Amazon Has Been Charging British Columbia Sellers PST on Most Fees Since 2021

September 2024 Update – The Ministry of Finance has began re-assessing previous PST refunds on referral fees and has deemed referral fees are Software and has started to claw back previous refunds. Many sellers of initiated legal action against the Ministry of Finance which is likely to end up in court. It's recommended for individuals to refrain from filing for refunds at this time.

January 2024 Update – The 2023 B.C. Provincial budget clarified some of the verbiage around “online marketplace services”. We've had meetings with many within the Ministry of Finance and the Tax Policy departments and they've clarified their positions on certain things. See below.

Since May 2021, Amazon has been charging most British Columbia-based sellers (unbeknownst to most of them) an additional 7% on advertising and referral fees. Worst of all, they've been charging this on sellers' global sales—whether those sales occurred in Canada, the United States, or Timbuktu. Because of this, many BC sellers have been paying a minimum of 1% of their sales (and most will be closer to 2% or greater) of their sales in provincial sales tax (PST).

To give you some perspective of the scale of this problem, a seller with $1 million in revenue with a 10% TACoS (Total Overall Advertising Cost) may have been charged over $33,000 in PST since May 2021. As most will know, PST is not recoverable like GST/HST is, so it represents completely lost money to sellers (well, at least until now). Also, this PST has been hidden in a multitude of reports that the vast majority of sellers would not know about—until now.

In this post, I'll show you exactly where these fees have been hidden, who may qualify to get them back, and how to get them back.

I must point out that while I have spent considerable time researching this topic, including speaking to multiple CPAs, speaking to the British Columbia Ministry of Finance's Rulings and Interpretations office, and speaking to sellers who have successfully claimed this PST back, this post should not be viewed as official accounting advice. And in fact, the government has been going back and forth on interpretation of both advertising fees and referral fees. When it comes to sales tax, there are nearly endless variables that may affect your eligibility. Speak to your accountant and refer them to this article to determine what is right for you and your business.

What Happened Why Is Amazon Charging PST?

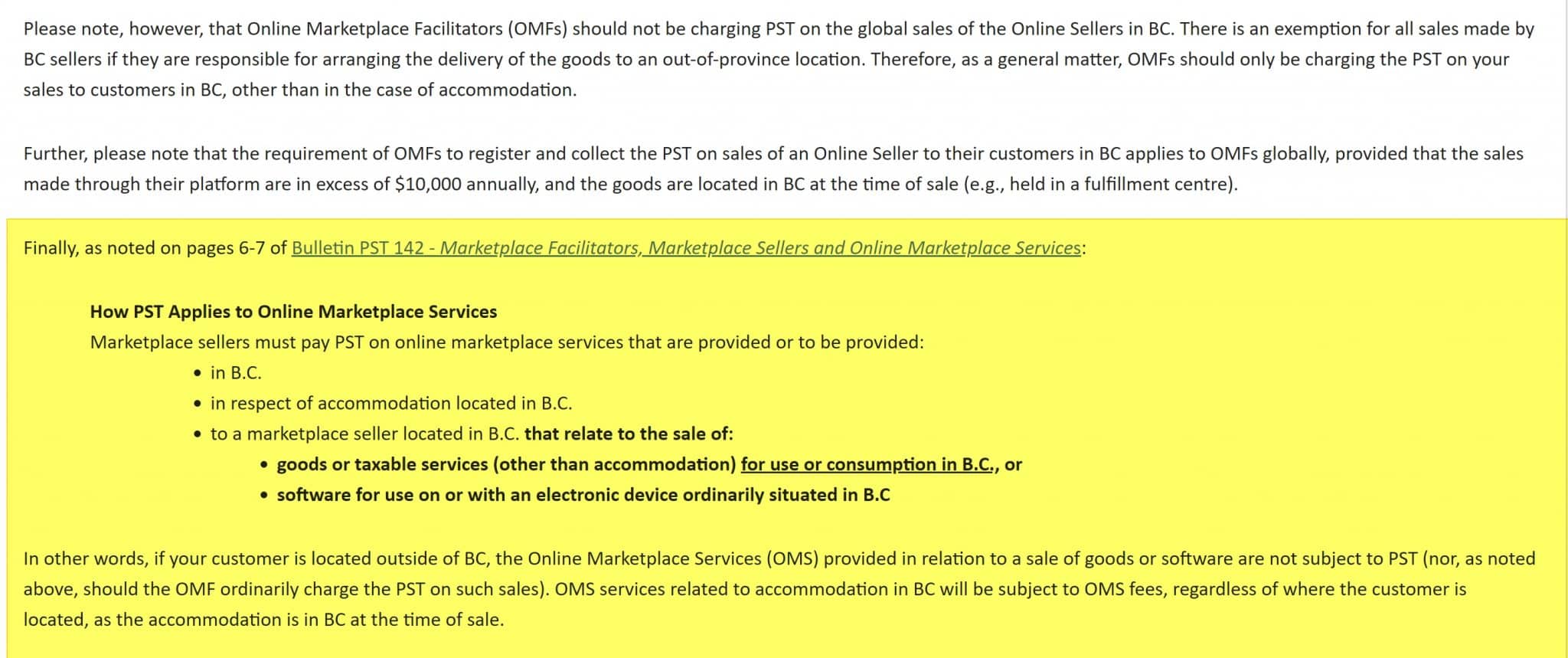

This entire mess started in 2021 when British Columbia proposed some new laws regarding sales tax collection for Marketplace Facilitators, Marketplace Sellers, and Online Marketplace Services. Essentially, British Columbia was trying to get its “fair share” of sales tax from online marketplaces like Amazon, eBay, and others. The spirit of the law appears to be that British Columbia wanted marketplace facilitators like Amazon to collect PST on items stored or shipped in British Columbia warehouses and/or items shipped to customers in British Columbia. Let me be clear here as well: we are talking about PST paid on fees, NOT what customers pay on orders.

Here is the latest bulletin as of 2023:

Online marketplace facilitators located outside B.C. must register to collect and remit PST on online marketplace services provided to online marketplace sellers in the following situations.

- The online marketplace service is provided to goods and the goods are in B.C. at the time the service is provided to the goods.

- The online marketplace service is storing goods and the goods are in B.C. when stored.

- The online marketplace service is in respect of accommodation located in B.C.

- If the online marketplace service is not a service to goods, storage of goods or in respect of accommodation, the online marketplace facilitator must register if the online marketplace seller is located in B.C., except where the service is used wholly outside B.C.

