How to Use the $800 De Minimis Threshold & Section 321 to Avoid Duties

25% Section 301 tariffs continue to exist and show no sign of going away no matter who runs the government. In light of this, many are looking for ways to get around these tariffs and there are legal ways to do so, specifically in regards to another section called Section 321. Section 321 refers to the $800 de minimis threshold the United States has.

In this article I'll give an overview of Section 321 and the $800 de minimis threshold and how businesses can use it to reduce their tariffs.

Biden Updates the De Minis Rules Targeting China (September 2024)

President Joe Biden clearly read our article and shortly after its released, issued a new rules proposal to get rid of de minimis for goods from China. He also called on Congress to overhaul the current de minimis rules. The information published here was valid as of September 10, 2024 but is subject to change (and potentially very quickly) so please tread carefully when it comes to de minimis rules.

What is Section 321 and De Minimis?

The de minimis threshold sets a minimum value for imported goods, below which they are exempt from customs duties and taxes. Each country establishes its own threshold to simplify the import process for low-value goods. Basically every country has a de minimis threshold but what makes America unique (and where the opportunity exists) is in the level of that threshold.

| Country | De Minimis Threshold for Duties | De Minimis Threshold for Taxes |

|---|---|---|

| Canada | $150 CAD | $40 CAD |

| UK | £135 | £15 |

| Australia | $1,000 AUD | $1,000 AUD |

| US | $800 USD | $800 USD |

In America the de minimis threshold is a whopping $800 after the Obama administration raised it in 2016 thanks to the Trade Facilitation and Trade Enforcement Act. This threshold is more formally referred to as Section 321 (not to be confused with Section 301 – the Section that implements additional duties). In Canada, for example, the de minimis is a meager $150 for duties and just $40 for taxes.

If you ship goods under $800 into America you avoid all duties (not just the additional 25% Section 301 duties).

How to Use the De Minimis Threshold to Avoid Section 301

Most businesses use warehouses in Canada and/or Mexico to reduce their duties via the $800 de minimis threshold; however shipping direct from China is also possible. These are the three ways businesses use de minimis to avoid duties:

- They ship directly from China in shipments under $800

- They ship from China to Canada first and then to America in shipments under $800

- They ship from China to Mexico first and then re-export to America in shipments under $800

This works quite well but there's some pros and cons to it:

- Shipments under $800 from China are impractical via sea and too expensive via air

- Shipments from Canada/Mexico still require paying Canadian/Mexican duties (which can be claimed back later)

- Shipments from Canada/Mexico still need to pay freight costs from Canada/Mexico to the U.S.

- If shipping to FBA your maximum claimable amount is $800 per day ($292,200 per year assuming you shipped 365 days a year)

As mentioned, shipping to warehouses in Canada and Mexico is by far the most common way (opposed to shipping direct from China). However, Canada and Mexico also have inherent problems, specifically you still need to ship your goods across the border. We'll discuss that shortly.

The De Minimis Strategy Relies on Having a Warehouse Geographically Close to America

Let me start by stating one thing: the strategy of using the Section 321 $800 de minimis threshold to avoid duties using Canada/Mexico relies on one thing: the location of your goods in Canada/Mexico must be geographically close to America. And by close, I mean within miles. Basically the strategy involves using low-cost couriers who transport goods across the border (and there's a whole cottage industry of these types of companies). If you're shipping goods from Mexico City to San Diego (more than 1500 miles apart) you're going to lose any cost savings on freight costs.

The good news is that there are many cities in both Mexico and Canada straddling the U.S. border (Tijuana and Vancouver being two examples) and there's many logistics companies catering to using de minimis to avoid duties.

What About NAFTA – There's no $800 Limit to That, Right?

Now you're saying…but Dave who cares about this de minimis crap, there's NAFTA! I'll just import first into Canada/Mexico and then re-export my China-made goods duty free with no limit. Unfortunately it doesn't work this way – your goods are still made in China which is what matters, not the last location of export.

