Amazon Didn’t Kill Bed Bath & Beyond—Here’s What the Ecom Company Did

Bed Bath & Beyond entered bankruptcy proceedings this week. Now the post-mortem analysis begins with an inquiry about who or what killed the brand. The immediate reaction always seems to be “Amazon killed [such and such brick-and-mortar retailer]” but in this case, there was another e-commerce juggernaut that's more guilty than Amazon.

Let's take a look at who really killed Bed Bath & Beyond and what we can learn from it.

Who Killed Bed Bath & Beyond and How

There's one company that in recent years has become a huge player in home goods: Wayfair. If you're not familiar, Wayfair.com started as a spaghetti plate of hundreds of different websites like Bedroomfurniture.com and cookware.com that eventually morphed into the New-York-Stock-Exchange-traded home goods e-commerce that it is today. It launched in 2002, over 40 years behind Bed Bath & Beyond's founding.

In 2020, during the height of the pandemic, Wayfair overtook Bed Bath & Beyond in terms of revenue and never looked back. In fact, Wayfair has nearly double the revenue of Bed Bath & Beyond all without a single brick-and-mortar store.

But how exactly did Wayfair come to kill Bed Bath & Beyond? We can see from a few stark strategy differences between each retailer. These strategy choices also give a good warning to other brick-and-mortar retailers and startup e-commerce companies alike.

Bed Bath & Beyond Never Embraced Paid Traffic—Wayfair Did

Wayfair's surge in revenue is reflected almost completely in its website traffic. Wayfair gets around 70 million monthly unique organic traffic compared to Bed Bath & Beyond's 24 million. However, organic traffic doesn't tell the whole story—paid traffic does.

While Wayfair averages about 2.2 million to 11.2 million monthly visitors from paid traffic sources over the last two years, Bed Bath & Beyond has only ever reached a peak of 1.1 million unqiue traffic from paid sources in 2021 and is typically closer to 300,000 to 500,000 monthly uniques from paid sources.

Bed Bath & Beyond never embraced paid traffic as Wayfair did. The former seemingly chose to rely upon its traditional forms of advertising used for its brick-and-mortar stores and hoped to piggyback off of that traffic rather than ever relying heavily on online advertising sources such as Google or Facebook ads.

Bed Bath & Beyond Was Late to the Marketplace Party—Wayfair Wasn't

While the lack of paid traffic from Bed Bath & Beyond was endemic to its overall poor strategy, arguably the most important factor in it never gaining serious e-commerce traction was its failure to quickly embrace marketplace sellers.

As most of the regular readers of this blog will know, Amazon is dominated by third-party sellers who make up well over half of all the merchandise sold by it. Similarly, Wayfair also is heavily dependent on its marketplace sellers.

