Pharmapacks Ceasing Operations – What Does It Mean for Other Third-Party Sellers?

August 28, 2022 Update: Pharmapacks has officially filed for Bankruptcy.

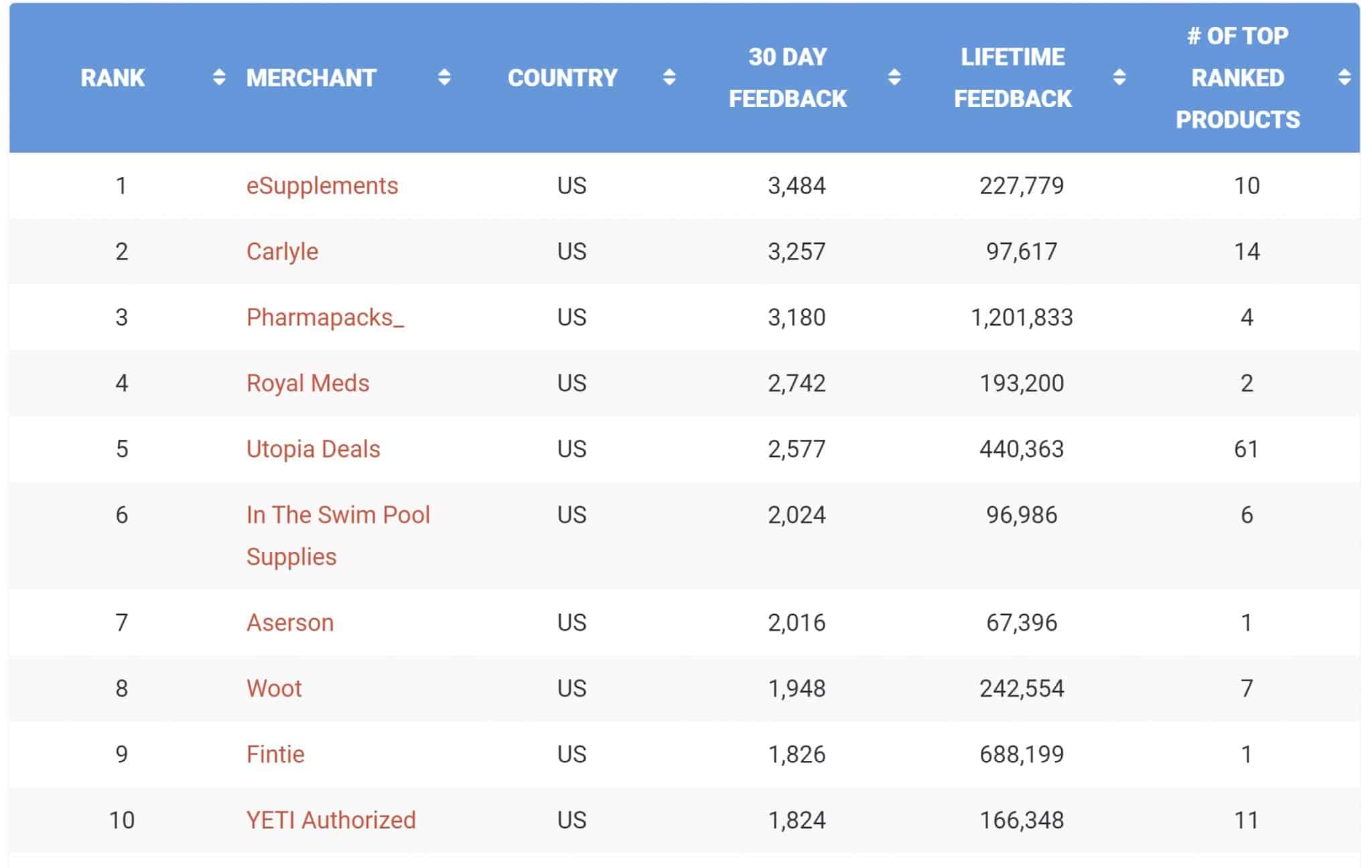

Pharmapacks will be ceasing operations after a failed SPAC attempt. Pharmapacks, for many years, has been one of the top third-party Amazon sellers and has been in our list of Top 100 Amazon Sellers for most of 2022.

What does this mean for the other top Amazon sellers like Pharmapacks who are predominantly resellers? And what does it mean for Amazon sellers in general?

Who Is Pharmapacks?

