How to lose $500,000 in 6 months Importing from China

A couple months ago this post went up: The Chinese are Coming: More and More Chinese suppliers are Selling Direct to Consumers. It struck a chord with a lot of people and was shared across a number of websites.

Chinese suppliers cutting out private labelers is indeed a very real threat. However, factories selling direct to consumers aren't necessarily the asteroids that are going to wipe out private labelers everywhere. Chinese suppliers, without a doubt, have a more direct supply line. BUT many of these suppliers lack the knowledge in internet marketing, logistics, and general Western consumer behavior that many of the readers of this blog do not.

A friend of mine was recently laid off by a very large pet product manufacturer in China that in late 2015 tried to hop aboard the Selling on Amazon bandwagon. In just six months they managed to lose over $500,000. My friend was kind enough to share the Profit and Loss (P&L) statement for the last 6 months so we can see just how and where this company screwed up. Here's the story of how one Chinese supplier fled the American ecommerce market with their tail between their legs.

The Company and its Losses

The company in point was a manufacturer of pet supplies based in China. The owners of the factory sell to many very large stores world wide and have for some time. Seeing the boom of ecommerce in America and the easy ‘Amazon money' they wanted to get in on it for themselves. They launched a new brand, opened an office in San Francisco, and hired many staff, one of whom was a friend recruited from another company. They began selling in the beginning of 2016.

The company, on the surface, appeared to be doing quite well. By June they had amassed over $300,000 in sales. Their gross margins appeared to be very healthy: they sold everything at a 300% markup, meaning if they bought a doggy chew toy for $10 they sold it for $30.

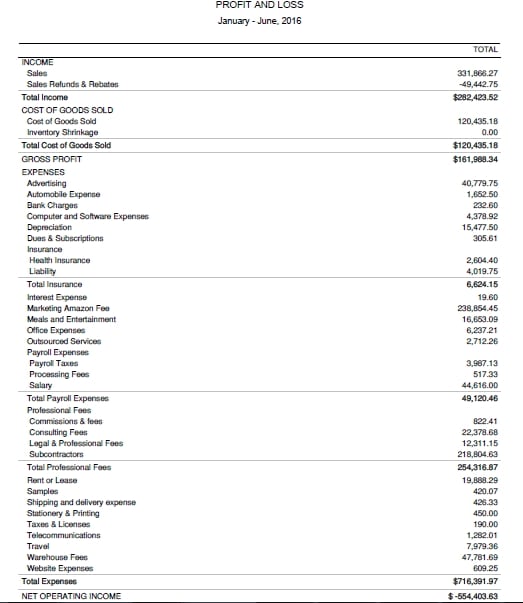

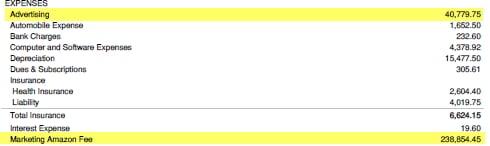

But all was not good. In July, my friend and nearly all of the staff got layoff notices. The Chinese company was shutting its doors. A quick look at the Profit and Loss Statement revealed why.

Note that little dash beside the $554,403.63 in the NET OPERATING INCOME? That means they lost over $554,000! This is a lot of money no matter how rich you are.

Three Critical Errors that Will Make Your Private Labeling Business Unprofitable

This Chinese supplier screwed up running a private label business on a scale and speed I've never seen before. But all of their critical mistakes are mistakes I've seen many other importers and private labelers make – including myself! Looking at the P&L we can see there are three primary causes of this company losing over $500,000 in 6 months and some important lessons we can all take from them.

- Paying too much attention to gross margins

- Paying (and overpaying) others to do work you can do yourself

- Not monitoring advertising and marketing costs

Paying too Much Attention to Gross Margins

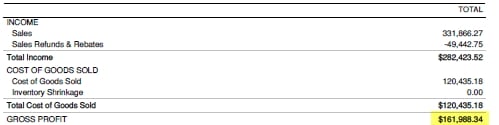

If you look at the profit and loss, their gross profit margins look very healthy. Out of $331,000 in sales, their Cost of Goods sold was only $120,000.

This has to be one of the top mistakes I see almost every new importer making. They assume that if they can buy a widget for $10 and sell it for $20 they have a home run. What often happens is that this importer will start selling these products and will be plugging along nicely. Lets pretend they're selling 300 units a month on Amazon. They expect to have $3000 in profit each month (300 units x $10 profit) OR if they're really smart, they assume they have $2100 in profit ($3000 minus 15% of Amazon fees on gross sales). All the while they've ignored the cost of inbound and outbound freight to Amazon, duties, customs broker fees, freight from the port, inventory shrinkage, software product subscriptions, etc. It's a classic example of not seeing the forest for the trees.

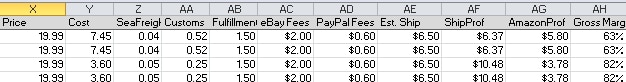

The problem is that it's really hard to calculate in your head all of the variable expenses with a product, let alone trying to attribute fixed costs. It's too easy to fall into the trap of seeing that “Sold, ship now:” email from Amazon, looking at the “Your earnings” number, subtracting your product cost and thinking “Chaching chaching $$$!!!”.

