Amazon Q3 2024 Earnings – Advertising Revenue Soars 19%

Amazon shareholders got a treat on Halloween Thursday with Q3 2024 earnings that exceeded expectations thanks to soaring revenue from advertising. In other words, sellers were the ones who got the tricks as they paid a lot more in fees last quarter than the year prior.

What was the impact to the bottom line in the first real quarter of earnings since placement fees took effect? In this article we'll break it down.

Related Reading: Amazon Historical Quarterly Earnings Charts

Advertising Revenue Up 19%, But Retail Revenue Up Just 8%

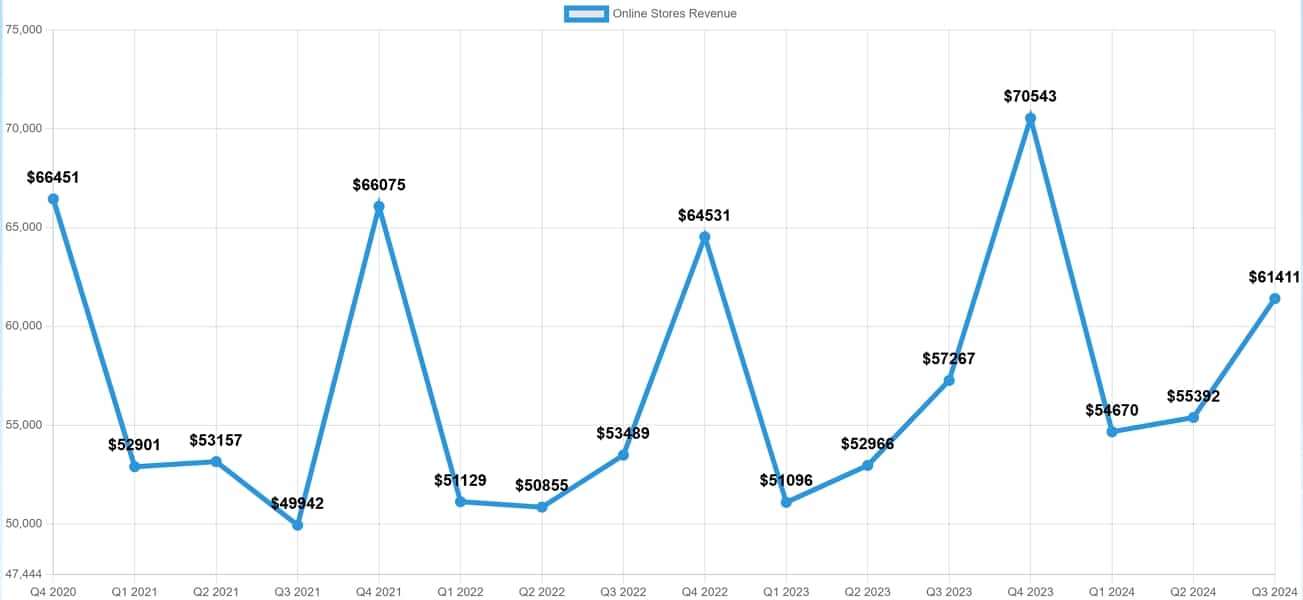

There are two metrics sellers should care about in Amazon's earnings report: Advertising Revenue and Third Party Seller Fees Revenue (essentially referral and FBA fees). If advertising and third party seller revenue growth was more or less consistent with overall “online retail sales” growth then sellers are paying roughly the same as in previous quarters. If growth for either of those two fees outpaced online retail sales, then sellers are, more or less, paying more for those two things.

Online store revenue was up 8% from Q3 2023. Online store revenue takes into account only 1P sales (i.e. items shipped from and sold by Amazon) but is one of the best indicators of overall revenue growth as Amazon doesn't account for gross sales of third-party sellers.