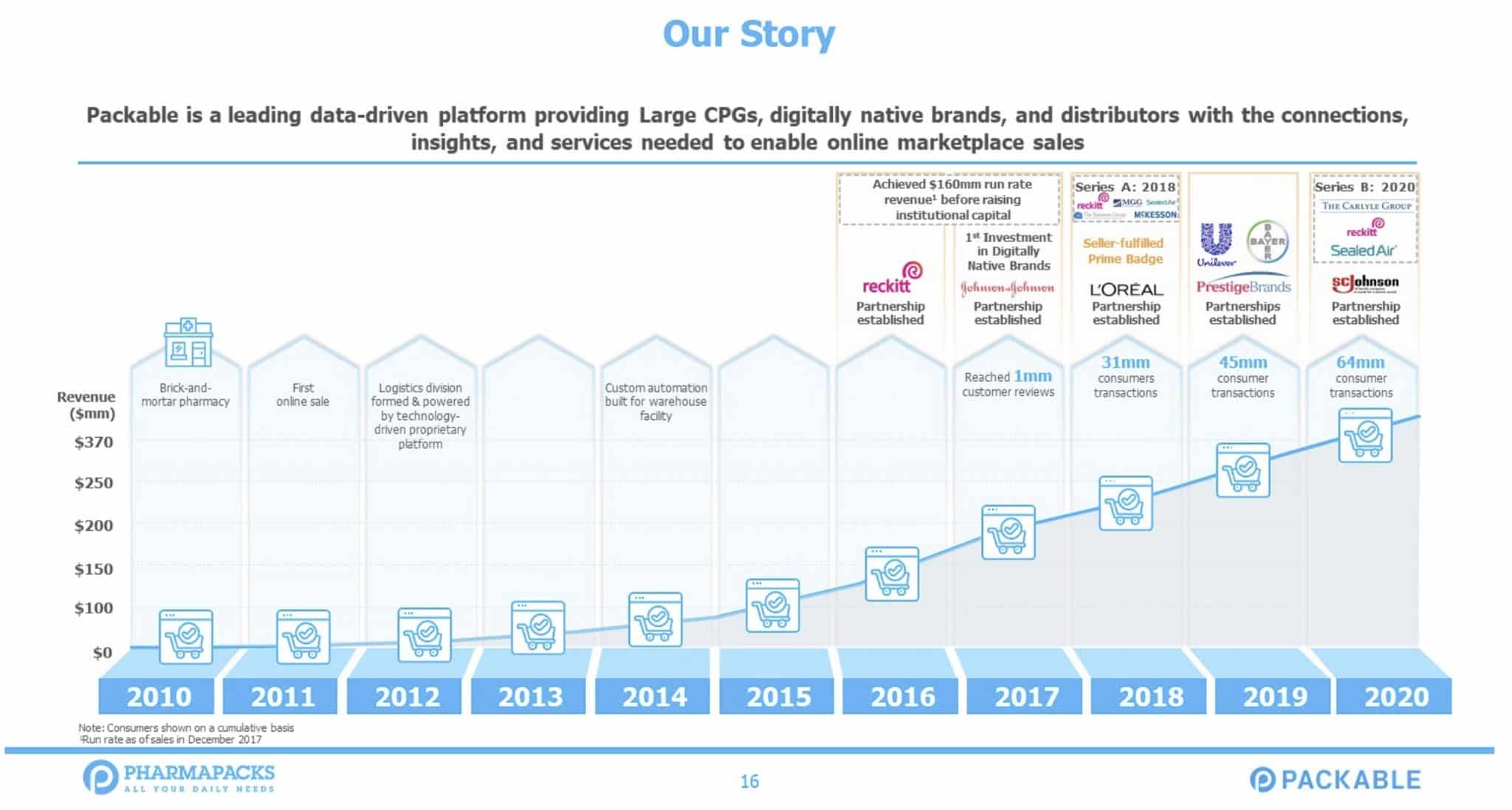

Packable, better known by its Amazon seller name Pharmapacks, was started in 2010 as a single brick-and-mortar store in Brooklyn. Eventually, it grew into one of the top third-party sellers on Amazon. In July 2022, it ranked as the third largest third-party seller on Amazon. In January 2022, Packable said their average daily revenue is $1.6million or about $48 million a month. In 2021, they reported a revenue of more than $450 million.

Their primary business involves reselling top-selling health and beauty products like Q-tips and Colgate. Check out their Amazon storefront to get a sense of their business. As of early 2022, they reported having approximately 1,000 employees.

Why Is Pharmapacks Ceasing Operations?

