Advertising Up 18% in Q4 – Amazon Q4 Earnings

Amazon just released its Q4 2024 earnings, and the results have some interesting and important revelations for sellers.

Advertising Up 18%, Revenue Up 7%

There are two metrics sellers should care about in Amazon's earnings report: Advertising Revenue and Third-Party Seller Fees Revenue (essentially referral and FBA fees). You can find all of the historical figures in previous quarters at the EcomCrew Amazon Stock Tracker.

If advertising and third-party seller revenue growth were more or less consistent with overall “online retail sales” growth, then sellers are paying roughly the same as in previous quarters. If growth for either of those two fees outpaced online retail sales, then sellers are, more or less, paying more for those two things.

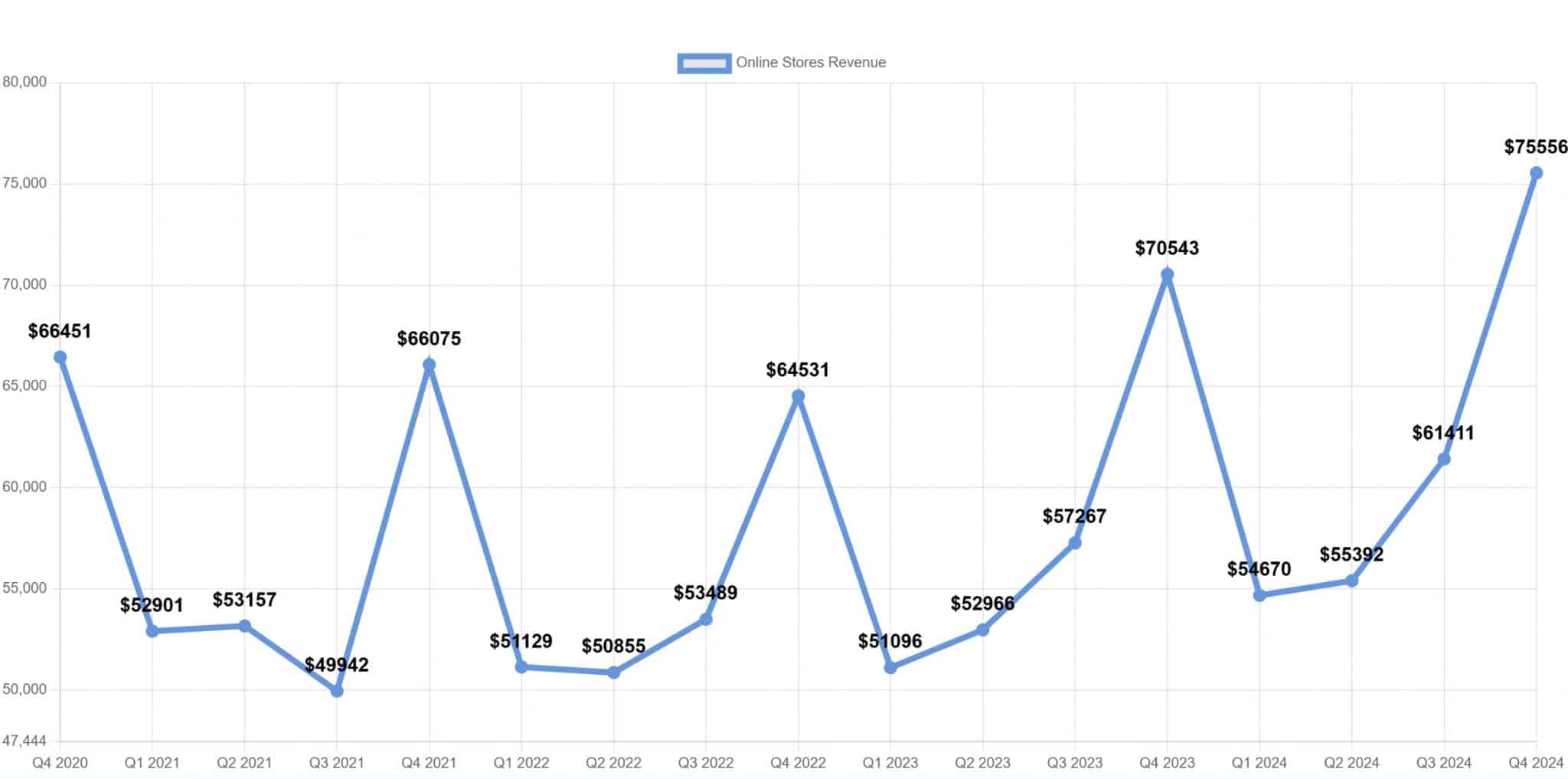

Online store revenue was up 7% from Q4 2024 (compared to Q4 2023). It was $75.556B in Q4 2024 compared to $70.543B in Q4 2023. Online store revenue takes into account only 1P sales (i.e., items shipped from and sold by Amazon) but is one of the best indicators of overall revenue growth, as Amazon doesn't account for gross sales of third-party sellers.

However, despite online store revenue being up only 7%, advertising revenue was up 18%. This is more or less similar to previous growth patterns in Q3, where online store revenue was up 8%, but advertising revenue was up 19%. As the chart below shows, advertising revenue has been growing at a staggering rate for Amazon, far eclipsing online store revenue growth. The growth is a result of both increased advertising CPC and CPM costs, as well as an increase in the number of sponsored products in search results and other locations on Amazon.

