AccrueMe Review and Pricing

This article contains affiliate links that will allow us to earn commissions without any extra cost to you. Read our full disclosure here.

Cash is king in e-commerce. How fast you scale depends largely on how much capital you have to develop and buy inventory. Third-party Amazon sellers have a couple of options for funding, including credit cards and bank financing. However, these methods are not only high-risk, they also often have high interest rates.

There are, however, companies like AccrueMe that help Amazon businesses with funding without being too risky. In a nutshell, you only pay when you actually make money. Read on to find out more about the company.

Contents

What Is AccrueMe?

AccrueMe is a fintech company that helps Amazon businesses scale using a unique profit sharing model. It invests a minimum of $10,000 up to $1 million for each business that qualifies, depending on the business’ assets. It does not require Amazon third-party sellers to give up any part of their business in exchange for additional capital. Instead, AccrueMe earns a portion (5% to 25%) of the business’ net profits per month.

It is available even to sellers who are not based in the United States, as long as they have a US-based LLC.

| An Overview of AccrueMe | |

|---|---|

| Date Founded | 2018 |

| Total Funding | ~$100 million |

| Monthly fees | None |

| Mandatory monthly payments | None |

| Interest | Zero |

How Does AccrueMe Work?

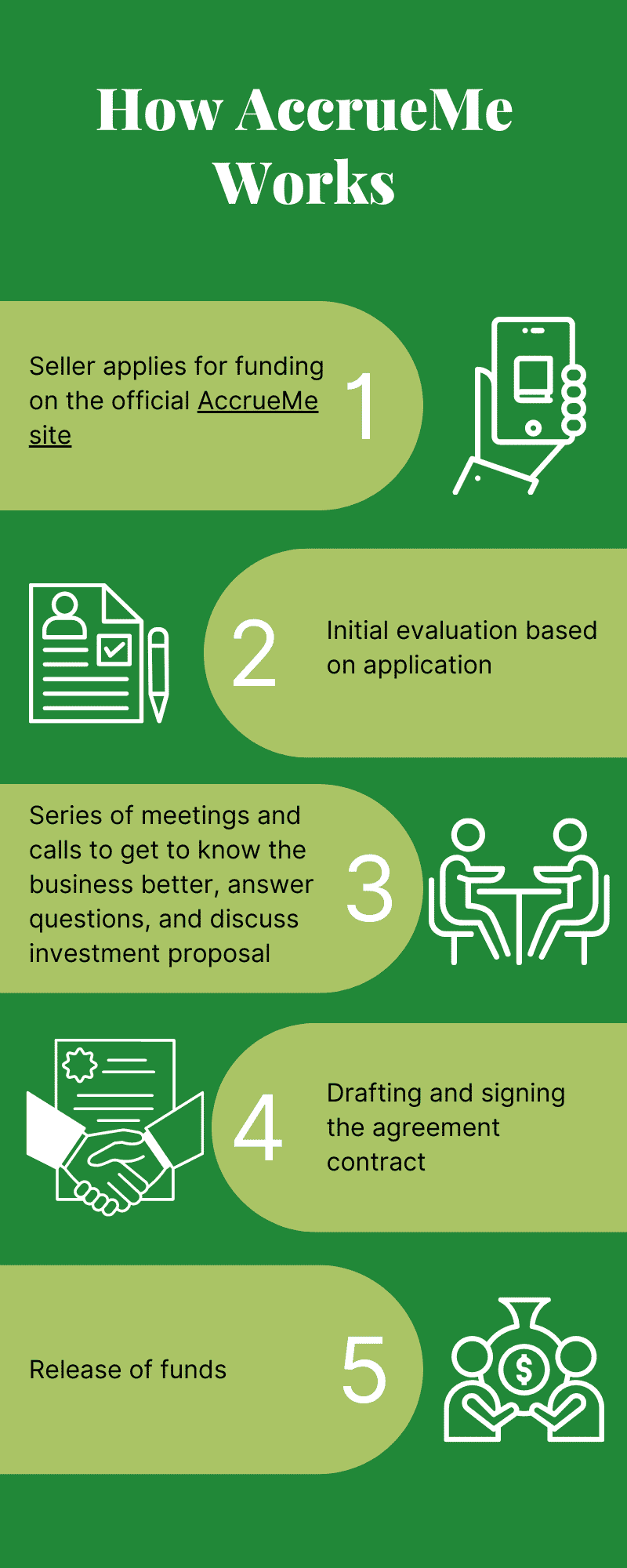

AccrueMe works by giving additional capital to profitable FBA sellers on Amazon.com. Unlike most e-commerce financing methods, AccrueMe does not issue loans, and there’s no need for a personal guaranty. There are no fees, interests, or fixed monthly payments.

