Business Structuring for Canadian Businesses in Ecommerce or Digital Marketing

I'm hesitant to write an article like this because there's so much legal and accounting technicality here that I need to be extremely careful with. I am neither an accountant nor a lawyer. I have to balance being careful while also being useful for you.

With that being said, in 15 years of doing online businesses, specifically e-commerce businesses, I've learned a lot about what Canadians need to know about the industry.

What Is a US LLC? How Does It Differ from a Canadian Corporation?

In the US, most people use what they call Limited Liability Companies (LLCs). If you see a business in the US, it normally ends in LLC, e.g., Dave Bryant LLC.

In Canada, most businesses use corporations. If you see a business in Canada, it normally ends in Inc. or Incorporated, e.g., Dave Bryant Inc. or Dave Bryant Incorporated (both mean the same thing).

LLCs and Corporations operate very similarly in the US and Canada—they both offer limited liability to the business owner(s) (i.e. theoretically, if someone sues you, only your company's assets are liable, not your personal assets). However, Canada does look at US LLCs a little bit differently than the US, which can bring up double-taxation issues.

Double Taxation and Tax Treaties

In a very broad nutshell, Canada and the US have a tax treaty that effectively saves you from paying tax both in the United States and in Canada. Essentially, one tax bill can be written off against another. This is an extremely complex topic with a ton of “gotchyas.” For example, in the United States, LLCs are viewed as “pass through entities” which means income generated by the business “passes through” to the owner. Canada, however, views them as corporations. The result can be double taxation. See this excellent article for more information on this.

Canadian Corporation vs. US LLC: Which Is Better?

The biggest mistake I see for Canadians debating between Canadian corporations and US LLCs for their business is they assume one of them is automatically the better one. That is definitely not the case. There are big pros and cons to both—and your accountant doing your taxes is not likely going to tell you about these pros and cons.

Canadian Corporation Pros & Cons

Pros of a Canadian Corporation

- Easier to set up for Canadians

- Straightforward taxation and accounting

- Relatively good income tax

Cons of a Canadian Corporation

- Makes your business harder to sell to an American because of the lack of SBA financing

- Harder to get US credit cards

- Near impossible to get US financing

I'm an advocate that if you're just starting, just go with a Canadian corporation. Why? Because it's more straightforward. Everyone you talk to in Canada will understand this better, from Canadian accountants, Canadian business owners, Canadian lawyers, etc.

Next, Canada is a great place from a taxation perspective for small businesses, especially compared to the US. Generally, our corporate tax rates are lower than the US. When you hear about the US having lower tax rates, they're normally talking about personal tax rates. But guess what? As soon as you pay yourself anything, you pay the tax rate of where you live. A lot of people don't realize you cannot change your residency based on where your company lives. If you go and register an off-shore bank account, as soon as you pay yourself any money, you're going to be taxed in Canada. Now there are some benefits to offshore bank accounts for corporate taxes, compounding, etc. but you don't need to worry about this until your business makes hundreds of thousands of dollars in profit.

Now the biggest problem with a Canadian corporation compared to a US LLC is the lack of various financing options that are glorious in the US. For example, Amazon lending, at this time, is only available to US companies. US credit cards with amazing points are only available to US companies (there are some workarounds, but that's another topic). Finally, when the time comes to sell your business, it's easier to sell if it's a US LLC because these businesses are eligible for SBA financing (which most US buyers want).

US LLC Pros and Cons for a Canadian

Pros of LLCs

- Easier to get generous US credit cards

- Easier to get plentiful US financing

- Easier to get cheaper US insurance

- Easier to sell your business to an American business

Cons of LLCs

- More complicated taxes

- Could be subject to double taxation if you're not careful

Many Canadian entrepreneurs looking to start an Amazon business or other digital business instantly think they need to get a US LLC. Why? Because they read a bunch of American blogs and they all talk about LLCs. There are reasons to get a US LLC, but you don't need a US LLC to run an Amazon business, and you probably don't want one.

The biggest reason to get a US LLC is it opens your world to US credit cards, financing, insurance, and other services that non-US companies don't get access to. Want an Amazon loan? You can't qualify as a Canadian business. Want a nice Amex Business Gold that gives you 4x points on advertising spend? You need to be US-based.

The big con of running a US LLC is it complicates your life. You're now dealing with taxes in the US and Canada and, worse, you could be subject to double taxation because Canada looks at US LLCs as the equivalent of corporations whereas the US considers them “pass-through entities” (again, see this article for a good explanation).

When It Doesn't Matter If You're a Canadian Corporation or US LLC

There are a bunch of things where it makes zero difference if you're a Canadian corporation or US LLC.

- Opening a seller account (Amazon, eBay, etc.). You can do this easily whether you're a US LLC or a Canadian corporation.

- Both are limited liability companies.

- Getting a US Dollar business bank account based in Canada

- Getting a US Dollar personal bank account based in the United States

First and foremost, and I can't stress this enough—you do not need a US LLC to sell on Amazon.com. In fact, you don't even need a business.

Next, both Canadian corporations and US LLCs are limited liability business structures, which means you're afforded some level of personal asset protection.

Next, in terms of banking, there is a difference between having a US dollar account in Canada (i.e., an account based in US dollars) and a US dollar account based in the United States. You might be wondering why it matters.

It matters because Amazon will always convert US dollars into the currency of wherever your bank is based, no matter the currency of the bank account. So if you have a US dollar account in Canada, Amazon will gladly accept that bank account, but it will convert it into Canadian dollars, send it to your bank account, and then your bank will convert it back into US dollars. Both Amazon and your bank will take about a 3% fee each time.