Here's how to solve this problem: you absolutely, 100%, must keep a spreadsheet that estimates all of your variable expenses. There's a screenshot below of the the Excel document we use in my company (my course has a full copy of the Excel document). And then, from time to time, review your estimates against a sample of actual orders (minimum 10 orders) and ensure your estimates are correct.

Paying (and Over-Paying) Others to Do Work for You

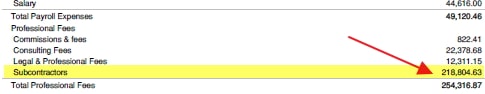

This Chinese supplier paid over $200,000 in subcontractors. They had a subcontractor for photography, a subcontractor for website development, a subcontractor for Amazon descriptions, a subcontractor to manage the subcontractors, and so on and so on.

Almost all successful (re: profitable) ecommerce companies are extremely nimble. The existence of Amazon, Shopify, Adwords, etc. is predicated on being easy enough for the average Jane to use. If you need to hire outside help to do jobs that your competitor is doing themselves, you are either a) going to be higher priced or b) you'll be unprofitable.

Here's how to solve this problem: if you're just starting your private labeling company, at a bare minimum, you should be able to upload your products to Amazon, take photographs of your products, write reasonable descriptions, setup a Shopify store or other website, and manage a basic advertising account with Google or Facebook. Resist the urge to use freelancers when starting your business like a recovering alcoholic has to resist a beer at an open bar wedding.

Not Monitoring Advertising & Marketing Costs

This Chinese supplier had two costs of advertising and marketing: advertising costs via Amazon Sponsored Ads and free product giveaways in an effort to generate product reviews.

Online advertising is a lot more granular and attributable than previous forms of advertising like television and print. Subsequently, most online marketers have a better grasp on advertising costs than many other expenses yet its still a cost that can get out of hand. Part of the problem lies in the fact that often advertising is attributed as a percent of sales, i.e. Amazon Sponsored Ads reports your conversion costs as an Average Cost of Sale (ACoS) meaning that if you spent $5 in advertising to generate $100 in sales, your ACoS is 5%.

However, I think it's better to think of your advertising costs as a percent of profit. For example, this Chinese supplier paid $40,000 in advertising costs for $331,000 in sales. As a percent of revenues this is just 12%. However, as a percent of profits this cost is 19%. Nearly one fifth of their profits are blown away on advertising.

This company's other major marketing expense was on product giveaways to help generate Amazon reviews. They were giving away dozens of products a week. Ideally, such giveaways are a one-time expense until the product has some traction. But these promotional marketing strategies come in other forms too, largely in the form of sales and discounts. Sales and discounts are difficult to spot in your financial statements as they're normally not a ‘line item' – they're simply hidden in reduced revenues.

How to solve this problem: Always think of your advertising costs as a percentage of your profit, not of revenues. Don't run unprofitable ads just for the vanity of generating sales. The same goes for sales and discounts- don't assume you can make up for decreased margins with higher volume. Ensure the numbers make sense.

Conclusion

The encroachment of Chinese suppliers I believe will have a measured impact on many private label businesses but as the results of this Chinese supplier show, there's more to selling products than making products.

The losses of this Chinese supplier were at a larger scale and occurred within a shorter time frame than losses experienced by smaller businesses who are guilty of making similar mistakes. However, the mistakes they made are nearly identical to those mistakes that other private label businesses routinely make. Hopefully this summary of their failures and losses will help prevent others from making similar mistakes.

What's your take? Have you made any critical mistakes in your business? If so, please share in the comments section below.

Hey! Great article.

Suppose I order 1000 USD worth of merchandise from Alibaba, what will I end up paying for all the transport charges to India? Will it be a significant percent of the profits?

Thanks.

It depends how big it is but yes, it will likely be $200-400 at least.

This is excellent: “All the while they’ve ignored the cost of inbound and outbound freight to Amazon, duties, customs broker fees, freight from the port, inventory shrinkage, software product subscriptions, etc. ”

I must share with others.

Interesting point about not paying others to do work you can do yourself. I would use a freelancer to do a job that I can’t do well myself. For example, I am not good a photos. I don’t have a camera and I am only a beginner when it comes to using photo editing software. So, I was happy to pay a freelancer to do it for me. That being said, I made sure the freelancer was working at a price I could afford.

I remember reading on one of Philip Kotler’s books that studies show that only 17% percent of sales are effective. Kotler states that sales are effective only when you have a superior product to your competitors. In that case, they allow your product to get into the hands that wouldn’t have bought them otherwise. Once they discover it is a superior product, they will keep buying it. Without a superior product, the customer will just go back to buying the cheaper product once the sale is over.

So one might ask the question. Why to companies have so many sales? My guess is that they don’t succeed at differentiating their product. So, they need a discount to increase sales. The second reason is liquidity. They need the cash. Keeping goods collecting dust on the shelves, doesn’t pay bills.

One of the most thoughtful comments in a long time! I suspect many companies have high sales, but not a lot of companies have high profits. There’s such an obsession with revenue numbers in business communities and not enough on profits. Thanks for the book mention as well – I will try to check it out some time.