How to Avoid U.S. Tariffs for Ecommerce – Individual Customer Orders (D2C/FBM) and FBA

There's basically two scenarios in which ecommerce sellers want to use de minimis to avoid duties: shipping individual customer orders and shipping into Amazon FBA.

Individual Orders (D2C or FBM)

Let's say you're an ecommerce seller who ships individual packages to your customers either from your Shopify site or via Amazon FBM. This is the ideal way to take advantage of de minimis as in most cases each customer order will be considered individually to count against the $800 de minimis threshold (meaning you could potentially exceed that $800 daily threshold). There's some nuance here so consult a customer broker for exact specifics for your situation.

There are a ton of logistics companies in Mexico and Canada on the border with America which cater to this exact situation. Examples are G-Global and Farrow Logistics. Again, the crux of this strategy rests on you warehousing your goods close to the U.S. border.

The advantage to this strategy is that it potentially allows you to exceed the $800 maximum. The disadvantage is that shipping speeds can be slower than shipping directly from the U.S. In theory these specialized carriers have daily deliveries to the U.S. but delays inevitably occur. If you have a highly time-sensitive product catalog this strategy may not be practical for you.

Shipping in Bulk to Amazon FBA

Let's say you want to ship in bulk from Canada/Mexico to Amazon FBA. Let's also say that you want to send in 200 garlic presses which cost $2 each (FOB China). Let's say they have a regular duty rate of 7% + 25% for section 301 tariffs. Let's also say they come in cartons of 50 pieces each (so you have 4 boxes).

There's two options. One, you can just ship via regular carrier like UPS or Canada Post into FBA. There's a big problem though – there's no partnered carrier across the border and shipping fees are typically very high. For example, let's imagine your garlic presses come in boxes of 50 each so you need to ship four boxes. You would actually spend more in increased carrier costs than from any potential duties savings.

| Using Cross Border Shipping Company + Partnered Carrier | Shipping Direct with UPS from Canada | |

| Packages: | 4 Boxes x 25 lbs each | 4 Boxes x 25 lbs each |

| Duties Savings | $256 ($800 x 32%) | $256 ($800 x 32%) |

| Shipping Costs | $90.90 ($70.90 (Partnered Carrier) + $20 Cross Border Carrier Fee) | $360.32 (Canada Post) |