The Ministry of Finance made a significant change in 2023 by eliminating previous language that essentially said Amazon and other OMFs must charge PST on advertising and fees “if the service has strong or substantial factors connecting the service to B.C. at the time the service is provided.” This language was incredibly ambiguous and they replaced it with “except where the service is used wholly outside B.C.”. The question becomes when is an advertising service provided “Wholly outside of B.C.”?

Interpretation of When a Service is Provided “Wholly Provided Outside of B.C.”

With the 2023 budget amendments the crux of the issue about whether Amazon should charge PST (and whether sellers' are entitled to refunds) comes down to whether the advertising is provided wholly outside of B.C..

When a seller advertises their goods on Amazon.ca, there's little doubt that the advertising is not provided wholly outside of B.C. as there are going to be some British Columbias who see those ads. The issue is about non-Amazon.ca marketplaces such as Amazon.com and Amazon.co.uk.

When you use Sponsored Products or other advertising on Amazon.com the vast majority of people who see those ads will be in America. But could someone in B.C. potentially see those ads and thereby that advertising is, in fact, not provided wholly outside of B.C.?

The answer is yes, advertising can be served to a British Columbians IF you have “North America Remote Fulfillment” enabled in your account.

Does Disabling Remote North America Fulfillment (“Export”) Potentially Eliminate PST Liability?

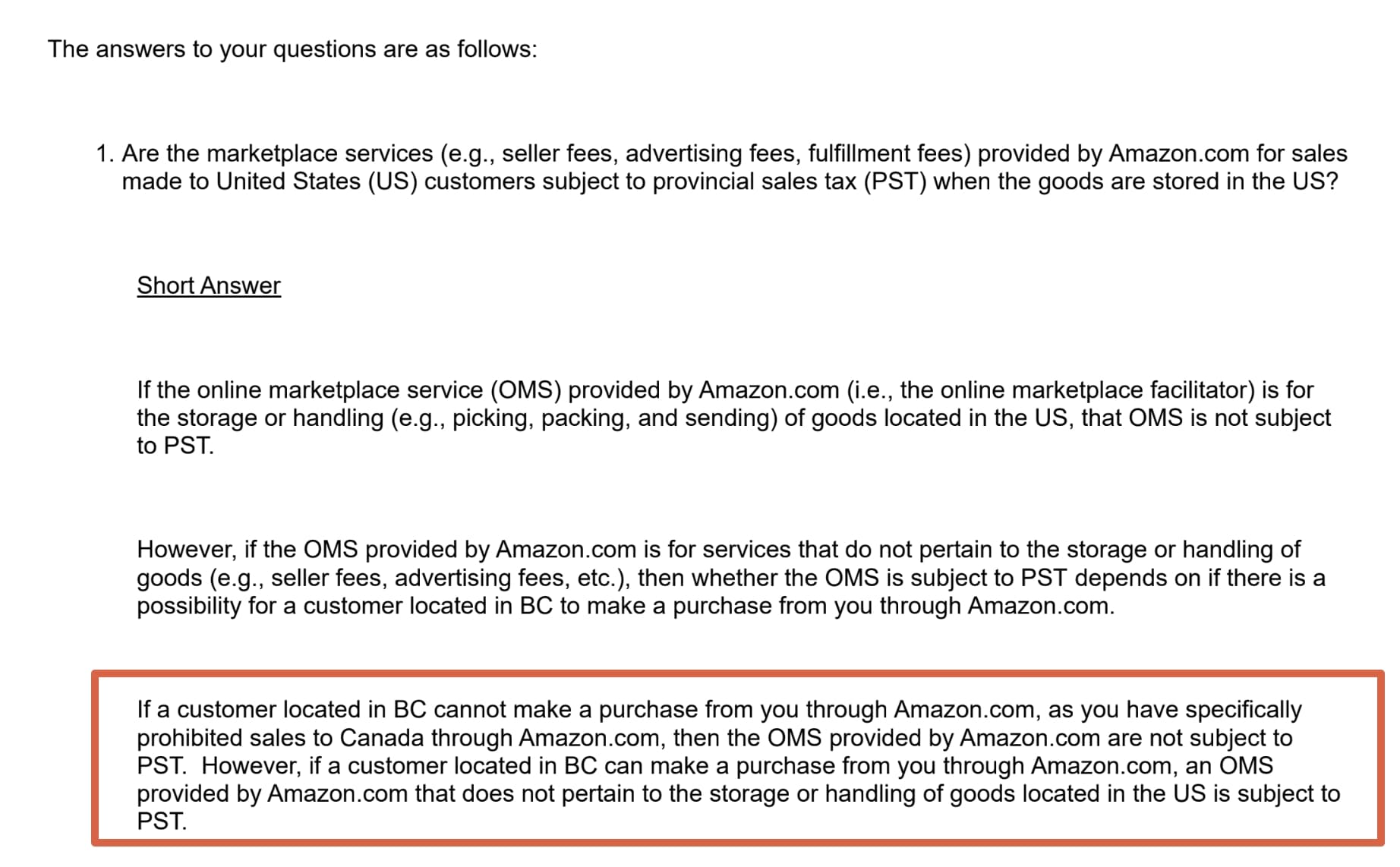

One EcomCrew audience member requested clarification from the Ministry of Finance about whether preventing an item from being purchased by Canadians (and subsequently preventing advertising from being served to them) would suffice to eliminate PST liability.

This audience member received the response below:

EcomCrew had a meeting with a director from the Policy, Rulings and Services branch and they confirmed this ruling is in fact correct and also encouraged EcomCrew to make the ruling known to other B.C. marketplace sellers.

It's highly unlikely Amazon will stop charging PST on advertising any time soon given the current legislation and ambiguity. In fact, the Ministry of Finance encourages businesses to collect PST when in doubt and leave it up to the business being taxed to file for a refund.

