Holiday 2024 In-Store Sales Expected to be Lowest Since 2008 but Ecom Expected to be Strong

On September 18, according to Bain & Company's annual U.S. retail holiday forecast revealed that U.S. retail sales growth is expected to be “below average” at 3% this year. This is significantly lower than the 10-year average of 5.2%. It is projected that total U.S. retail sales for November and December will reach nearly $941 billion.

In this case, Bain's forecast includes data that suggests holiday sales growth will be slower, reflecting overall economic challenges, such as higher consumer costs for necessities and rising credit card debt. Bain's forecast aligns with Deloitte's projection, which estimated holiday sales growth between 2.3% and 3.3% for the period from November to January.

Key Findings from Bain’s Report

Bain expects non-store sales—primarily e-commerce—to grow by 9.5% year-on-year, accounting for about 90% of holiday sales growth. On the other hand, in-store sales will remain relatively flat, with only a 0.5% year-on-year growth. This would be the lowest growth rate for in-store sales since the Great Recession in 2008.

The growth rate for in-store sales is expected to vary across product categories. General merchandise, apparel accessories, and groceries are projected to experience the strongest sales growth, while categories such as department stores, sports and hobbies, furniture, and construction and gardening will likely see negative single-digit sales growth.

Amazon's Growth Uncertain

After Amazon's lackluster Q2 results in which they hinted at slower demand due to consumers aggressively seeking discounts, it remains uncertain how Amazon will fare during the holidays in 2024.

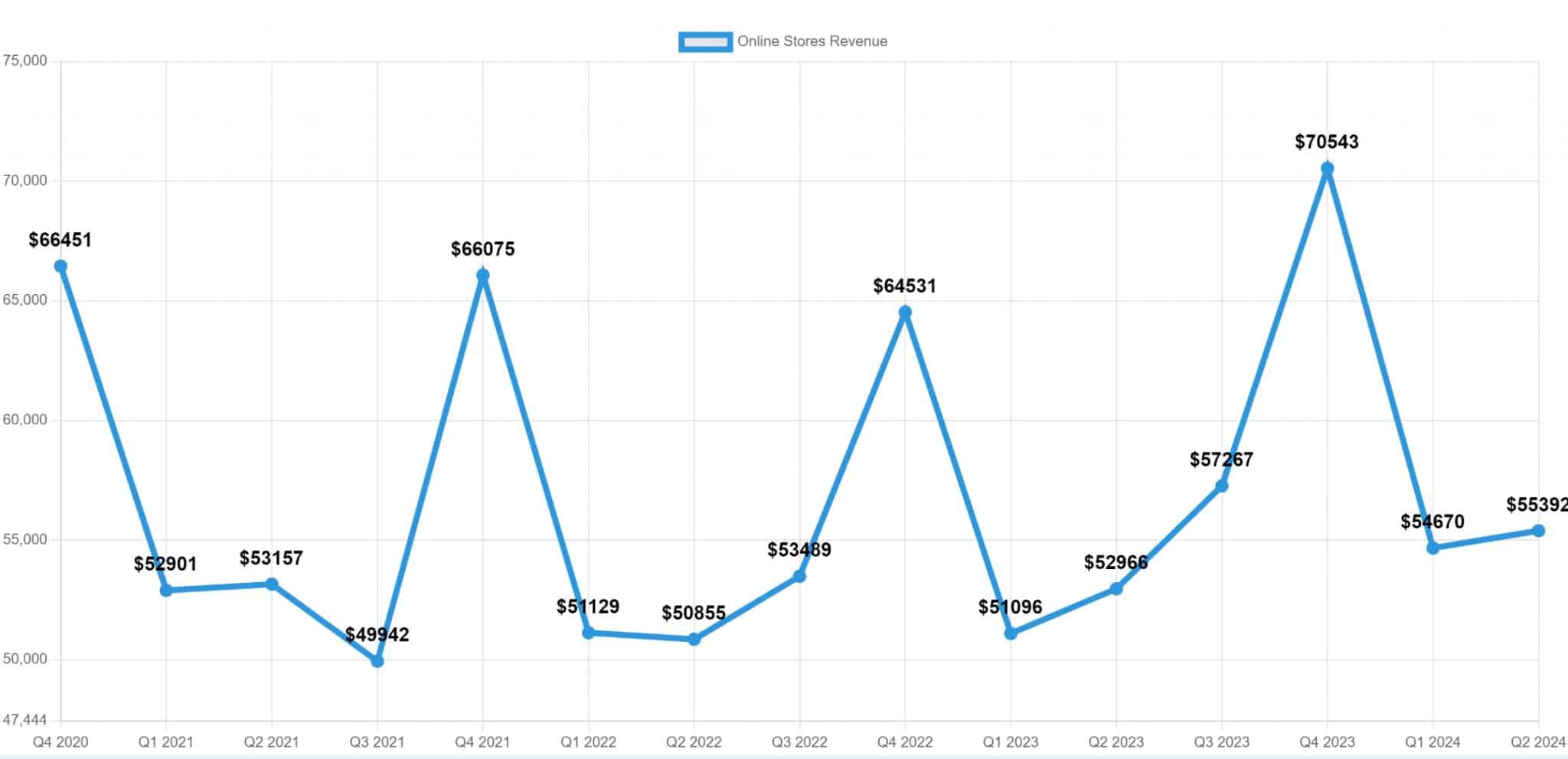

For Q4 of 2023, Amazon's overall online-store revenue (1P sales) grew from $64billion to $70billion, representing a 9.3% increase. Whether Amazon will meet Bain's expected ecommerce growth of 9.5% remains to be seen.

Challenges for Sellers

Several factors could dampen holiday sales this year. Consumers are facing increasing costs for essential items, such as housing and healthcare, while rising credit card debt and lower savings rates are reducing disposable income. However, potential interest rate cuts by the Federal Reserve and a strong stock market may help to boost consumer confidence in the coming months.

Aaron Cheris, a partner in Bain's retail business, commented that 2024 has been a relatively slow year for U.S. retail, largely due to rising costs and unemployment. Interest rate cuts and positive stock market performance could moderate sales growth, but retailers will need to act early by emphasizing value and attracting consumers through strategic promotions.

Bain's Holiday Advice for Retailers

Bain suggests several strategies for retailers to excel during the holiday season:

- Emphasize value by offering high-quality products, regardless of price.

- Attract customers with intuitive search tools, personalized marketing, relevant gift lists, and timely promotions.

- Showcase exclusive products, collections, brands, and partnerships.

- Improve the shopping experience with skilled holiday staff and better delivery options, including fast shipping and easy returns.

- Focus on seamless customer service across all channels.