AccrueMe makes money by taking a percentage of a seller’s net profits. So if the business does not make money (or worse, loses money), the seller-borrower does not owe the company anything during that month.

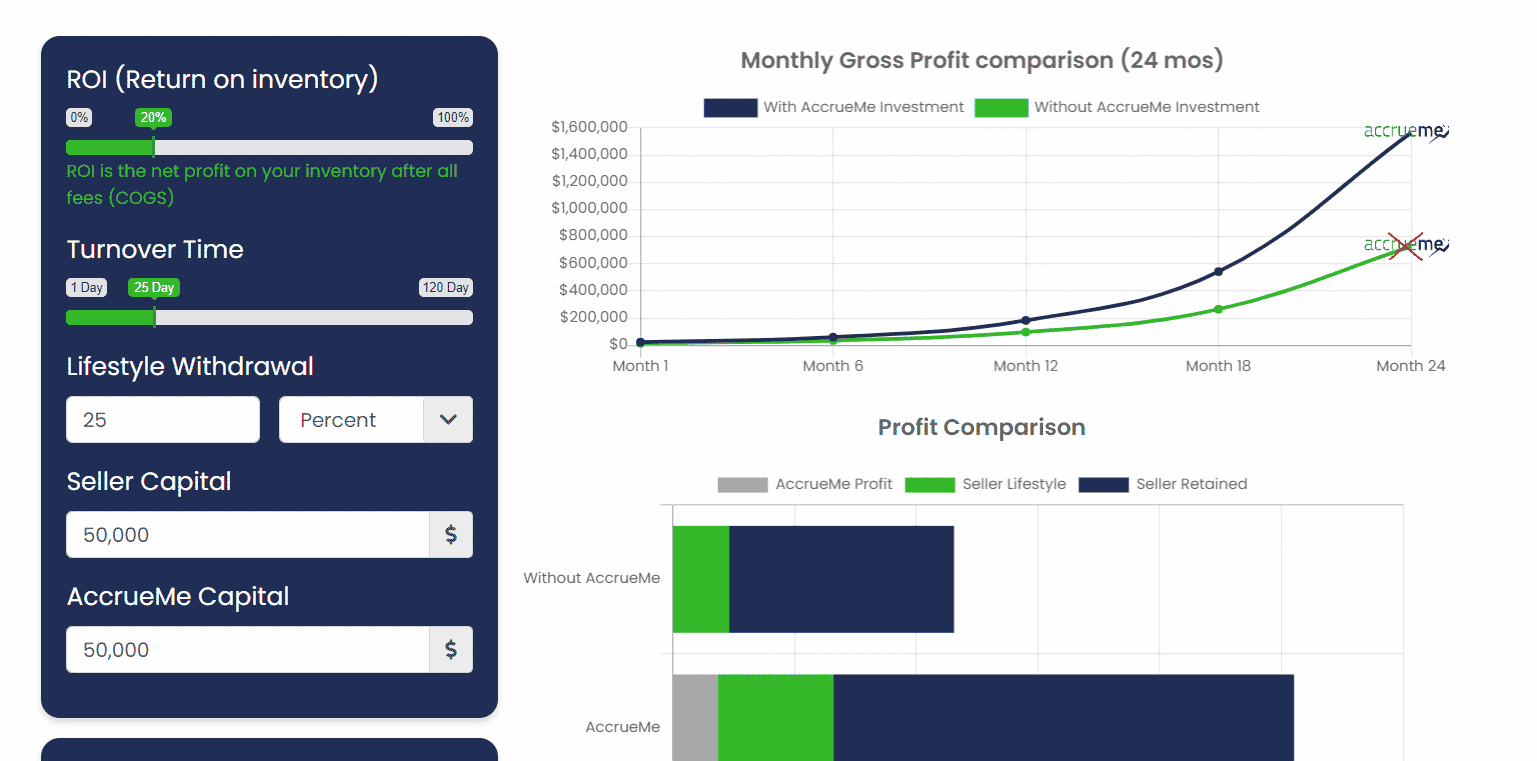

AccrueMe gives additional capital up to how much the business has in assets. For example, if your business is worth $50,000 and you want to scale it faster, AccrueMe can give you up to $50,000. It then earns half of its capital percentage based on your net profits, i.e., your revenue minus your COGS, Amazon fees, and PPC. The company is able to monitor your business in real-time by using Amazon’s API.

