Amazon Mass-Terminates Vendor Central Agreements

Amazon has started to terminate the Vendor Central accounts for many sellers. Many sellers have reported receiving messages from Amazon notifying them that as of November 9, 2024, they will stop purchasing products from them.

What is Vendor Central?

Vendor Central is Amazon's 1P (1st-Party) platform where they purchase products from brands and sellers and physically take ownership of inventory. This is different from 3P accounts (3rd Party) Amazon FBA where Amazon merely acts as a platform for sellers and sellers maintain ownership of the inventory at all times.

You can view our complete Vendor Central article.

What is Amazon Doing to Vendor Central Accounts?

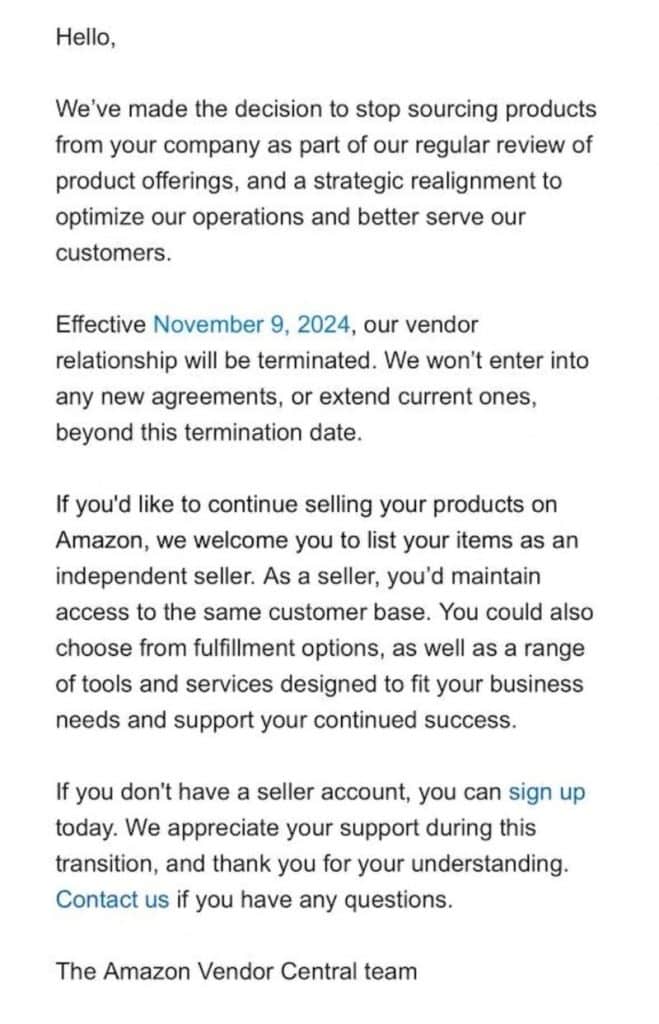

Amazon isn't suspending Vendor Central accounts in the way they would for a Seller Central account for a policy infraction. Sellers on Vendor Central will still be able to access their accounts, but Amazon “…[will] no longer enter into any new agreements, or extend current ones, beyond this termination date.”

Below is a copy of the notification that many customers have received.

In effect, Amazon is stopping the issuing of new Purchase Orders to many VC clients.

It's Unclear How Many VC Sellers Were Affected

It's unclear exactly how many VC sellers have been affected by the rollout, but it's likely sizable. There has been significant discussion about this in various groups including the popular LinkedIn Amazon Vendor Central group.

It's likely the termination is largely for smaller brands and not being targeted towards larger enterprise brands as this would result in a significant inventory availability issue to customers for some of the top consumer brands.

Why is Amazon Terminating Vendor Central Agreements?

The reason why Amazon is terminating agreements is not clear, but it is clearly a deliberate and well-thought-out strategic push from Amazon. Some of the reasons could be:

- Vendor Central sellers are less profitable than third-party FBA sellers and Amazon wants to push smaller VC sellers towards Seller Central.

- They are turning their attention to enterprise brands and away from smaller brands.

- Amazon is nervous about the inventory risk from acquiring ownership of inventory in the face of a slowing economy.

- There has been abuse of the Vendor Central platform in the past to manipulate listings, and Amazon is seeking to limit the number of accounts operating.

