One of the Largest (and Formerly Banned) Chinese Amazon Sellers Just Went Public

Do you remember the ‘Amazon incident' of 2021? This was when hundreds of Chinese sellers had their accounts suspended due to a massive server leak and a subsequent investigation by the Wall Street Journal.

Suspended sellers is nothing new on Amazon, but the sheer size of some the sellers who were suspended was. It included numerous sellers with revenue well in excess of $100m USD and included the top sellers in China including RavPower, Mpow, and Aukey.

Well one of these sellers is back (in fact, they never went away) and they just went public on the Hong Kong Stock Exchange. Their IPO filings shed enormous light into the inner workings of how these mammoth Chinese sellers operate as well as giving intriguing insight into what exactly transpired during the Amazon review manipulation incident.

Aukey and “The Amazon Incident”

In 2021 hundreds of sellers (almost all Chinese) got suspended “permanently” for review manipulation. One of these sellers was Aukey. Aukey at the time was one of the largest sellers of electronics such as battery banks on Amazon.

Aukey, and others, were basically accused of paying customers to leave positive reviews for their products. It all got kicked off when a Wall Street Journal report highlighted the use of review inserts like the one below.

Aukey had many of their accounts suspended and according to their IPO filings, “Primarily due to the Amazon Incident, our revenue decreased by 21.7% from RMB9,071.2 million [$1.259 billion USD] in 2021 to RMB7,100.2 million [$986 million USD] in 2022. In 2021, we had a net loss of RMB589.9 million [$81million USD].”

At the time, Aukey operated hundreds of different Amazon seller accounts as we can see in their shareholders disclosers before going public.

What Happened After the Fake Review Incident?

Days after an article published in the Wall Street Journal in June 2021, Aukey and many other sellers were banned.