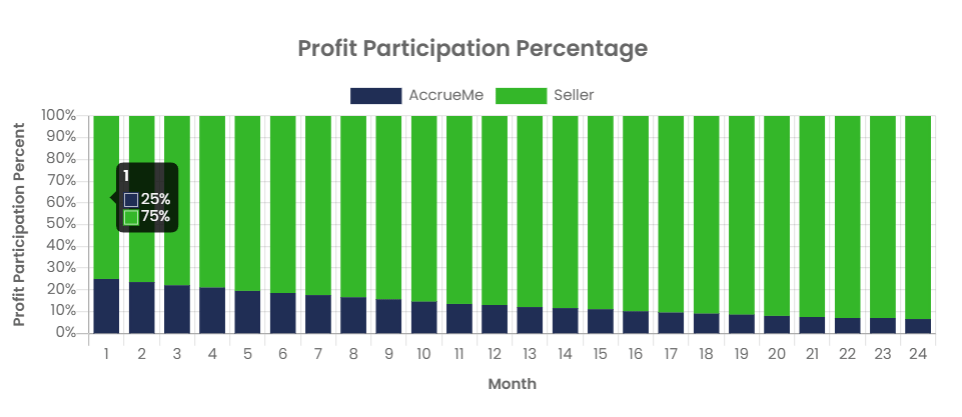

In our example, AccrueMe has a 50% share in the total capital, and it is entitled to 25% (half of 50%) of your net profits. The seller can choose to pay this back to the company or keep it and add it to the capital. Hence, sellers can choose to accrue the company’s share in the profits. This can be done indefinitely until the owner sells the business.

Profit-sharing is calculated on a monthly basis. So if you have a bad month where you actually lost money, you don’t owe AccrueMe anything for that month. This is why they call their process success-based because they only make money if you earn profits.

If you do the math, as your business grows and becomes more profitable, AccrueMe’s percentage in your overall capital becomes smaller, which reduces its profit participation percentage.

It’s important to note that AccrueMe works on a profit-sharing basis, not on equity. This means you retain full ownership of your business no matter how big the additional capital the company provides. When you finally want to exit and sell your business, you just have to pay AccrueMe what you owe them and that’s it.

Pros and Cons of Using AccrueMe

Pros of AccrueMe

- Not a loan (no mandatory monthly payments)

- You don’t lose ownership over your business

- No interest

- No credit check

- You only owe money only when you make money

- Profit-sharing is based on net profit

- Available even to small sellers

- No profit-sharing during the first 30 days

- Does not require a personal guarantee

Cons of AccrueMe

- Limited to Amazon.com sellers

- You need to have a US-based LLC

- They work only with already profitable sellers

- There are products that AccrueMe doesn’t fund, e.g., unproven private-label products

What Are the Requirements to Get Funding from AccrueMe?

When a business owner applies for funding, the company will evaluate the business to determine if it qualifies. AccrueMe has the following minimum requirements:

- The seller must be selling on Amazon.com.

- The business must be selling profitably through Amazon FBA for a minimum of 6 months.

- You should have at least $10,000 in your business (their minimum investment).

- The business has a US-based LLC.

