Brand Report – March 2022 ($754,656)

Welcome to the March edition of Brand Report! Each month, we'll break down our monthly revenue so you can see what's working and what's not.

We'll give you aggregated numbers across the eight brands we either own or have significant equity in. In our exclusive Secret Sauce Brand Report, you'll get our numbers broken down brand by brand. We'll also give you a 60-minute class each month detailing one particular thing we're working on right now that you can use to start and grow your own business. Our next class is on April 27. It's all about how we use agencies and freelancers in our companies as well as tips and tricks for hiring full time staff. Get the Secret Sauce for your brand.

Revenue for March 2022

Our revenue for March 2022 was $754,656, which is roughly $132,000 more compared to February.

All of our brands, except one, were up from February 2022 from 10% to 75%. One brand was down 25% from February.

A lot of this gain from March is due to the seasonality of our brands and being fair-weather brands. In fact, one of our brands was down roughly 25% when compared year over year due to a combination of cuts in advertising, supply shortages, natural decline from Covid peaks, and just more competition.

What We Worked on This Month

Here are some of the things we worked on in March:

- Final Production of a New Innovative Product – After a few months of testing and going back and forth with samples, we entered into the final production of a trial order of a fairly innovative camping shower product. By the time this item is available for sale, it will likely be late June, so this will be just enough time to trial the product during the summer camping season. Unfortunately, it also means by the time we decide if we will be re-ordering the product, we'll be entering the end of summer. Long story short, this item won't have any impact on the P&L until 2023.

Two Wins for Our Brands in March

Here are a couple of things that worked for us in March:

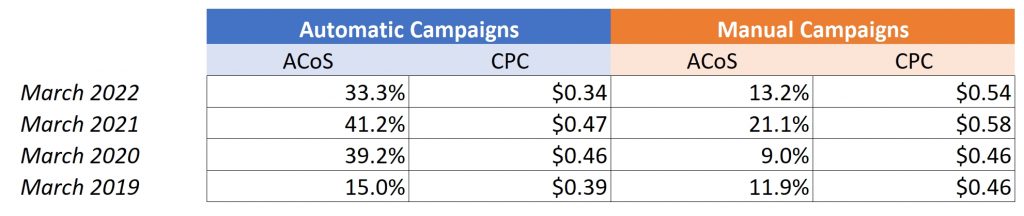

- Lowering ACoS from 32.4% to 21.3% Year-Over-Year. We've made a very conscious effort to work on lowering our ACoS this year, largely because of compressed margins due to increased logistics costs and our plan to sell at least one of our brands at year-end. So far, we've been seeing positive results. One of the brands we focused on this month saw ACoS drop from 32.4% in March 2021 to 21.3% in March 2022.

How did we drop ACoS significantly? Largely by reducing or eliminating auto campaigns. Our automatic advertising campaigns have seen our average ACoS consistently rising over the last three years from 15% in March 2019 to 41.2% in March 2021, all with our average cost per click barely increasing. In my experience, Amazon has done a much poorer job of picking relevant keywords and ASINs to target in automatic campaigns over the last several years. - Patented Product = Huge Success on Amazon and First Wholesale Orders. One of the things I'm most proud of over the last couple of years is spending a lot of time developing truly differentiated products and even getting one patented. My strong belief is that to succeed on Amazon, you can't win anymore just by strong marketing and branding – you need to have truly differentiated products now.

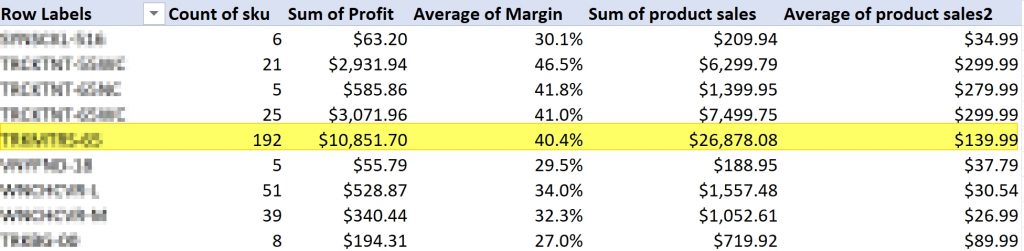

Every month, I'm maniacal in making an Excel Pivot Table of all of our products' performance by SKU. We have software that does this too, but a Pivot Sheet provides much more granular and reliable data than any software I've used. One of our products, a vehicle accessory, is enjoying its first full Spring being offered, and sales have been extremely strong. They were over $25,000 in March, and this was only for one particular type of vehicle. We have a container on the water with other vehicle types, and I'm hoping for sales of this product to easily exceed $50,000/month as we head later into Spring/Fall. The best things about these are 1) Margins are great. This product has a cost of just over $30 and is selling for nearly $150 now. 2) The product is patented. Patents will not stop people from either violating them illegally or getting around them legally, but it will afford much less competition and a much longer life cycle.

Two Fails for Our Brands in March

Here are a couple of things that didn't work for our brands in March.

- Year-Over-Year Same-SKU Sales Are Drastically Down. I talked about the nice success one of our new patented products is experiencing. This is great, but it's also hiding some pretty significant year-over-year losses for same-SKU sales. This same vehicle accessories brand is down about 25% year-over-year. However, if you remove the sales of SKUs we just started offering this year, it's closer to being down 50%. As I mentioned in the beginning, some of this is due to cuts in advertising, some due to stock shortages, and some due to post-COVID (is it too early to say post-COVID?) declines but some of it is simply more competition.

- China Shutdowns Are Wreaking Havoc on Holiday Inventory Planning. Anyone sourcing products from China knows that China is finally seeing pressure against its zero-COVID policy and cases are skyrocketing there resulting in massive lockdowns across the country. This is a big problem as we have a number of products currently in development that we're waiting on samples for before placing our final holiday orders. With logistics delays, we have a July target for when most of our holiday orders need to enter production in order to be available in time for November. This deadline is going to be pushed to its limit.