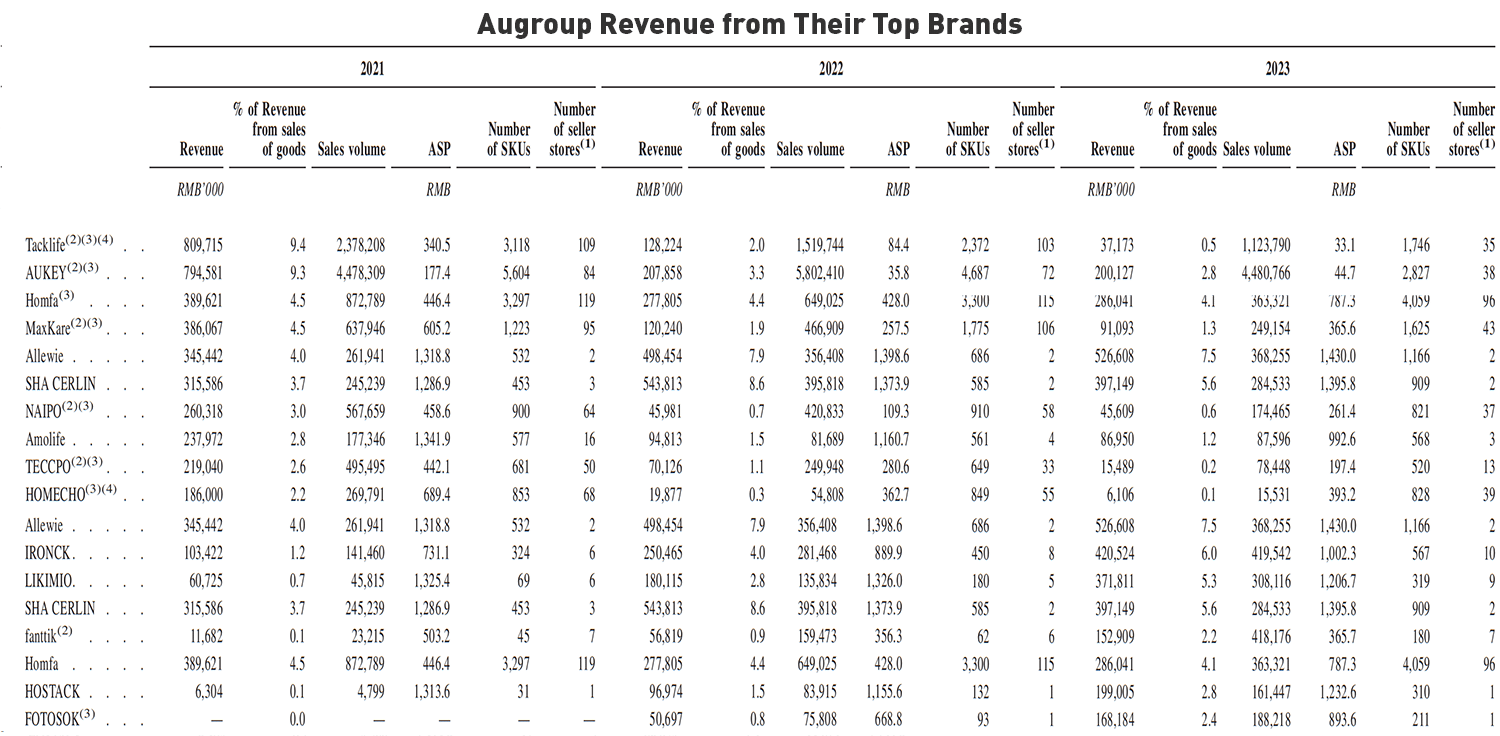

Thanks to Augroup's IPO filings we can see exactly what happened before and after the incident. Below is a full summary of Augroup's financial performance of its top brands over the last 3 years.

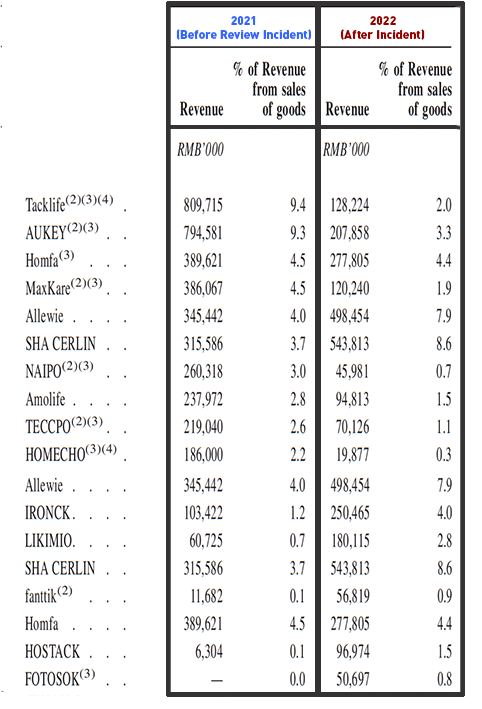

We can zoom into 2021 vs 2022 to see the impact to revenue even more clearly.

As we can see, Augroup was hit hard on two brands: Aukey and Tacklife. Before the Review Incident, Aukey and Tacklife did 1.6billion RMB ($222million USD) in revenue and were 18.7% of their revenue. After the incident, these two brands did 335million RMB ($46million USD) in revenue and were just 5.3% of their revenue. In 2023, these two brands were just 237million ($32million USD) RMB in revenue.