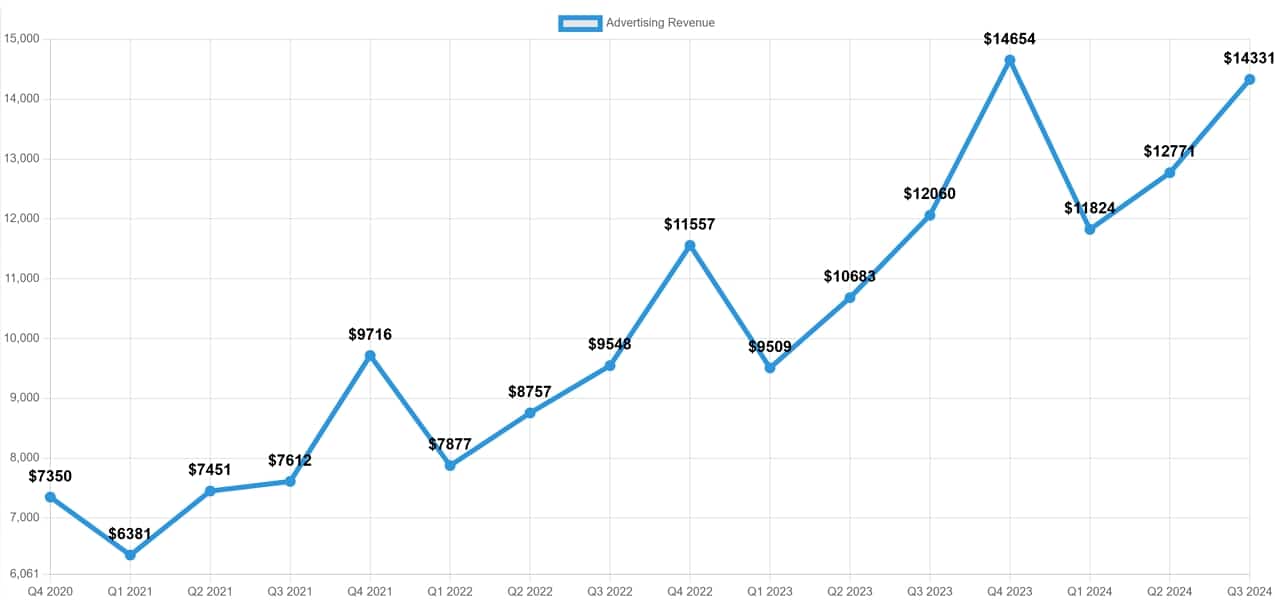

However, despite online store revenue being up only 8%, advertising revenue was up 19%. As the chart below shows, advertising revenue has been growing at a staggering rate for Amazon, far eclipsing online store revenue growth. The growth is a result of both increased advertising CPC and CPM costs as well as an increase in the number of sponsored products in search results and other locations on Amazon

Amazon Advertising Continues to Be a Major Player in Online Advertising, but Still Behind Google & Meta

Google currently occupies 27.7% of the digital advertising market, followed by Meta (Facebook) at 22.8% and Amazon with 8.8%.

Meta's advertising revenue was up 19% in Q3 and Google's was up 10%.

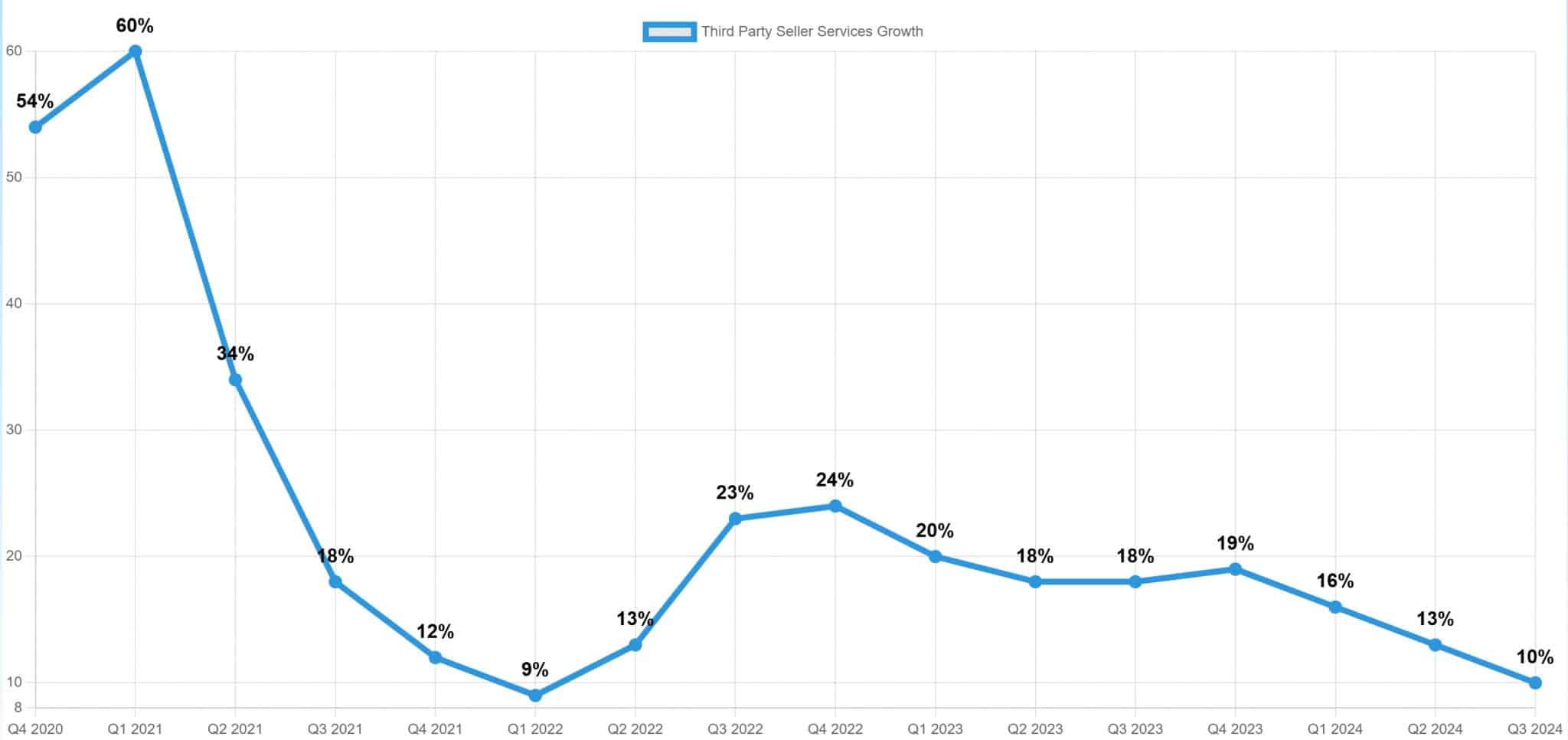

Amazon FBA Fee Growth Slowest in Over 3 Years

As nearly all sellers know, Amazon rolled up placement fees earlier in the year which put many sellers' arms up in air to the perceived increased costs.

However, Third Party Seller Services revenue was up 10%, close to the overall online retail sales growth of 8%. In fact, this was the slowest growth in FBA fees in over 4 years. One possible explanation is that sellers are foregoing placement fees and paying to ship their items to more locations (and the fees associated with sending items to multiple warehouses, even when using a ‘partnered carrier,' would not necessarily show up in Amazon's financials.).

Conclusion

Overall, Amazon's Q3 results are more of the same for the last several years. Overall growth remains steady at around 8%, FBA fee growth continues around that same pace, and the cost advertising continues to skyrocket.