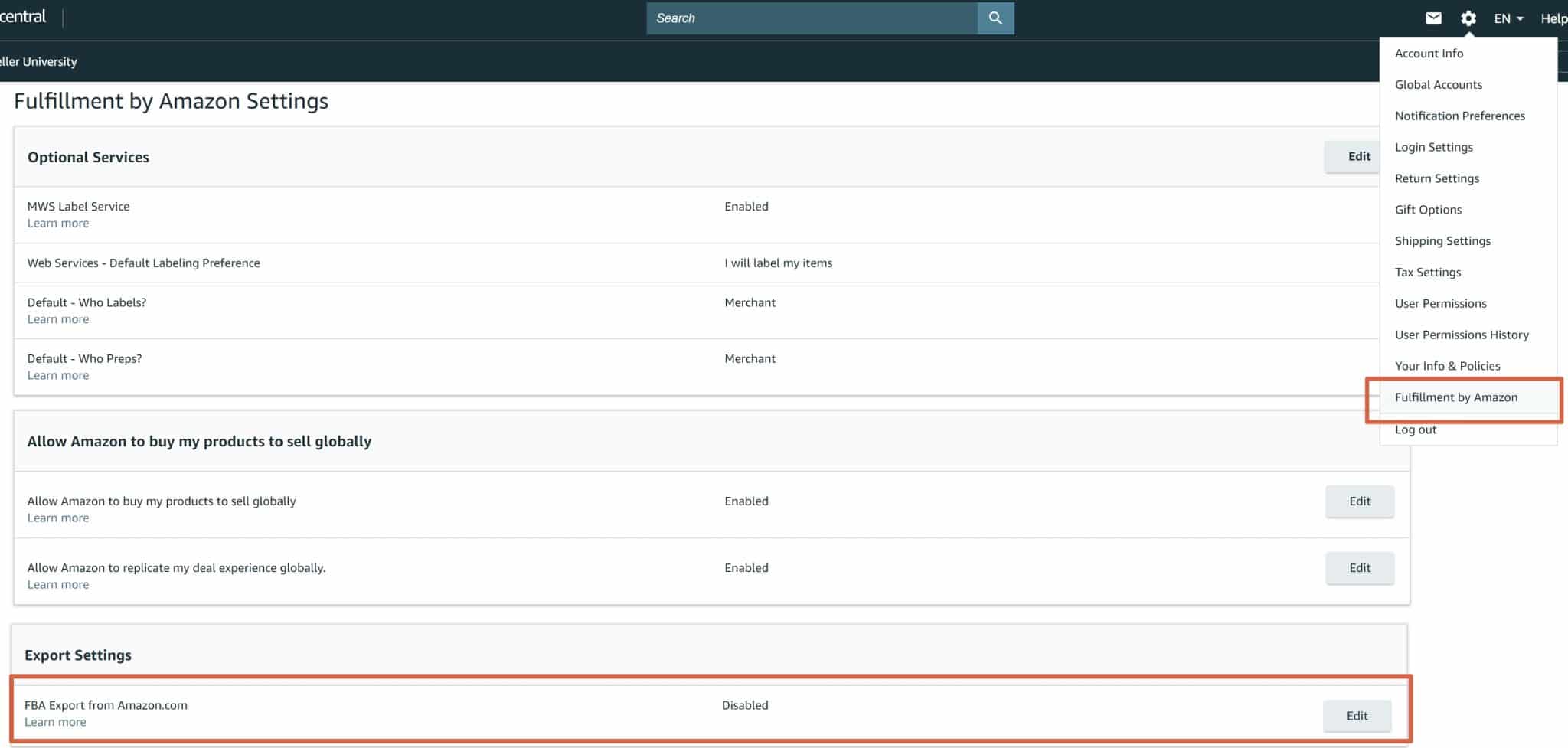

How to Disable Export and NARF in Your Amazon Account

You can disable export to Canada in two ways. First, you can blanket block export to all countries by going to Settings->Fulfillment and disabling Export.

The other option is to go the North America Remote Fulfillment page and eliminate only Canada (but keep Mexico).

Amazon is Unlikely to Stop Charging PST

When the laws were originally written, there was some very ambiguous language used in the bulletins. The Province has since updated the bulletin with some very clear examples of when marketplace facilitators need to charge PST.

In my opinion, given the ambiguity in the laws, I would suggest that Amazon made a strategic decision that there was a minimal downside to them erroneously collecting PST as sellers can technically file to get this back. On the other hand, if it did not collect, it would lead to a bigger problem if it eventually turns out that it should have. However, none of this explains why they started collecting PST in May 2021, fourteen months before the rules took effect (perhaps it was just a blunder?).

There are three primary areas that Amazon has been charging sales tax on:

- non-Canadian advertising

- non-Canadian referral fees (i.e., the approximately 15% commission you pay to Amazon every time you sell a product) and

- Canadian referral fees.

Let's look at each of these three areas along with the official bulletin and actual written responses from the Ministry of Finance's Rules and Interpretations team.

PST on Non-Canadian Amazon Advertising

Amazon has been charging you PST on your non-Canadian advertising costs since May 2021 (ironically, they have not been charging it on Canadian advertising).

You are a marketplace seller located in B.C. and you advertise your goods through an online marketplace. You pay a service charge to the marketplace facilitator to have your listing higher in search results. The advertising service does not have any strong or substantial factors connecting it to B.C. You do not pay PST on this charge as it does not relate to the sale of goods for use or consumption in B.C. and the service is not considered to be provided in B.C.

I am not an accountant, so will not give an official opinion here. But I think the language is pretty clear. Regardless of your opinion on the above verbiage, these new rules took effect July 1, 2022, and Amazon has been charging PST since May 2021.

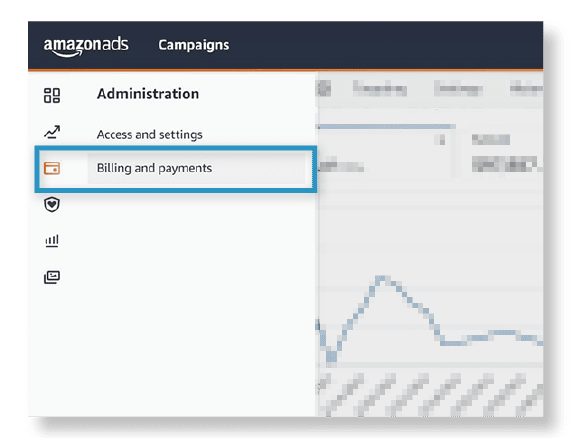

Where do I find the PST advertising reports? The reports showing PST are within your advertising campaigns under Billing and Payments. Here you'll find your invoice history.