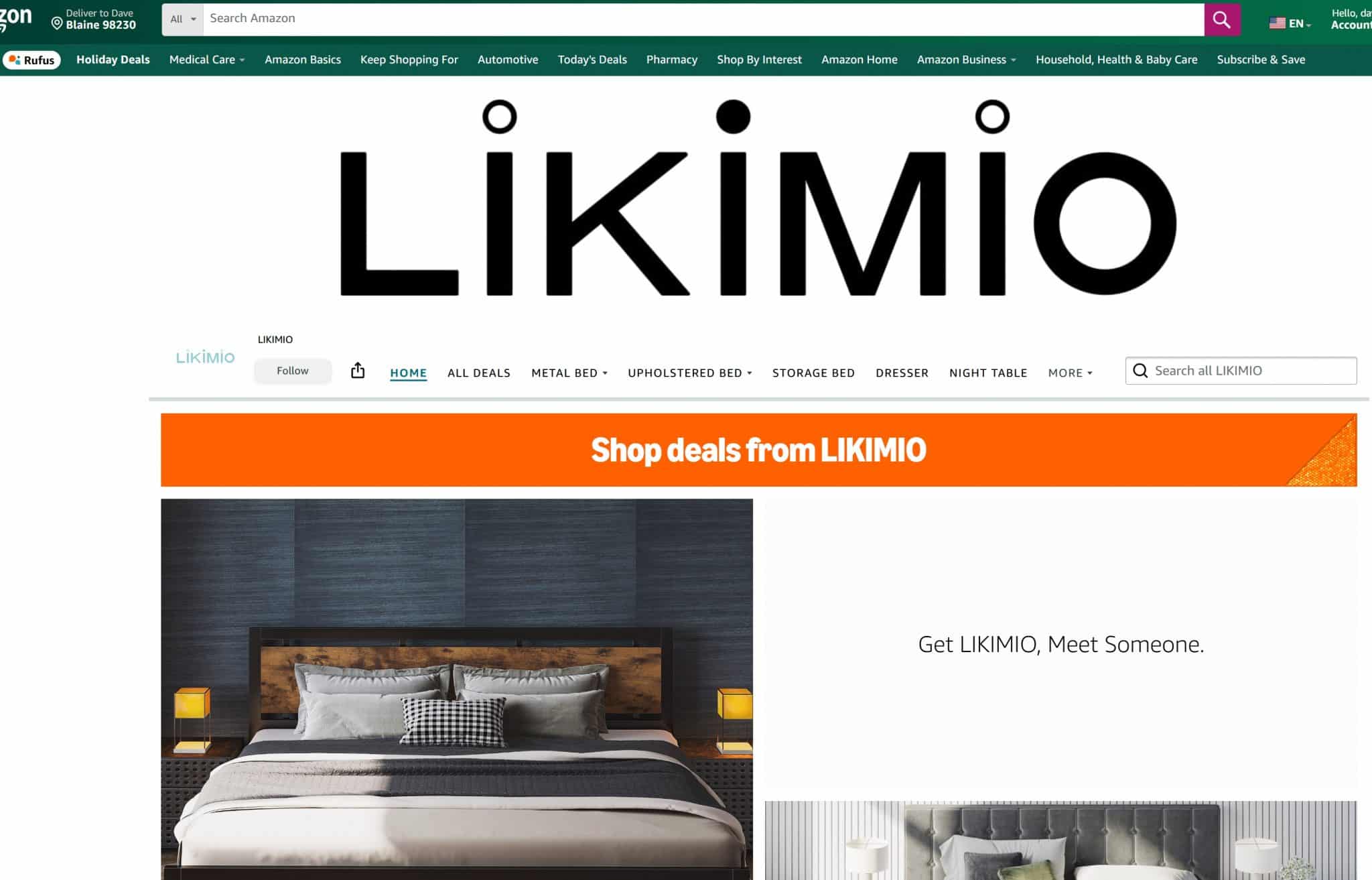

We can see that many of Augroup's brands, such as Aukey and Tacklife, continue to be banned from Amazon (their Amazon stores are active but show no active products). However, we can also see that many of Augroup's brands were unaffected (presumably). For instance Allewie, IRONCK, and LIKIMIO have all seen huge surges in revenue and continue to operate today.

Did Amazon simply not know about these other brands? That seems highly unlikely and Amazon either viewed the permanent suspension of many of Augroup's top brands as punishment enough or truly views each Amazon account in a vacuum.

Augroup Abandons Electronics and Focuses on Furniture

One of the more impressive things we can see from Augroup's IPO filings is its impressive pivot from selling primarily electronics to selling primarily oversized furniture. Regarding this, it said:

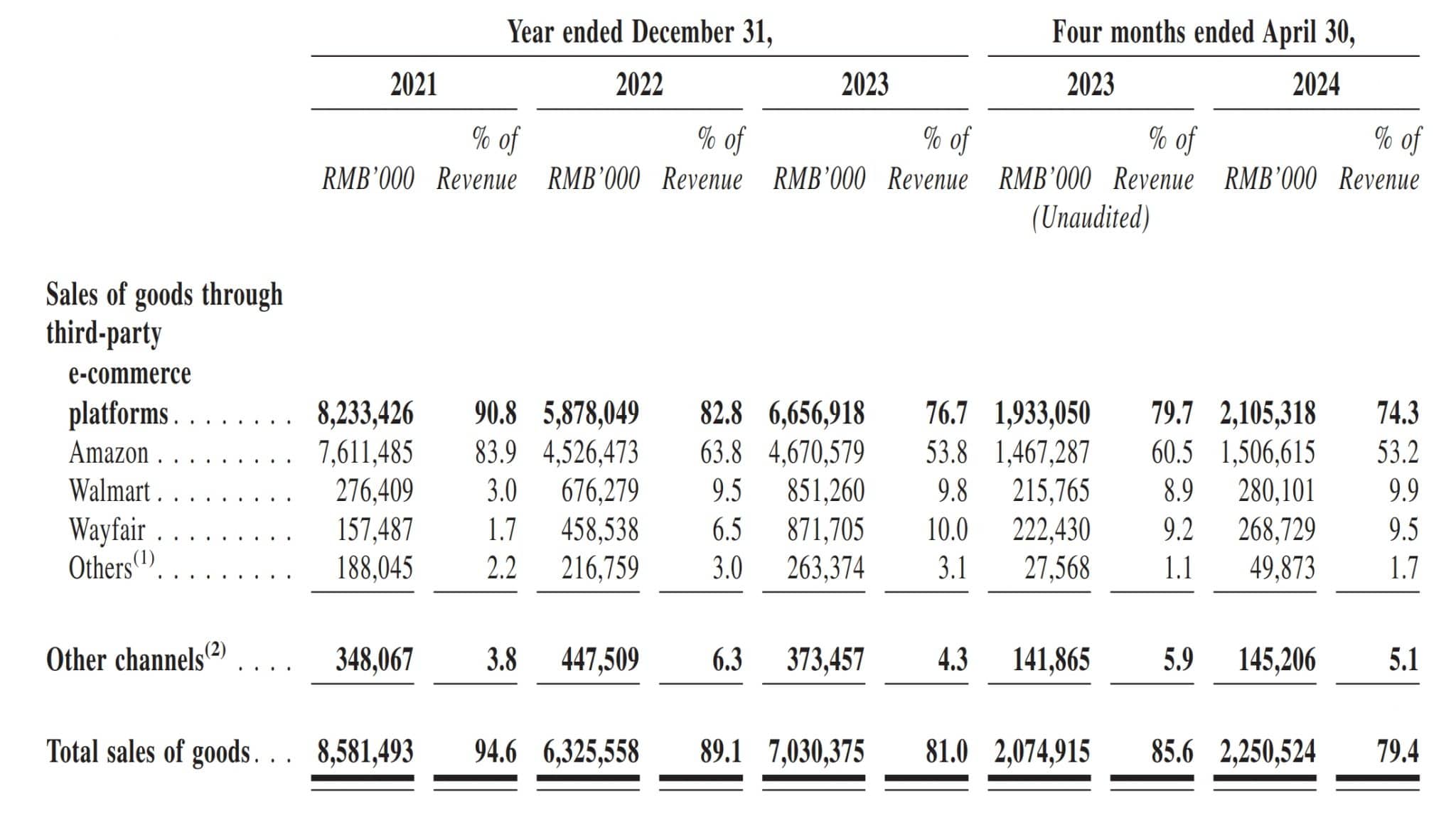

“To alleviate the impact of the Amazon Incident, we optimized our online store network and refined the brand strategy for better management and resource allocation, enhancing operational efficiency. Specifically, we have focused on furniture and home furnishings and devoted substantial time and resources to cultivating a diverse brand and product portfolio. We have also built our presence on other leading e-commerce platforms such as Walmart and Wayfair.”

Essentially what Augroup said is that electronics on Amazon are too competitive and require too many risky tactics and that it's trying to diversify away from Amazon and on to other platforms such as Walmart and Wayfair.

Augroup (formally Aukey) Files to Go Public on the Hong Kong Stock Exchange

In late 2024, Augroup (formally Aukey) filed to go public on the Hong Kong Stock Exchange and officially went public on November 8, 2024. As of November 18, 2024 it has a market cap of roughly 5billion HKD and EBITDA of 775.98M.

The IPO filings give incredible transparency into how Augroup operates. Some interesting takeaways:

- Walmart and Wayfair now make up 19.4% of their revenue compared to just 4.7% in 2021.

- Augroup operates a significant logistics company called Shenzhen Westernpost which provides logistics services to over 700 Chinese ecommerce companies.

- According to reports, Augroup ranked first in six categories in terms of GMV on the Amazon U.S. site in 2023. The company had a market share of over 10% in ten categories on the Amazon U.S. site in terms of GMV in 2023.

- The company actually fulfills many (most?) of its products without FBA. According to their IPO filings: “…we are able to provide cost-effective logistics solutions for medium-to-large goods at a price 30% lower than that of Fulfillment by Amazon (“FBA”). In 2023, over 95% of orders fulfilled by Shenzhen Westernpost for medium-to-large goods such as furniture were delivered to last-mile fulfillment service providers within 24 hours after placement of orders.

- Augroup decreased the number of suppliers it works with from 1,517 in 2021 down to 575 in 2024, despite large revenue gains.

Key Takeaways for Amazon Sellers

Augroup's suspension from Amazon and it going public has many intriguing takeaways for Amazon sellers.

Perhaps the most interesting is the fact that Amazon allowed Augroup to continue to operate many of its brands that (presumably) were not engaging in review manipulation. Did Augroup get a higher degree of leniency given their size? It's hard to say. To be fair, Augroup took a $100million loss in 2022 as a result of the suspension and one could argue that justice was served, despite them continuing to operate on Amazon.

The other interesting takeaway is that we can see now after Augroup going public (and other lawsuits from other suspended sellers) that Amazon did in fact suspend many sellers, and in unison, just days after a Wall Street Journal report. It seems unlikely that Amazon collects evidence on these sellers in just those few days and that rather Amazon was aware of the activities of these sellers prior to the WSJ report and that it was the mere tipping point for Amazon to finally act and suspend the sellers. In other words, Amazon collects evidence against illegal tactics from sellers and cautiously picks its timing to act on suspensions.

There's other operational insights as well, including:

- Augroup has significantly reduced its reliance on Amazon and now increasingly relies on Wayfair and Walmart

- Augroup heavily uses Amazon Vendor Central for many of its accounts

- Augroup has a significant logistics division that it outsources to over 700 ecommerce sellers. In other words, it has made one of its cost centers and a profit center.

Overall, regardless of your feelings on whether Augroup should continue to be allowed to sell on Amazon, their pivot away from electronics and into furniture along with their revenue recovery is an impressive accomplishment.