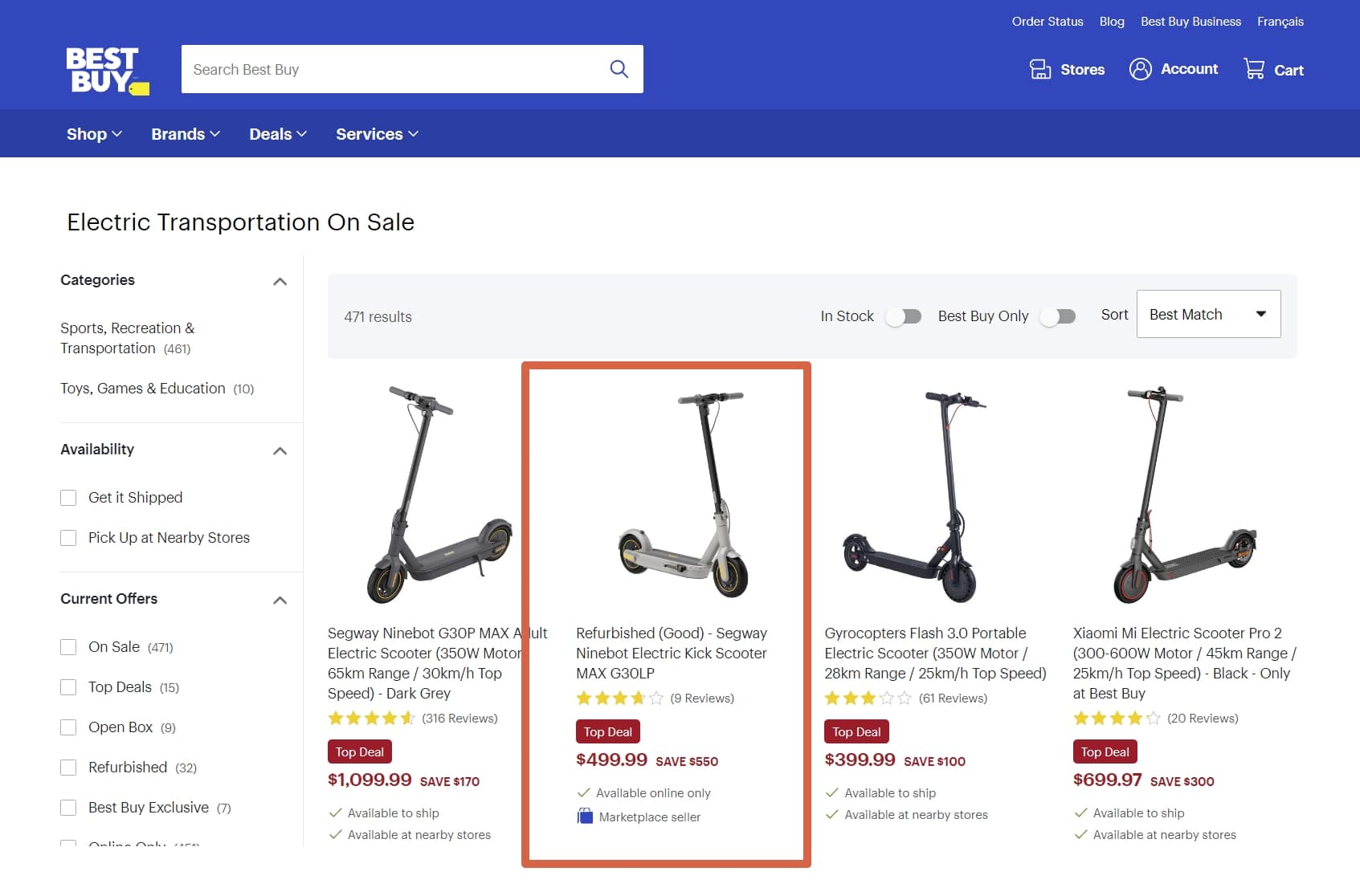

Bed Bath & Beyond, on the other hand, only opened up to third-party sellers in a last-ditched effort in 2021, which by then was far too late to be welcomed by either consumers or sellers. Compare that to other large brick-and-mortar retailers who launched marketplaces well before then, specifically Best Buy who first launched their marketplace in 2015 (rather unsurprisingly, Best Buy has been one of the fairy tales of an older brick-and-mortar retailer that has managed to thrive in the 2000s).