- There will be a significant impact to the ‘optics' for Amazon's revenue to shareholders, and they have been waiting to time it appropriately (see below).

The most likely answer for any strategic decision like this is due to profitability concerns: Amazon simply views 3P accounts (FBA) as more profitable than 1P accounts and wants to push VC sellers towards FBA. Third-party sellers are responsible for logistics, marketing, and advertising for their products, opposed to first-party accounts where Amazon is responsible for the majority of logistics and marketing for products.

When Amazon acts as the seller for goods, it also means they take ownership of that inventory. The result is Amazon incurs significant risk from holding that inventory, especially in the face of a potential economic downturn. It's possible that Amazon is simply trying to hedge its risk from having too much inventory on its balance sheet.

As a small side note, Vendor Central accounts have historically been used to manipulate listings on Amazon. There has been a fairly robust ecosystem for re-sold Vendor Central accounts simply for the benefit these accounts can have for making changes to products (including the seller's products and other products). Limiting the number of VC accounts in operation likely isn't a primary focus of Amazon but is certainly a positive by-product for them.

The Impact on Financial Statements from Vendor Central Agreement Termination

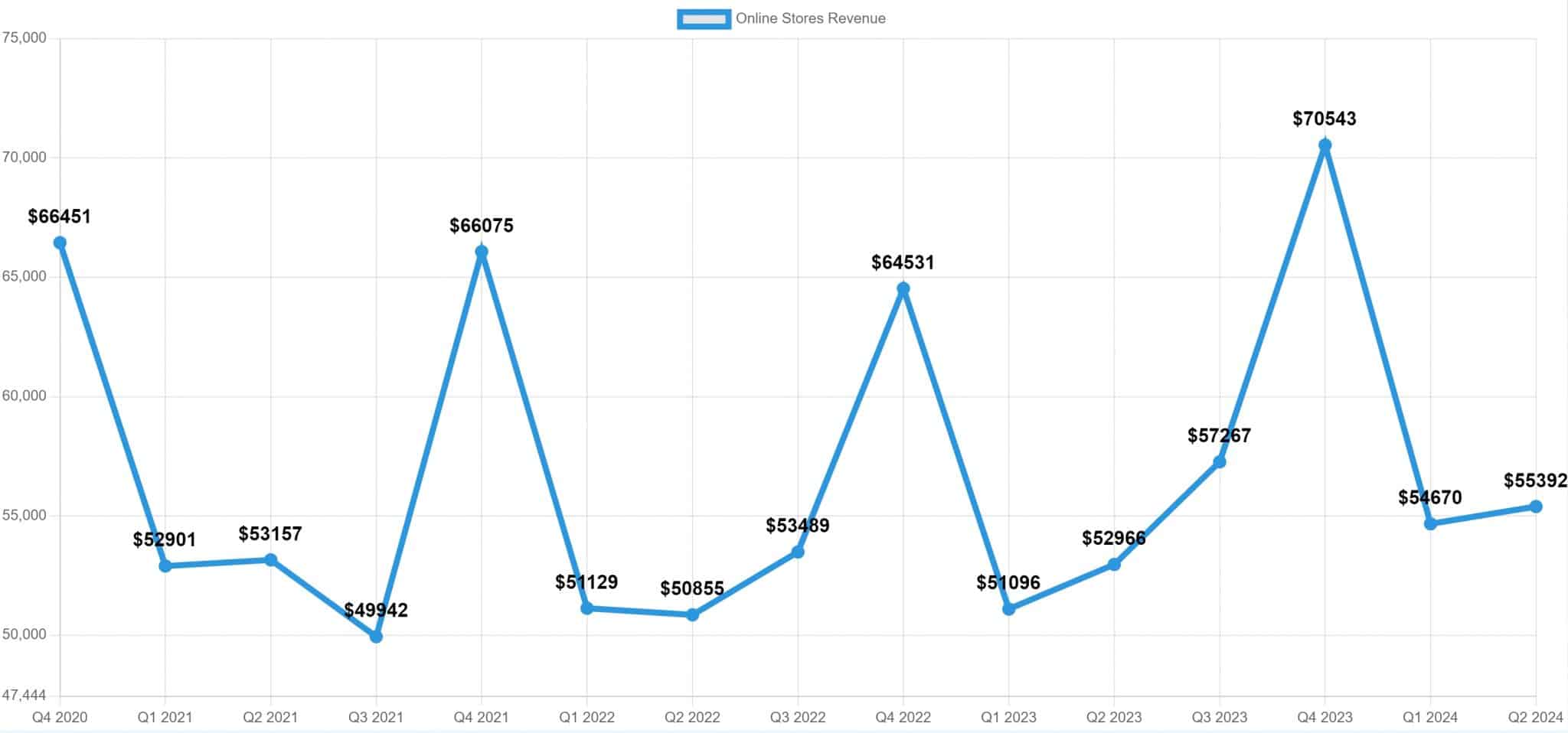