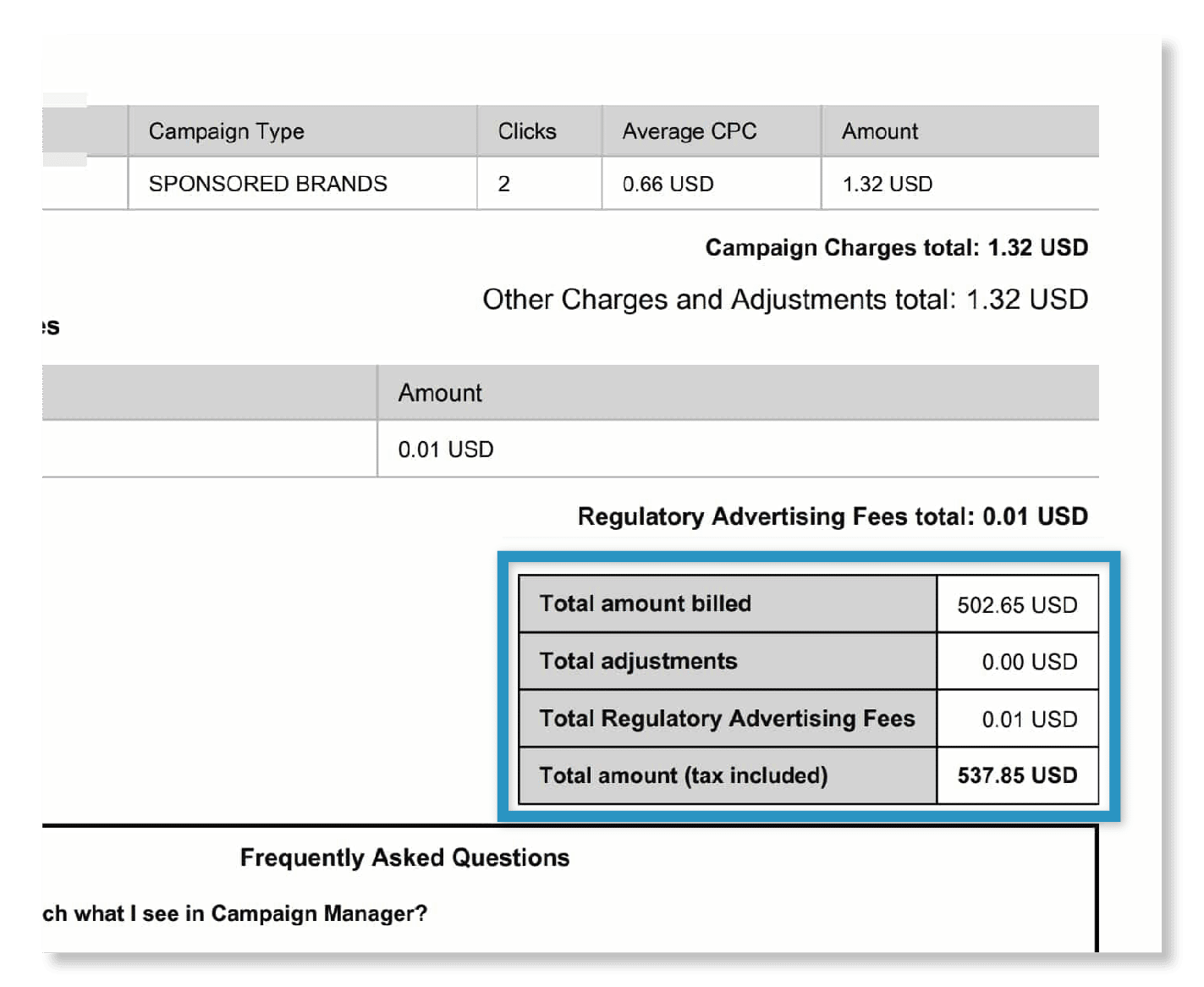

Very annoyingly, Amazon does not even list the PST. Instead, it applies it as a “mystery tax” that conveniently works out to exactly 7%. You will also only find this applied in the PDF invoice, not the browser-based invoice.

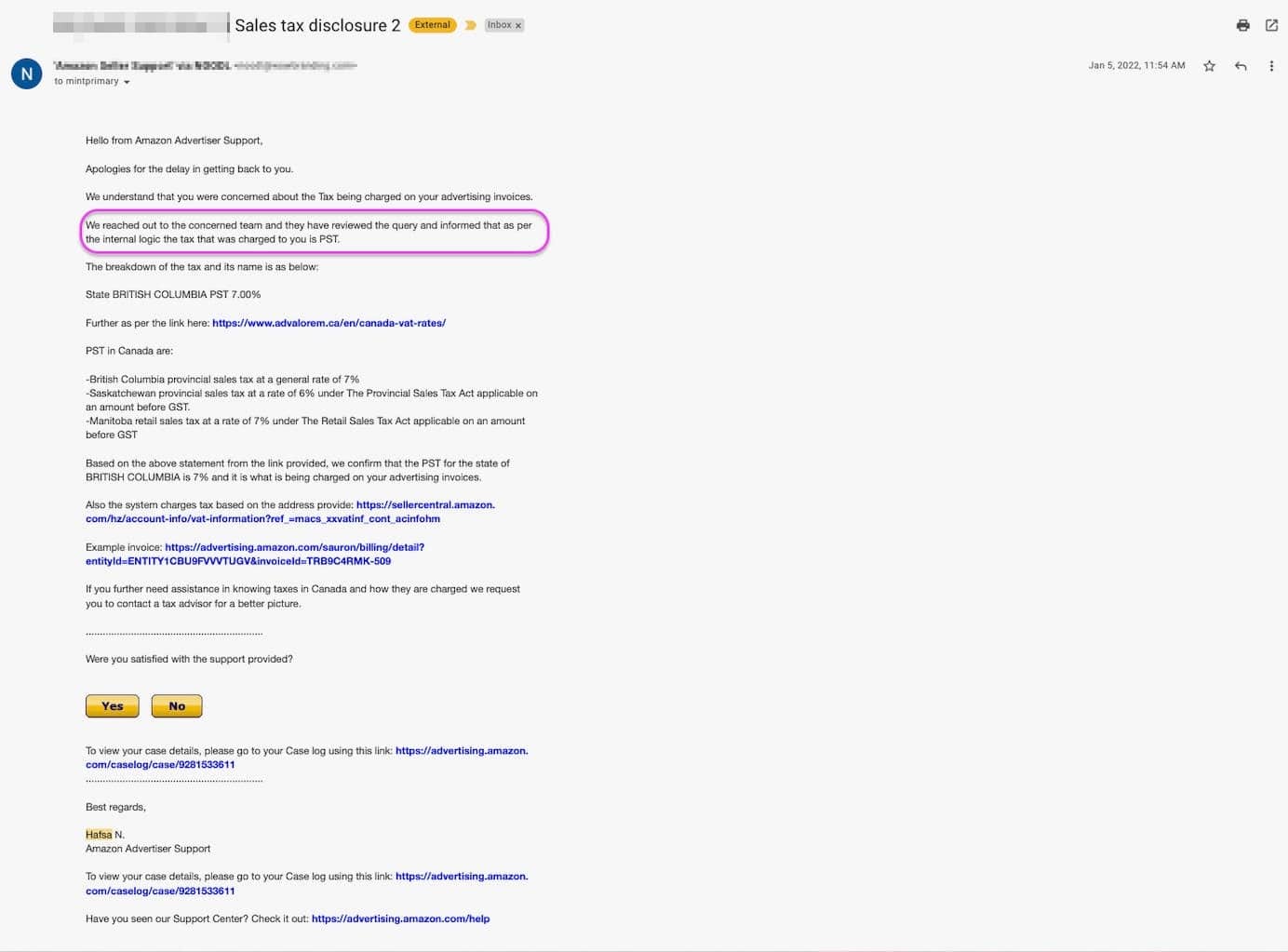

As mentioned, Amazon does not display that the 7% is PST. It took a considerable amount of back and forth with Seller Central to finally get them to disclose what this fee is exactly (see below, you may also want to reference this in refund requests with the Province).