FBA Fees Continue to Rise

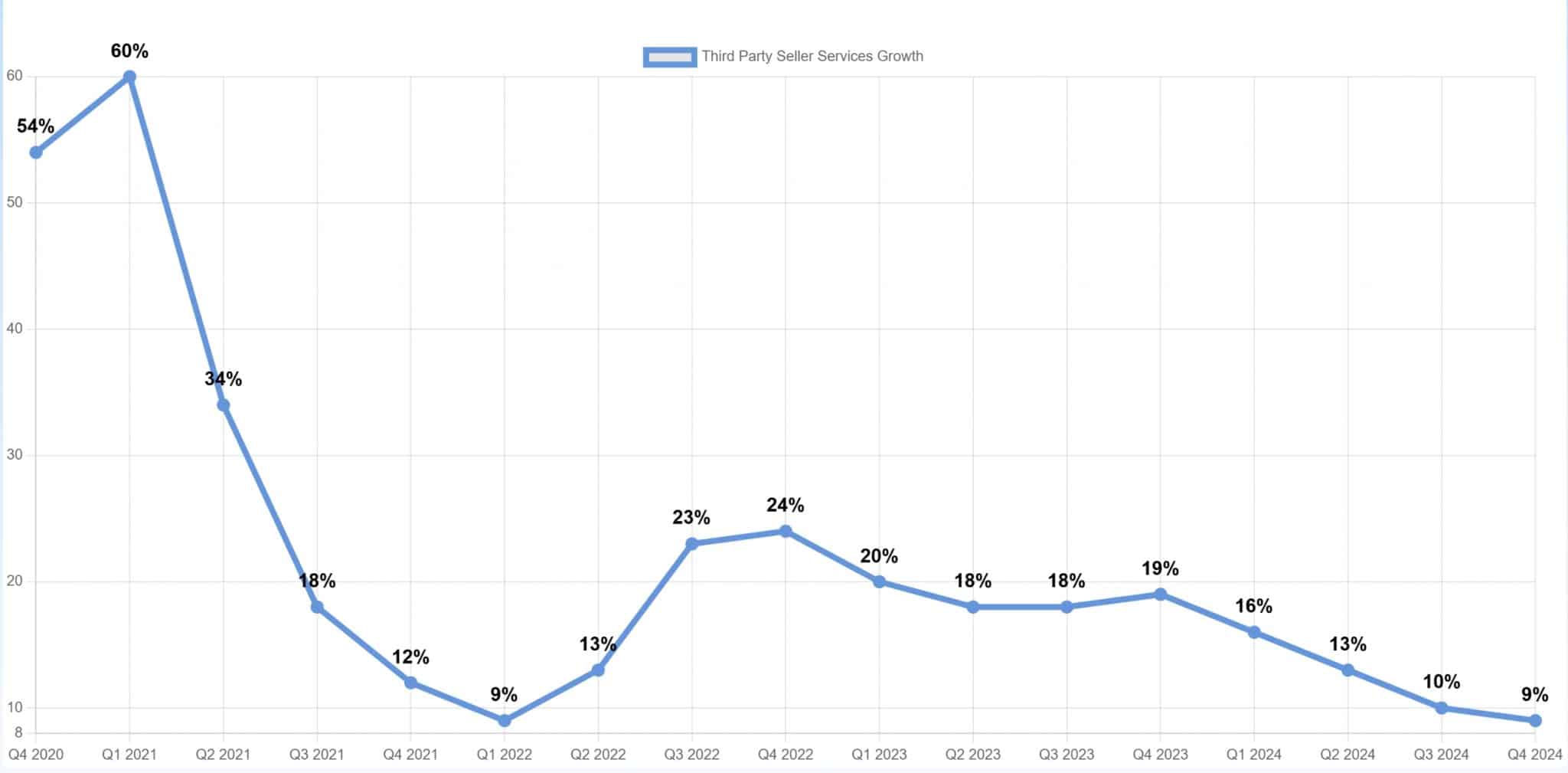

Also of note were FBA fees, reported as “third-party seller fees” (which basically include referral and FBA fees).

FBA fees were up 9% year-over-year. Does that mean that Amazon didn't charge that much more in FBA fees in Q4 2024 compared to 2023? Not necessarily.

FBA fee growth is a measure of both FBA fee increases and third-party seller revenue growth. In fact, if we assume that third-party seller revenue grew at roughly the same pace as first-party seller revenue (7%), it would mean that FBA fees would have needed to increase roughly 28% to reach that 9% number. In other words, it's possible that FBA fee growth increased 28% in Q4 2024 compared to 2023.

Other News

Amazon also announced a number of other results and achievements for the quarter:

- Was named the lowest-priced U.S. retailer by Profitero for the eighth year in a row. The study found Amazon’s online prices were an average of 14% lower than those of other major U.S. retailers.

- Launched Amazon Haul, a new ‘ultra-low price' experience in Amazon’s U.S. shopping app and mobile site (essentially a competitor to Temu).

- Announced a number of AI initiatives.

- AWS growth continues to be strong, up 19% for the quarter.