Amazon to Charge Canadian Sellers 3% Digital Service Tax (DST) Fee

On July 1, 2024, Canada introduced a controversial Digital Services Tax (DST). Amazon has responded by instituting a new a 3% fee (note that I say fee, and not tax) on most North American Amazon fees for Canadian sellers.

In this article, I'll break down why this new fee is simply a new Amazon fee and not a tax, break down what services it will and will not apply to, as well as explain the impact on your bottom line.

Related Reading: Amazon Has Been Charging B.C. Sellers PST on Most Fees Since 2021

What Is Canada's New Digital Services Tax (DST)?

On July 1, 2024, Canada implemented a controversial Digital Services Tax which taxes Big Tech companies, such as Amazon, for their activities in Canada. The act has been controversial because many in the US see it as being discriminatory against American firms.

The act actually retroacts to 2022 (more on that later) meaning Big Tech firms have to pay taxes going back to 2022.

In regards to online marketplaces and Amazon, the fees tax the following:

- Access to, or use of, the online marketplace, commissions from facilitating supplies between users of the online marketplace

- Revenue from providing premium services relating to the online marketplace.

It doe not include fees on shipping and fulfillment (or warehousing). In other words, the DST will apply to referral fees and advertising, but not FBA fees or warehousing.

What Is Amazon's New DST Fee and Why It Is a Fee and Not a Tax

On August 1, 2024 Amazon announced that “On October 1, 2024, we’ll introduce a digital services fee to account for DST.” Notice the wording there: Amazon is introducing a digital services fee. Why are they calling it a fee and not a tax?

The reason Amazon is calling this a fee and not a tax is because the Digital Services Tax is payable by Amazon and not sellers. It is not like when Amazon charges sellers HST on advertising (yes, they do that) and they remit to the government on behalf of sellers.

Amazon is basically saying “OK Canada, you want to tax us? Then we're going to jack up fees for Canadian sellers and get back some of our taxes as increased fees.”

Regardless of your feeling on Canada's decision to institute a Digital Services Tax, this is a very shady decision by Amazon to implement a new fee targeted just towards Canadians.

What Fees Will Amazon Apply the Digital Services Fee To?

As the new Digital Services fee is unilateral fee applied by Amazon and not an actual tax, Amazon is free to apply the fee to whatever Amazon fees it likes.

At this time, it appears Amazon will be charging this fee only on “Selling on Amazon Fees” (i.e. referral fees) and not FBA fees or advertising.

Amazon Is Charging the Fee on Fees in Canada and the US and Mexico

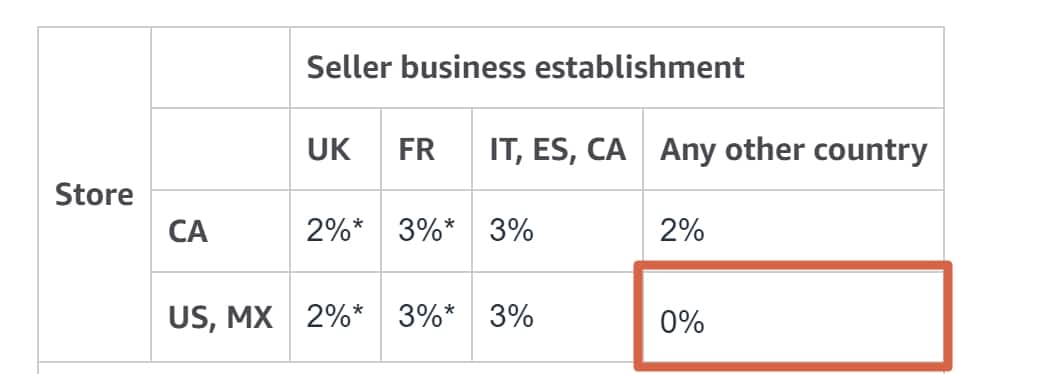

The fee overall would not be a major issue if it was targeted only for goods sold in Canada and it was payable equally to any seller who sold on Amazon.ca. The issue is that Amazon is charging the tax for all sellers on Amazon.ca BUT charging it only to Canadian sellers (and a handful of other European countries) for sales made on Amazon.com and Amazon.com.mx.

This means that a Canadian seller will pay an additional 3% on applicable fees made on Amazon.com and Amazon.com.mx but American and Chinese sellers (who make up over 93% of the sellers on those platforms) will not pay those fees. In other words, it will be more expensive (and subsequently difficult) for Canadian sellers to compete on Amazon.com.

It should be noted that Google announced they would institute a similar fee but it is only for ads served in Canada.

What Is the Impact of the Digital Services Fee on Profitability?

Let's imagine the fictitious company ACME XYZ Inc. that sells $1 million per year on Amazon and has a 10% net margin with 15% from referral/selling on Amazon fees.

| Before DST Fee | After DST Fee | |

|---|---|---|

| Revenue | $1,000,000 | $1,000,000 |

| Referral Fees (Based on 15%) | $150,000 | $150,000 |

| Other Costs | $750,000 | $750,000 |

| Digital Services Fee | $0 | $4,500 |

| Profit | $100,000 | $95,500 |

As you can see, the impact will actually be quite significant to Canadian sellers.

Will Amazon Retroactively Collect Fees Back to 2022?

Canada will collect the Digital Sales Tax on Amazon retroactively to 2022. However, Amazon will not retroactively collect the Digital Services Tax fee retroactively but will rather collect it going forward starting October 1, 2024.

Conclusion

The new digital services fee will significantly affect the bottom line of all Canadian sellers. Furthermore, the new fee goes well beyond what a similar fee from Google charges in the fact it is based on US and Mexico seller fees in addition to Canadian fees and is only charged to Canadian sellers. Ultimately, it will undoubtedly make it more difficult for Canadian-based ecommerce businesses to compete abroad.

Will you be making any changes to your business operations based on the new Digital Services Tax? If so, let me know in the comments section below.

Soooo brutal, really getting death by 1000 cuts this year it seems. Time to think about relocating? Nah, probably time to put some serious money and effort into getting off Amazon.

I do have a couple contacts pretty high up with Amazon Canada, in thier PR department. If you would be interested in lobbying against this to them, maybe we could use E-Com crews Canadian subsriber base and get a petition going?

Shoot me an email if you’d like to discuss!

Hi Cameron – feel free to give me a shout to dave@ecomcrew.com. Happy to talk :)