It should be noted that Amazon's advertising invoices are completely non-compliant with British Columbia law. They neither list the tax being charged nor the seller's name.

PST Charged by Amazon on Non-Canadian Amazon Referral Fees

There's one other major area where Amazon is charging PST, and that is on Amazon referral fees.

In this situation, the verbiage is far less clear as the tax bulletin does not address this situation. Normally, Amazon Referral fees are accounted for as commissions on a tax return but the tax bulletin doesn't address this exact situation. The closest thing is the advertising verbiage above.

So with this ambiguity, I reached out to the Ministry of Finance's Rules and Interpretations team once again on August 14, 2022.

An Amazon marketplace seller is located in British Columbia. This seller makes a sale for $100 to a customer in New York. The item is fulfilled and shipped from Florida.

Amazon charges the seller $15 in Selling on Amazon (SOA) fees.

Is this $15 Selling on Amazon fee subject to PST?

The Ministry of Finance replied on August 15, 2022:

The charge for the OMS would be subject to BC PST if the OMS is provided in BC, as discussed on page 7 of the bulletin:

- If the service is a service to goods (e.g. picking, packing, storing, delivery), then the service is provided in B.C. if the goods are located in B.C. when the service is provided to them

- If the service is not a service to goods (e.g. customer service, advertising), then the service is provided in B.C. if the service has strong or substantial factors connecting the service to B.C. at the time the service is provided

However, provided that the OMF is not located in BC, or otherwise providing the marketplace service in BC (as discussed on page 7 of the bulletin) – as apparently is the case in your example — then the $15 “Selling on Amazon” (SOA) fee in your example is not subject to PST.

The question I asked the rules and interpretations team could not have been clearer—and so was their answer.

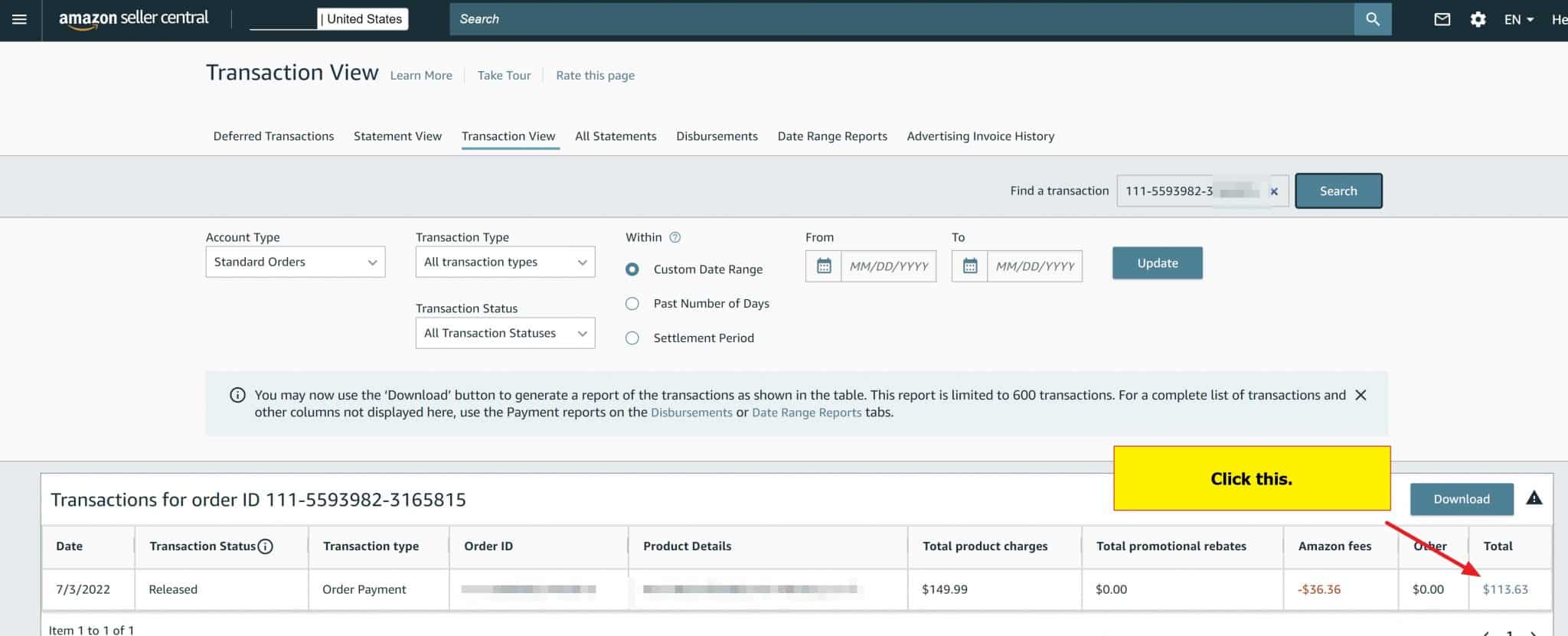

Where do I find the PST in Amazon referral fees for non-Canadian orders? You can see the PST charged on individual transactions.

First, go to Transaction View under Reports -> Payments. Click on Total for any individual order.