Bed Bath & Beyond Had Expensive Prices and Slow/Expensive Shipping

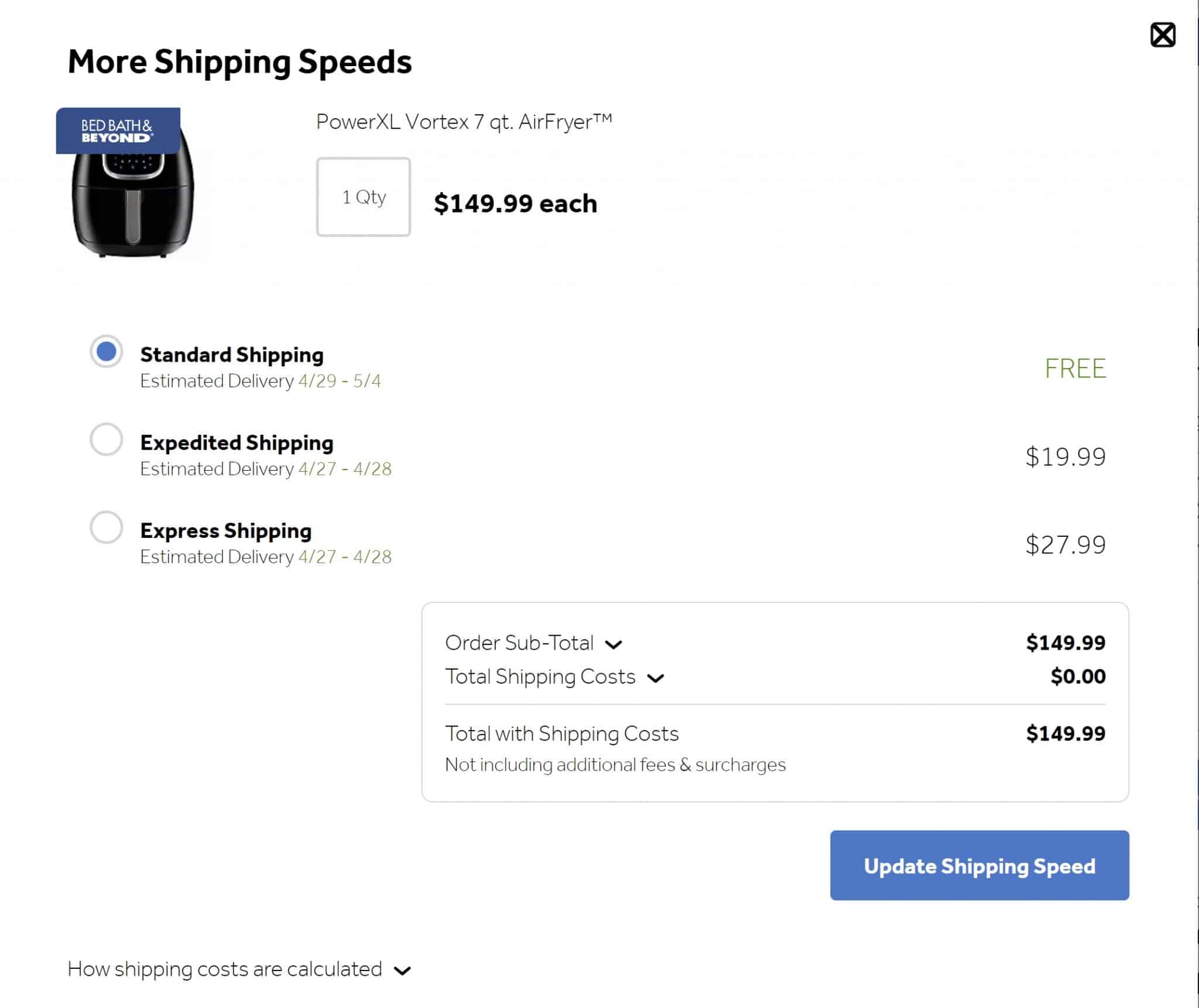

Bed Bath & Beyond, like many brick-and-mortar retailers, has struggled to offer quick and cheap fulfillment options. Essentially, Bed Bath & Beyond offers consumers two delivery options: free and slow (often 3+ days) or expensive and fast.

Bed Bath & Beyond tried to leverage its footprint of hundreds of stores across the country to offer same-day delivery on many items. There was a catch though—it cost $9.99 and it wasn't available in all regions.

Now to be fair, Wayfair has never been known for having extremely expedient shipping but customers are largely willing to sacrifice quicker shipping for lower prices (see Chinese marketplace TEMU's meteoric rise this year). What they won't tolerate though is high prices and expensive/slow shipping.

Bed Bath & Beyond's E-Commerce Software Was Slow to Adapt

In 2020, Bed Bath & Beyond hired a new chief digital officer, Rafeh Masood, tasked with trying to make the company stronger in e-commerce. Before we place the blame on Masood, he had the unenviable task of not just saving the Titanic, but pulling it from the bottom of the Atlantic Ocean, restoring it completely, and convincing customers to take their next cruise on it.

No clearer was Masood's challenge than when pledged he was going to make checkout easier on the website by “reducing the number of steps needed to check out online from seven to three” (imagine 7 steps to checkout in an Amazon 1-step checkout world).

When Bed Bath & Beyond finally caught up with their desktop shopping cart, Wayfair had long been tech-forward and was enjoying a Top 20 Shopping app in the AppStore embracing AR.

Conclusion

Ultimately, history tells us that brick-and-mortar retailers like Bed Bath & Beyond who face the Innovator's Dilemma ultimately end up with the same fate as brick-and-mortar retailers like Toys “R” Us, Sears, and J.C. Penny. What will the ultimate fate of Bed Bath and Beyond be after bankruptcy? If Radio Shack and history can tell us anything, it may be that the most likely scenario is a YouTube influencer like Tal Lopez buys the company strictly for its brand name legacy to help sell online courses.