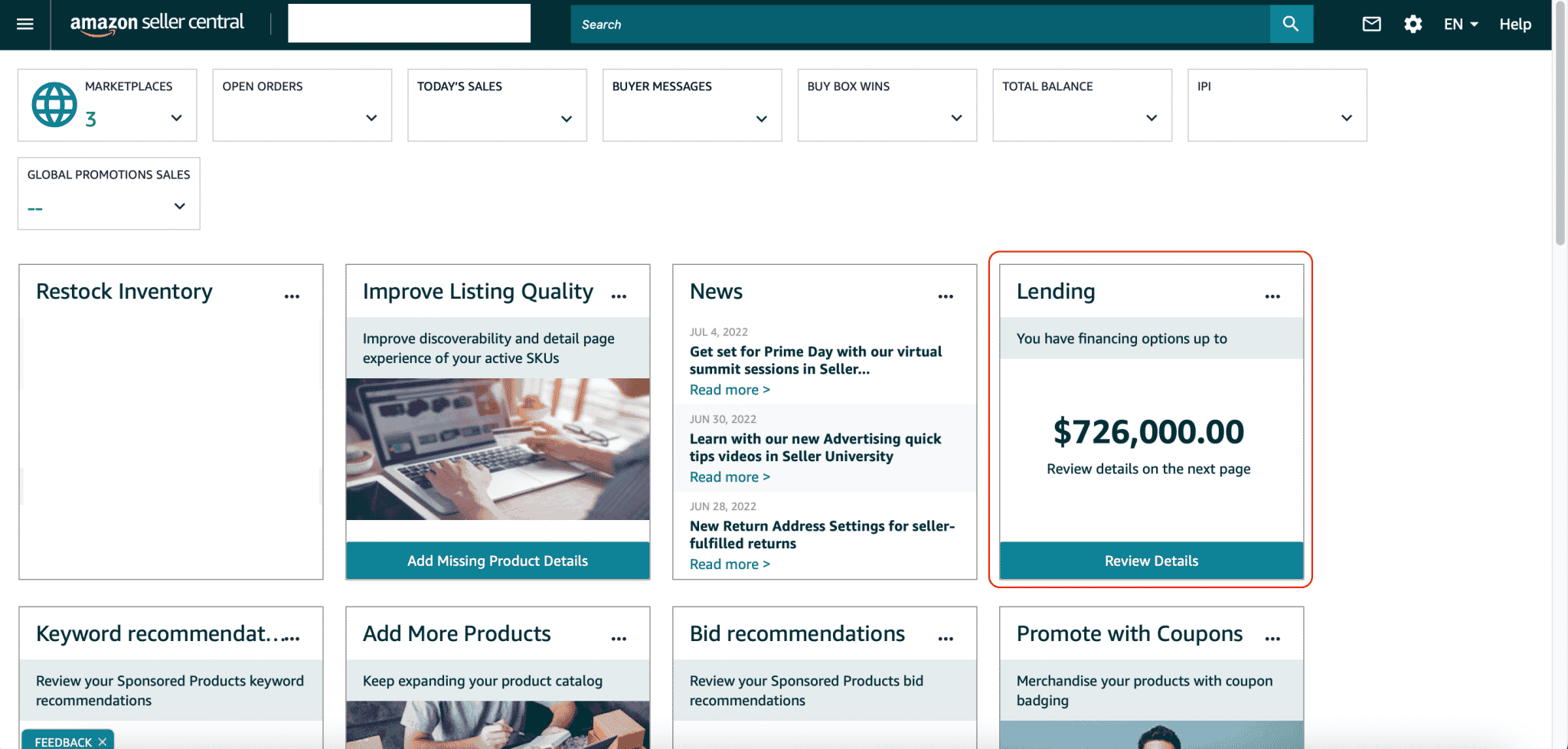

AccrueMe vs. Amazon Lending

Another source of funding third-party Amazon sellers can use is Amazon Lending. So how does it differ from AccrueMe?

The main difference is that AccrueMe does not disburse money as a loan while Amazon Lending does. And because it’s a loan, you have to make monthly payments to Amazon whether or not your business makes money (they take it out of your balance in Seller Central).

Amazon Lending is invite-only and lends between $1,000 and $750,000 to sellers who meet the following requirements:

- Must be selling on Amazon for at least 12 months

- Must meet customer satisfaction metrics

- Has total sales of at least $10,000 in the past 12 months

- No serious customer complaints in the past 6 months

- No outstanding copyright or trademark infringement complaints

- Complies with Amazon’s listing style guidelines

You’ll know if you qualify for Amazon Lending if it shows up on your Seller Central dashboard:

Final Thoughts

AccrueMe provides funding for Amazon sellers at no initial cost and you pay only when your business actually earns money. This business model seems too good to be true for most people. However, we did find it hard to find a negative review about the company.

You can check it out for yourself by getting an AccrueMe funding estimate.