It's important to note that Amazon is eliminating so many Vendor Central accounts it will have a significant impact on the perceived revenue growth of Amazon. This is because Amazon, in its financial statements, records gross revenue from 1P sales (i.e., Vendor Central) but only records the fee revenue from 3P sellers (i.e., FBA sellers). In other words, if Amazon sells a $100 vacuum from a Vendor Central customer, it would record $100 in sales; for a 3P FBA seller, it would only record the fees it charged for that order (typically 20-50% of the sale).

The impact is going to be that Amazon's “Online Store Revenue” will almost certainly dip in its next quarterly financial statements, but its revenue from “Seller Service Fees” will increase (though likely not as much as revenue dips). The impact may be positive on overall profitability but negative toward revenue growth. In an economy where shareholders are favoring profitability over growth, this will probably be viewed as a positive outcome for investors.

You can view our full analysis of Amazon's historical stock performance over the last several years.

Conclusion

The short notice of contract termination to Vendor Central clients will be a significant disruption to users of the platform. In 2015, we transitioned away from Vendor Central to Seller Central, and it significantly impacted our profitability and revenue growth for many months. In the long run, having greater control over listings was a positive for our business, and hopefully, the same holds true for current Vendor Central sellers affected by this announcement.

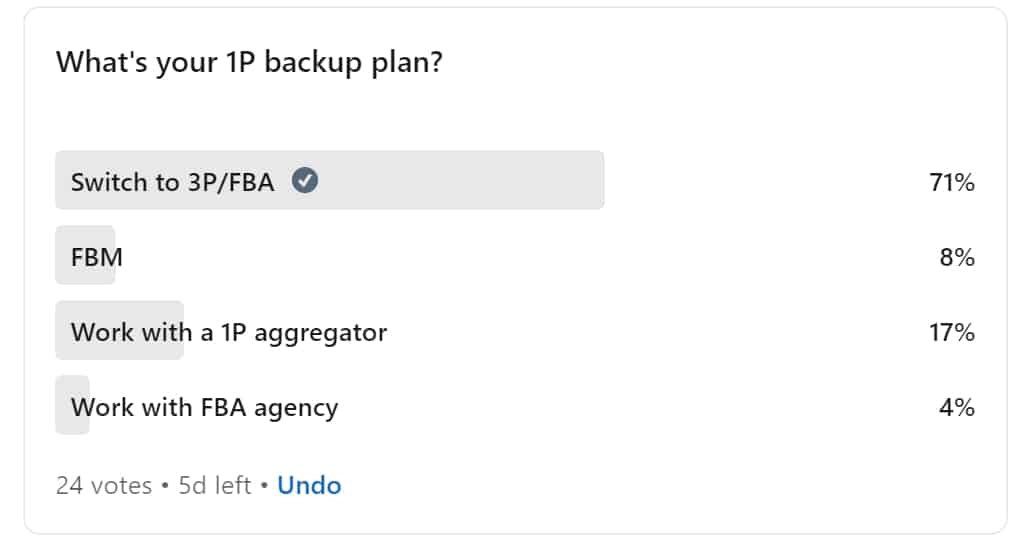

Are you a Vendor Central seller who received notification from Amazon that they will no longer purchase your products? If so, will you be shifting to Amazon FBA or away from Amazon altogether? Let me know in the comments below.

Please recommend an agency that will transfer my cancelled Vendor Central account to Seller Central.

Thanks.

Heidi & Company

heidi@heidinails.com