bit higher in May 2022 compared to 2021. Revenue is vanity, profits are sanity.

What We Worked on This Month

- Going to the Philippines. Mike set off for a 3-week trip to the Philippines at the end of May and I’ll be joining him in early June for a much shorter trip. Since COVID hit, it has been roughly two years since we’ve seen any of our employees in person, and many of our newer employees we’ve never met in person. As we all know, Zoom calls are great but are a sore replacement for actual in-person meetings.

- Final WordPress Development. We’ve set a hard deadline in the middle of July for launching our newest content website. We’re in a rare situation where we have a week of content essentially finalized, but our customized WordPress theme is nowhere near completion.

Two Wins for This Month

- Two new Filipino employees hired. I’ve been trying to hire an additional Philippines-based writer and graphics designer for my offroading and boating brands for several months now. As I’m going to the Philippines in June, I used this as my hard deadline for hiring for these positions as it will allow for a bit of in-person training. I finally hired a couple of really strong candidates for this position, including one person with a strong boating background (exceptionally hard to find in a writer!).

We launched a new “cockroach product” this month and it nearly instantly sold out during the initial trial phase. - Instant sell-out (kind of) of a new “cockroach” product. We launched a new cockroach for my Offroading brand earlier this month. Check out my article on the cockroach product development method on how to use this system to launch easy wins. Basically, these are large, oversize products with high price points and low competition, and relatively low demand. This product is fairly customized, innovative, and unique, and it’s probably one of my quickest product development times ever – roughly 90 days. As with most of this brand’s product launches, we air-shipped a small quantity of product in before shipping the rest via sea (I’ll explain why exactly we do it that way in the members-only email) and that shipment literally sold out almost within hours. I’m going to detail this exact product in this month’s Secret Sauce members-only email, so consider checking out a Secret Sauce membership for $20/month if this sounds interesting to you.

Two Fails for This Month

- Incorrect COGS = Big Losses. One of our brands has had near-record revenue for several months. However, our monthly profit for the brand has been sinking big time. Normally the biggest culprit would be rising advertising costs or some one-off events like a big inventory write-off but this wasn’t the case for the brand.

We finally narrowed down the problem. What was it? One of our best-selling items had a couple of major price increases over the last year, and these costs were never recorded in our reporting software. The result was Seller Bench was showing the item as being massively profitable when in fact it was losing money.

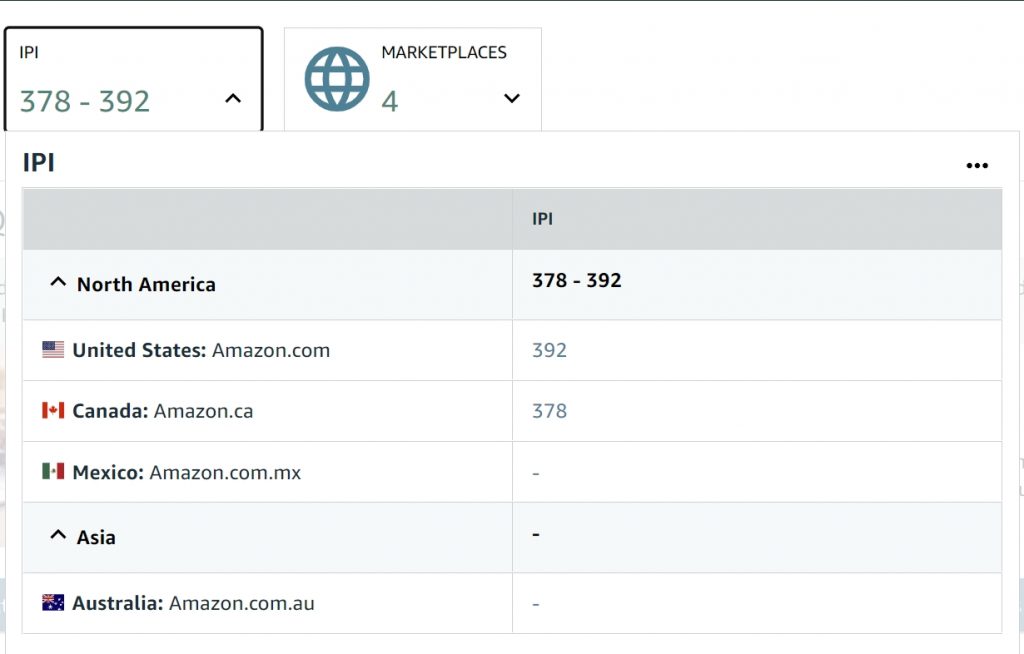

Unfortunately, this is a very frequent problem for sellers, especially as their catalogs grow, that I’ve seen multiple times in my own brands and others’ brands. Lesson learned: make sure you’re showing the correct COGs in your reporting software. - IPI Score Dropped to 392. Our IPI score for one of our brands dropped below the 400 threshold to 392. As you may know, Amazon gives you two shots at evaluating your IPI score each quarter. If you’re above the threshold amount at either point, you won’t get any inventory restrictions.

Because Amazon puts such heavy weight on historical performance months ago as opposed to recent performance, I have significant doubt we’ll get above the 400 threshold in time for the next evaluation point. This means we’ll likely be having inventory storage restrictions placed on us. The last time we had these inventory restrictions, they were far greater than we needed so I’m optimistic it’ll have minimal impact on this account.