| Duties in Canada | $80 ($800 x 10%) | $80 ($800 x 10%) |

| Potential Savings | $165.10 to $85.10 | -$104.32 to -$184.31 (No savings) |

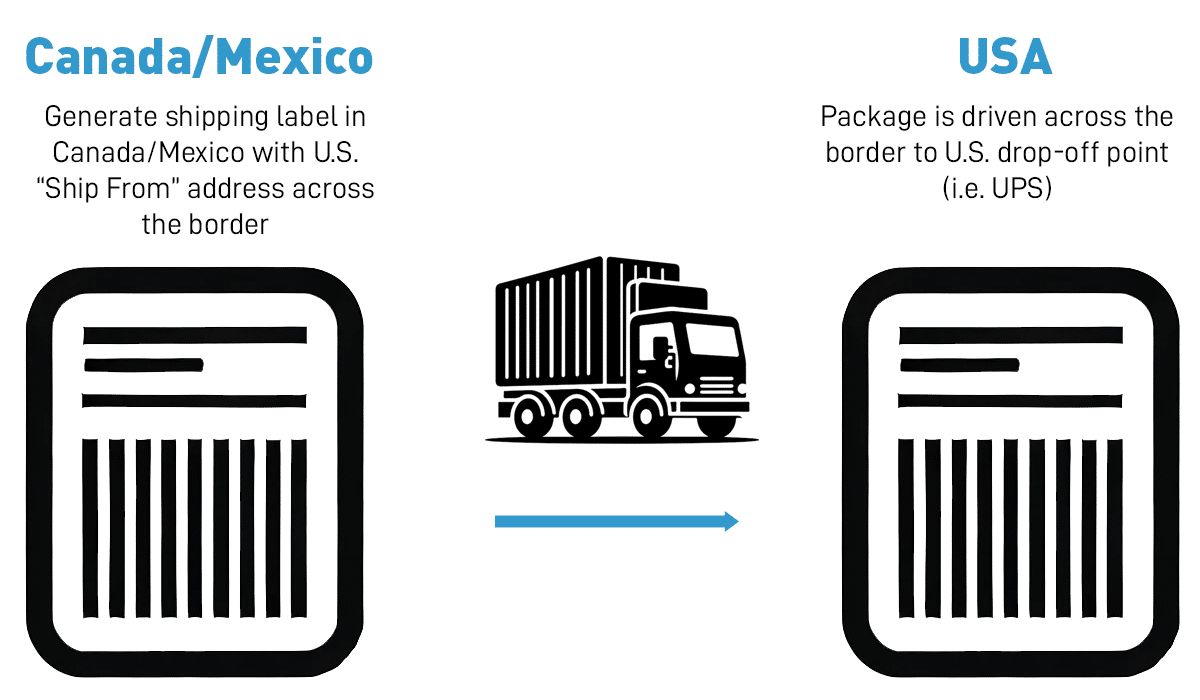

The alternative is shipping in bulk using a specialized carrier that makes frequent trips across the Canadian or Mexican border and drops the goods off at a UPS depot in the United States, effectively allowing you to use a partnered carrier from Mexico/Canada with U.S. domestic shipping rates. This might sound crazy but there's an entire industry of carriers who do this exact thing – Stallion Express and Chit Chats being an example from Canada.

There is one major potential caveat to this strategy: there is a “single order” clause in regards to Section 321 (see below).

Getting Your Duties Back from Canada/Mexico

One of the main drawbacks to this strategy is that you will initially have to pay Canadian/Mexican duties. Typically these are cheaper than the U.S. tariff equivalent (because of section 301 tariffs) but still not insignificant. There's two ways around this:

- Bring your goods into a bonded warehouse (a warehouse in which your goods do not formally clear customs into that country)

- Claim your duties back as a duty drawback

The challenge is that in both of these scenarios, it can be expensive either way. Bonded warehouses have an expensive administrative cost to them (for entry and removal of items) and filing for duty drawbacks is also administratively expensive. We personally opt for the drawback option (from Canada) but it means that we get back a fraction of the duties we paid to Canada.

Section 321 De Minimis – The Single Order Clause

There is one potential issue with using Section 321 to avoid duties for goods shipped in bulk to the United States (i.e. Amazon FBA) and that is the “single order clause”.

The “single order clause” says that a shipment cannot be part of a larger order that has been split into multiple shipments to stay under the $800 threshold. For example, if a customer orders goods worth $2,400, a seller cannot split the order into three separate $800 shipments and claim Section 321 duty-free status for each. This would be considered an attempt to circumvent the regulations. The same argument could be made if one is shipping regularly daily shipments into Amazon FBA. If the shipments from Mexico/Canada to the U.S. are part of a larger, pre-arranged plan to distribute a bulk order in smaller increments to avoid paying duties, this could be seen as an attempt to circumvent the regulations. Of course, with Section 321 there wasn't much consideration made for Amazon FBA and you should discuss the risks/legalities of using this strategy in regards to FBA with a customs broker.

Conclusion

Section 301 tariffs may be here to stay and an increase in them isn't totally out of the realm of possibilities. Using Canada or Mexico to take advantage of the $800 de minimis threshold may be a viable, if albeit burdensome, way to reduce the cost of these tariffs.

Are you using the $800 de minimis threshold to reduce any duties? Let me know in the comments section below.

Great post! The Section 321 CBP regulation has truly transformed e-commerce by allowing faster, duty-free entry of low-value shipments into the U.S. This provision lets businesses ship goods valued at $800 or less without incurring extra tariffs, which helps small businesses and customers alike. However, it’s essential to stay updated on compliance requirements, as CBP rules are critical for smooth cross-border transactions. Thanks for sharing!