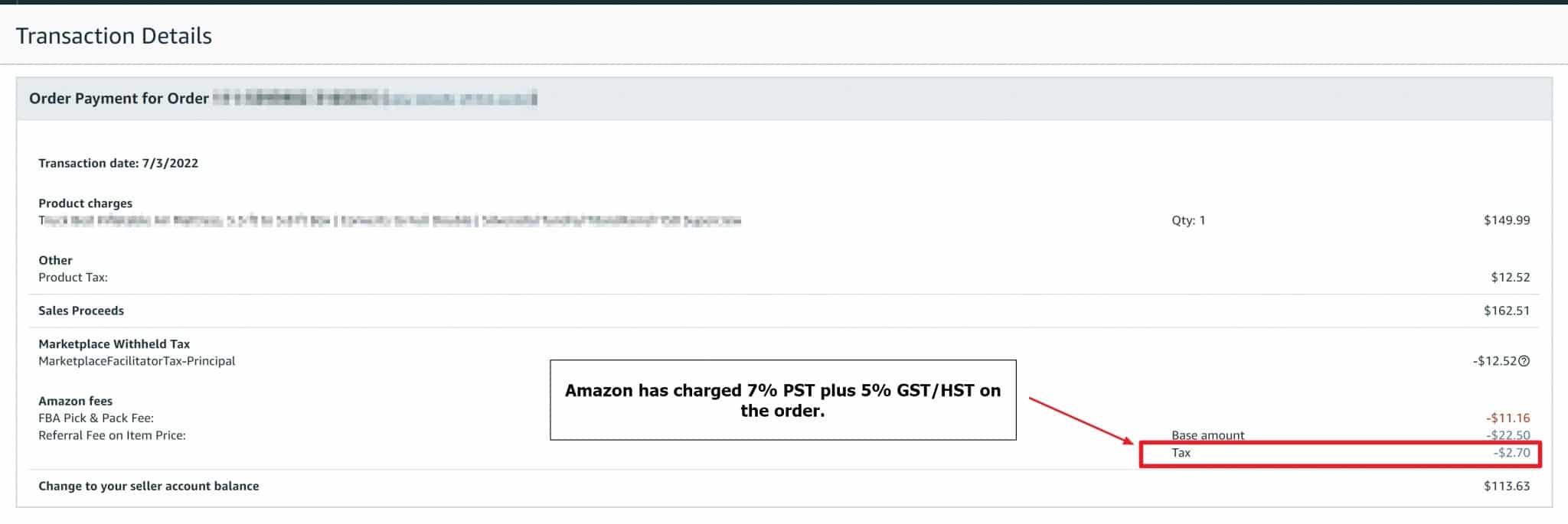

From here, you will be brought to a screen showing sales tax added to the referral fee on individual orders. Incidentally, Amazon is also collecting GST/HST on these referral fees. The GST/HST collection, whether it's correct or incorrect, is less of an issue as the GST/HST is completely recoverable as an input credit on your GST return.

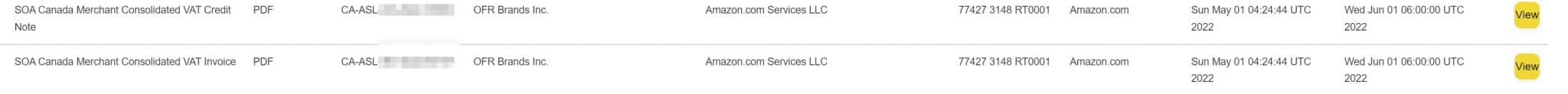

Amazon also provides a monthly invoice of your PST paid on Referral Fees. To find it, go to Reports -> Tax Document Library -> Seller Fee Tax Invoices. This report will have the invoice type SOA Canada Merchant Consolidated VAT Invoice as shown below.

PST Charged by Amazon on Canadian Amazon Referral Fees

This is where things start to get a bit murkier.

Amazon has been charging PST on referral fees for all of your sales performed in Canada since May 2021.

The law would seem to indicate that PST should be charged for an order shipped from B.C. to a buyer based in B.C. However, Amazon is charging PST on all of your Canadian sales whether to someone in Ontario or someone in B.C. and shipped from Alberta. Amazon does not identify in its sales tax reports where orders are shipped from or to where.

Given the complexity above and the limitations of Amazon, it probably makes requesting a refund on this PST difficult.

However . . .

Amazon has been collecting PST on referral fees since May of 2021 and should not have until July 2022. As quoted in a written response from the Ministry of Finance's Rulings and Interpretations office on August 18, 2022:

As noted above, OMS only became subject to PST as of July 1, 2022. Therefore, any charges for OMS prior to July 1, 2022, are not subject to PST.

This means you should be eligible to get back the PST that you paid prior to July 1, 2022. For those incurred after July 1, 2022, I'll leave that to you and your accountant to decide.

Where do I find the PST in Amazon referral fees for Canadian orders?

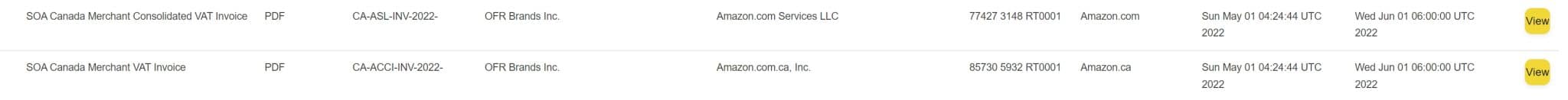

Once again, go to Reports -> Tax Document Library -> Seller Fee Tax Invoices. This report will have the invoice type SOA Canada Merchant VAT Invoice as shown below.

Amazon Has Been Applying PST Since April 2021 Even Though New Tax Laws Didn't Come into Effect Until July 2022

Despite the official tax bulletin verbiage and the clear written responses to our examples received from the Ministry of Finance's Rules and Interpretations team it's still uncertain why Amazon has been charging the PST since April 1, 2021 despite the fact the marketplace facilitator laws came into effect on July 1, 2022.

Could the New British Columbia Marketplace Facilitator Laws Just Really Be That Egregious and What Would the Consequences Be?

The problem with interpreting many tax laws is that they are often ambiguous. While I feel like the new rules have been written quite clearly, and the Ministry of Finance's Rules and Interpretations team has clarified many points, there are still areas where their wording could be clearer, e.g., what exactly constitutes “strong or substantial factors connecting a service to BC.”

The Ministry of Finance released an updated bulletin in July 2022 with many examples clarifying the exact situations and the Rules and Interpretations office has been extremely responsive. However, the ambiguous language still remains throughout the bulletin.

Let's just imagine a world in which Amazon has applied the rules correctly. What would the consequences be for marketplace sellers and for British Columbia as a whole? Basically, a seller with a 10% TACoS (total overall advertising cost) and 15% referral fee category would pay roughly 2% of their revenue in PST. If we consider many e-commerce companies are around 10% in net margins, this would mean they would effectively lose 20% of their overall profit and many e-commerce companies relying heavily on marketplaces would likely leave the province. Thankfully, it appears it's not the law that is broken but Amazon's application of it.

PST Applicability Comes Down to Interpretation of What “Software is”

Ultimately whether both referral fees and advertising fees are subject to PST comes down to the interpretation of what software is. The Ministry of Finance has gone back and forth between it's interpretation of software over the last two years. It's current stance that advertising and referral fees are both “software”.

Essentially the government is interpreting any digital service you purchase online as now being software. This can include advertising (either Amazon or Google) and referral fees of course but also other services like cloud computing.

The government has in the past has gone after companies such as Hootsuite and argued they should have self-assessed PST on their AWS cloud-computing bills (which needless to say would be in the millions). Hootsuite appealed all the way to the Supreme Court of British Columbia and the court ruled in favor of Hootsuite. In a summary of the decision from, BLG Law Firm stated that the Supreme Court of British Columbia “clarified that all software programs are software, but not all software constitutes software programs for purposes of the PSTA. In particular, a software program requires a user to utilize the software as an “application”. Consistent with its user-based distinction, a user must be capable of interacting with the software for it to be a software program.”.