How do you get around the above scenario? You open a bank account based in the United States. The good news is that most of the top 5 banks in Canada have US branches and will allow you to open one of these accounts super easily and online (e.g., TD, BMO, and RBC). The bad news is that you can only do this personally. Technically, you can open a US-based bank account for your business, but it's very expensive and impractical, and most small businesses never do this.

How to Get Your Canadian Corporation or US LLC

There are a million ways to register your Canadian Corporation or US LLC. You can technically self-register for either. In Canada, self-registering a corporation is fairly complicated, and most people use a lawyer. Unfortunately, you're going to get charged $500 to $2,000. I recommend just finding someone on Upwork. Go with the lowest bid as there's no difference in the result.

For a US LLC, it's quite a bit easier, but it's more complicated to pick the best state to get your LLC. This a complex question beyond the scope of this article. Popular candidates are Nevada and Delaware. In Nevada, for example, you can self-register through their government website Silverflume.

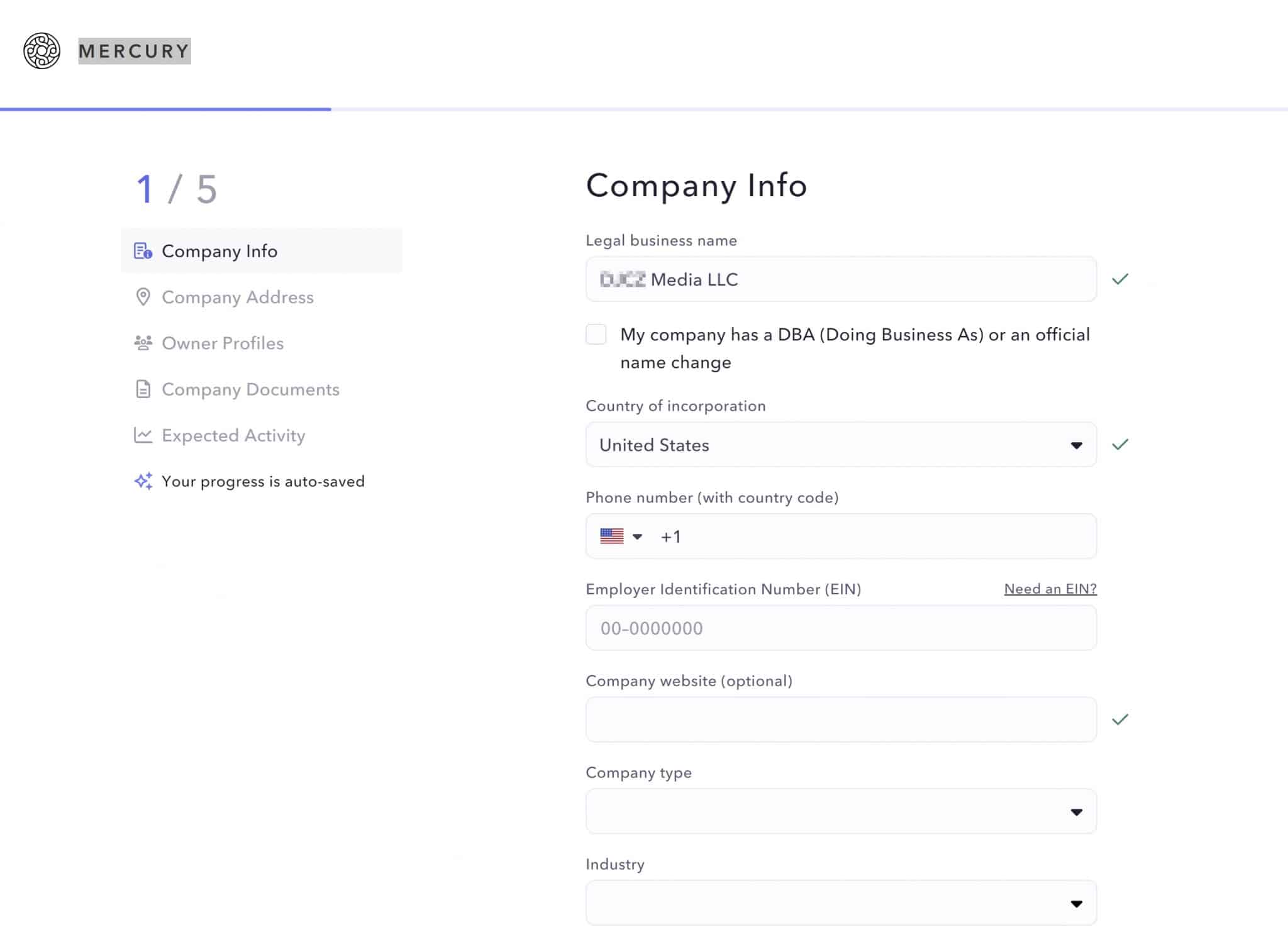

The better option for most people is to use a service. Mercury Bank, for example, has a great service that allows you to register for your US LLC and get banking all in one go.

Conclusion

In conclusion, for most Canadians getting started with their Amazon or e-commerce business, I recommend keeping things as simple as possible and keeping things in Canada as much as possible.

Running a business is complicated enough without trying to make your business some complex multi-national beast. If you're a larger business in the 7-figure or beyond range, the decision to open a US LLC becomes more complex and one you should carefully consider as there are a lot of gotchas.

Thanks Dave, really informative article for Canadian FBA sellers.

Glad it helped!