What You and the Government Can Do

The current interpretation of software is unsustainable for business in British Columbia. Ecommerce is roughly 15.8% of retail sales in Canada and is expected to grow to 22.8% in 2028. The current interpretation of PST makes running an ecommerce business out of British Columbia compared to other provinces that either do not have a provincial sales tax (Alberta) or the other provinces with HST that allow this expense to be recoverable.

The current political appetite is to “make big tech pay their fair share”, but instead the consequence is not to tax big tech but rather to tax small business.

The end solution is likely a political one and requires an invested MLA to help push legislation through which adequately and fairly addresses this issue. It requires an update to the current tax code which could look as follows:

- Provincial Sales Tax does not apply to fees for Online Market Place services and/or “software sales” when such fees are variable and charged as a percentage of a sale made to a customer for a physical product delivered outside of British Columbia.

- Provincial Sales Tax does not apply on advertising services and/or “software sales” which such fees are variable and paid on a cost-per-click basis or on an impression basis.

I'm not a tax attorney nor policy analyst but I know individuals from both groups have read this article and I hope this gives some rough idea of how to frame the future laws and rulings.

How Can Sellers Get Back the PST They've Paid?

As noted previously, the Ministry of Finance was granting PST refunds on referral fees but has begun clawing these back as of September 2024. You may apply for these refunds but it's recommended to wait further rulings and legal decisions before commencing the significant amount of work to file for these refunds.

The really good news is that you're probably entitled to get back all or most of the PST you've erroneously paid back from the government (and thankfully, you don't have to go through Amazon which would be even worse). The slightly bad news is that it's going to take a bit of work from you.

The main challenge in getting back the PST is the sheer volume of invoices you're going to need to submit.

First, you will need to download all of your advertising invoices since May 2021. For us, it represented hundreds of invoices (each invoice for us was roughly $500). Each of these invoices will most likely be in US dollars, and you will need to convert them to Canadian funds using either a daily or monthly average exchange rate from the Bank of Canada.

Second, you will have invoices and credit memos for your non-Canadian referral fees. Each month, you'll likely have two of these. These invoices go back to May 2021, so it means if you file for a refund in August 2022, you will have roughly 15 months of invoices to gather.

Third, you will have the invoices and credit memos for the Canadian referral fees you paid.

Once you have all of these invoices gathered, you will submit an Application for Refund General (PST). This form will include 10 rows for you to submit receipts. Depending on your advertising spend and how many months you go back, you will almost certainly need 100+ rows (for us, it was hundreds of rows).

For this number of rows (clearly, we're not the first people to go through such a mess), the Ministry of Finance has a special Excel document you can use. You're going to need to mail in each invoice. It will be hundreds or thousands of pages so you can also mail a USB thumb drive with the PDFs—they won't accept emailed documents in most cases (don't ask me).

An auditor is almost certainly going to contact you to ask you to clarify exactly what is going on. I suggest you point them to this article, which should make your life quite a bit easier. Expect a few rounds of back and forth with the auditor to clarify everything. Eventually, you will get a refund.

In my case, it was a good 10 hours of work between me and a VA, but we were also looking at a refund of tens of thousands of dollars, so it was a no-brainer.

Conclusion

If you're a six-figure or higher British Columbia-based seller, this post should get you a considerable PST refund from the province. My hope is that this post will not only save sellers a ton of money but it will also result in both Amazon stopping the erroneous collection of PST and the Province updating the verbiage used in the tax bulletin.

A very special thanks must be made to Dann Ilicic of Wow Branding. Two months ago, he sent me a cold email notifying me of this entire issue. Over several weeks, we spent a ton of time on the phone, via email, and in person to help me understand the problem in its entirety. If and when you get any money back from the province, remember Dann.

I contacted the Ministry of Finance for clarification on the issue. I thought your readers might find it interesting. They said: “If a customer located in BC cannot make a purchase from you through Amazon.com, as you have specifically prohibited sales to Canada through Amazon.com, then the OMS provided by Amazon.com are not subject to PST.”

So far Amazon.com is refusing to stop charging PST on our fees. I have already submitted a $200,000 refund request from the Ministry of Finance and heard back that they have a 6-month backlog at this point. Now it seems like we have to continue to submit refund requests going forward, which is a total pain.

I’m located in BC and sell 100% in the US. I’m currently going through the refund process and had both my refund claims for the tax on referral fees and advertising fees denied. The reason was as follows:

1. The Advertising Invoices submitted outlined advertising fees. These fees were classified as payment for the right to use software, and are therefore subject to PST.

2. The Seller Fees in the claim are additionally viewed as payment for the right to use software and are subject to PST.

In my case, the fees are being taxed due to bulletin 105, and not due to the new Marketplace Facilitator legislation.

I’ve appealed the decision, arguing that all software is provided in the Professional Seller account plan, and that payment of the referral fees and advertising payments do not meet any requirements from bulletin 105 that should lead them to be classified as payment for the right to use software.

Hi Glen,

How did your appeal go? And did you submit all the documentation yourself?

I am still waiting to hear the results. I will come back and update you once I get them. I submitted everything myself.

Thank you Glen. Looking forward to hear how this went for you. I tried calling the government and spoke with a representative but they didn’t provide much guidance.

Hi Glen, I’m in the same situation as you. The refund on my Sponsored Ads Fees was denied due to it being a ‘payment for the right to use Amazon’s sales platform’. That’s complete nonsense as the Professional Selling Plan already includes that right.

I’m about to submit an appeal but would love to hear how it went for you.

Cheers,

James

Hi James,

It is still in the appeal process. I had a phone conversation with the appeals officer around 2 months ago, and have not heard anything since. I will update here once I get any information.

Hi Glen,

Are you interested in collaborating and sharing documentation? Email me at trevor@gearouthere.com if you’d like to discuss working together on this. We are dealing with appeals and exploring legal options.

Sure thing. I will reach out.

I just got the same denial with the same two reasons. Researching next steps now and I came across your comment – did you make any progress?

Hi Doug,

No progress yet. Will update once I hear anything.

Hey Glen. Any update on this? I’m hearing the same now. In fact, they are trying to claw back a refund they already gave me a year ago based on this new logic. Would be curious to know if you made any headway on this matter. Thanks so much.

Hi all,

Going through this process. Just FYI, advertising spending is now considered taxable. Here is more detail: https://www.ecomcrew.com/british-columbia-begins-taxing-global-digital-advertising-sales/

Hi there,

Amazing article. We are working through the refund process now, likely a multi 6 figure for us! Has anyone had success with getting amazon to stop charging the PST on your account all together? Lots of info on how to navigate and manage the problem but unclear how exactly to stop the charges from happening.

I’m in the same boat. What is your strategy for submitting the Canadian Referral Fee portion? Which Amazon report are you using? Your help is greatly appreciated!

would also like to know the same

If possible, we can work as a team to start a petition to stop the charges. Or we can discuss offline about how to go through refund process quickly. If the situation keeps the same, I will move my business to Albert next year.

Email me at trevor@gearouthere.com if you’d like to discuss working together on this. We are dealing with appeals and exploring legal options.

The PST of Amazon world wide advertising fee is charged by Amazon for more than 2 years. Is there anyway to stop it? Thanks

Amazon is continuing to charge us 7% any idea how to get them to stop charging PST on advertising?

Thanks!

Advertising invoice of amazon.com doesn’t have PST number on it, so BC Gov’t doesn’t treat the tax as PST. Any way to download Advertising invoice with PST information?

Hey everyone,

As an 8-Digit Ecommerce seller whose been audited by the BC PST Department, I wanted to add in some extra points:

Provincial Sales Tax (PST) Bulletin 125

Advertising Placement

You do not charge PST for advertisement placement services, such as placing your

customers advertising in the following places:

Bench signs

Boards on hockey arenas

Billboards (including electronic or digital)

Bus signs (e.g. inside bus or on bus exterior)

Bus stop shelters

Internet (including social media) and internet search engines

You can try to get back your Amazon PST on the 15% commission based on the last line item of the BC PST Exemptions listed here

How did that work out for you Alex?

When you are talking about referral fees, I believe you are strictly talking about the 15% commission of the retail price on an order Amazon charges.

But, is there not also the question of FBA pick and pack fees? Amazon will charge 12% for an order going to BC, seemingly regardless of whether it shipped to BC. Have you come across this as well?

Should Amazon be collecting PST on seller pick and pack fees for orders not originating in BC that ship to BC?

Here are the rates Amazon is collecting in tax on just the FBA pick and pack fees. Feel free to check this against your orders:

– Order to Ontario, they charge 13% (sellers claim that as HST ITC presumably).

– Orders to Alberta, they charge 5% (sellers claim that as GST ITC presumably).

– Orders to Quebec, they charge 13% (sellers claim that as HST ITC? Despite Quebec having it’s own QST PST, Amazon still only charges 13% on pick and pack fees as tax to the seller).

– Orders to Manitoba, they charge 12% (not sure what to make of this – Manitoba state tax is also 7% – so Amazon is charging Manitoba PST and 5% GST. Is the Manitoba situation analogous to BC?)

– Orders to New Brunswick, they charge 13% (again, not sure if all of this is just considered HST and thus ITC applicable?)

– Remaining provinces yet to be checked.

Finally, what about this PST they are clearly charging on the sales tax service fee? Small as it may be, these things add up to thousands of dollars on a large enough scale.

Will have to revisit this many more times. Been looking at this for the better part of 6 hours straight. Hope to hear your thoughts Dave.

Hi Dave

Did you make a claim only for the 14-month period? Or did you make a claim for the entire time SINCE May 2021?

If the latter, then when looking at PST on Canadian Amazon FBA referral fees, how did you distinguish between the scenarios where PST was supposed to be charged on referral fees? Talking about those instances where inventory was shipped from a BC location TO a customer in BC. If I read your article correctly, this detail is not included in the tax reports provided by Amazon, so you could not claim against it. It’s a minority of sales, sure, but it seems essential to standing up against an auditor’s scrutiny.

It’s possible through data range reports to see, at a single order transaction level, the destination city and province, but I don’t see a report where you can also see the origin. If an order is destinated for BC, but is shipped from Ontario, it would appear to be not applicable for PST charged on FBA referral fee. Any idea how to find this information?

Very interesting article by the way. Not sure if we will get the $20 or $30k Amazon appears to owe us, hoping you can clarify the questions above though.

This is swindling at it best and I was also charged the BC fee ad well for what I will never know.

So annoyed because Amazon rep doesn’t know what Im talking about nor do they see it on my tv supcription statement and still trying to figure this out.

I am incorporated in Quebec and was also charged these charges

I have over 30k USD in these charges

I tried getting it back when I filled my annually GST/QST

But the agent is refusing to refund it and is referring me to this link

https://www.revenuquebec.ca/en/businesses/consumption-taxes/gsthst-and-qst/itcs-and-itrs/#:~:text=As%20a%20registrant%2C%20you%20can,input%20tax%20refunds%20(ITRs).

In which it says that I need to deal with Amazon about it

Great Post – I sell (seller-fulfilled) mostly from BC to other parts of Canada (#1 ON, #2 BC, #3 QC). I am confused as to why any Seller Referral Fees are charged PST at all. But if I am reading your article correctly, are you saying that only sales between my BC based biz and BC customers are subject to PST on Seller Referral Fees? Amazon is still charging PST on ALL sales. I do think that Gov’t has made an error in applying PST at all, as these fees are built in to the sales price, thus the Gov’t is double collecting PST on Amazon sales (if that makes sense).

This issue is mostly related to AMAZON incorrectly charging PST. Not necessarily the government.

Dave the more I read into this, the more mind-boggling it gets.

Great article and timely for me. I just moved to BC and noticed the PST being charged.

Question. What reason did you put down for requesting the refund? I want to fill it out and have as few questions as possible.

Thanks

We put down something along the lines of “Incorrectly applied”. You are going to get questions, but this issue is becoming more widely known in the MOF.

Hi Dave,

Are you interested in discussing off thread? We are exploring legal options. Email me at trevor@gearouthere.com if you’d like to discuss.

I’ve been pretty involved in the issue, meeting with MLAs and the tax policy team multiple times. Feel free to email me to dave at ecomcrew.com though.

This is incredible. I’ve spent the last day running my numbers estimate I am owed over $19k. Fingers crossed we are able to recoup this as we are not a particularly large seller, so I can only imagine how much this would be for others. Thank you for this incredibly informative post!

You’re welcome. Hopefully it helps a few people :)

Were you able to recoup the money?

Hi Dave! Great find here and thanks for the writeup. Couple of questions that I hope you could clarify:

1) Is this applicable to US based sellers who sell in BC, Canada? Or only those based in BC?

2) Was Amazon also charging the customer the ~ 7% PST tax? If so, then wouldn’t the payments to BC on your behalf just cancel out with that? Or were they deducting the amount from you and paying the tax yet not charging that to the customer?

Thanks as always for sharing!!!