For experienced Amazon sellers, the business model of reselling low-margin commodity products and competing against dozens or hundreds of other sellers for the buy box may already be sounding alarm bells. However, the real death knell came last year when Packable announced a merger with another company, Highland Transcend Partners I Corp, for the purposes of offering a SPAC (Special Purpose Acquisition Company), basically an alternative way of raising money through an IPO. Once the economy started to grind to a halt, so too did the market for SPACs and Packable's ambitions of offering a SPAC.

According to documents seen by CNBC, “Packable said in a notice to employees Monday that it was laying off 138 people, or roughly 20% of its staff, with the remaining 372 employees expected to be terminated as “individual winddown responsibilities are completed…We diligently pursued internal and external financing options but were ultimately unsuccessful. Given the company has no viable financing alternatives, we are now forced to cease operations, liquidate any remaining collateral, and shut down the business, including the facility you report to.”

Are Other Large Amazon Resellers Doomed?

The business model of reselling huge volumes of consumer products at ultra-low margins is still popular among the third-party sellers on Amazon. Royal Meds and MYBATTERYSUPPLIER (the fourth and twelfth largest resellers, according to our July 2022 calculations) have largely similar business models. Can they survive in a world with increasing competition and decreasing margins?

One could argue that Pharmapacks got into trouble by chasing hyper-growth fueled by their dreams of a SPAC offering (more on that shortly). Conversely, one could also argue that days of large resellers thriving are over. We've seen it over the years as the list of top third-party sellers is more frequently dominated by true direct-to-consumer brands like YETI and Anker.

Do Amazon Resellers and Aggregators Face the Same Peril?

The announcement of Pharmapacks, one of the largest Amazon third-party sellers, ceasing operations follows the string of bad news for Amazon aggregators. Do resellers and aggregators face the same fate then?

The business models for resellers like Pharmapacks and aggregators like Thrasio might seem entirely different, but in reality, they're not that dissimilar. Aggregators like Thrasio pay big valuations to acquire other brands and sell them on marketplaces, while resellers like Pharmapacks buy other products to resell them. The common thread is that neither business model is aggressively developing their own products: they're paying to acquire them, either from other brands or other entrepreneurs.

Aside from the lack of ingenuity and scrappiness, there's one other link between ill-rated resellers like Pharmapacks and the Amazon aggregators: many of them seemed to disregard the importance of profitability with the hopes of showing massive revenue, seducing investors, and exiting at some massive valuation.

Scrappy and innovative e-commerce entrepreneurs know that revenue is just a vanity metric. The sanity is in looking at the bottom line.

Are Smaller Amazon DTC Brands in Trouble Too?

The impending death of Pharmapacks shows that the business model of reselling goods (essentially retail arbitrage) is, at the very least, a difficult-to-scale business model. The collapse of the aggregator market has shown that the idea of achieving huge economies of scale by rolling up a bunch of smaller brands may actually accomplish the opposite: you get dis-economies of scale demonstrated by excessive overhead and bloat.

So where then does that leave smaller DTC brands like the ones operated by this article's writer (and probably many of this article's readers)? Clearly, there are a few common trends in the world of third-party marketplace sellers:

- Scaling is difficult as an Amazon third-party seller, especially at the level required to go public

- Margin compression is real—meaning bloated overhead can be fatal

- Catalog growth and innovation are table stakes

These trends could result in a few things. Perhaps it results in an Amazon marketplace consisting of a larger number of smaller DTC brands as opposed to being dominated by a few massive companies. Perhaps it means DTC brands have fewer product marketers and financiers and more product designers and engineers. Or perhaps it just means that lower margins eventually result in even more overseas sellers.

Regardless of what the implications of Pharmapacks' demise is for other third-party sellers, one thing is certain: expect to see more news like this from other Amazon-centric companies whose hopes rested on an eventual IPO.

Sad to see them go. I was working there as a temp when they announced the merger. Huge amounts of inventory was coming in but slowed down early this year. They also stopped hiring. Now I know why.

I started an Amazon side business about 5 years ago as a reseller. I started in retail arbitrage and moved into purchasing products wholesale from local manufacturers to resell on Amazon. It was always a side hustle and only generated a small monthly profit. I’m now winding that business down as it’s clear Amazon does not want resellers on its platform. So many features on Amazon now require brand registry which resellers typically won’t have access too. In addition, there’s just been continued competition from other resellers and Amazon price-matching to other retailers and suppressing the Buy Box. Without exclusive products or distribution or some edge, there’s always someone out there willing to sell the same product for less – whether because they have lower overhead and lower profit targers, or just a lack of financial sense to realize they’re making no profit.

Hi,Michael

how about setting a website and resell those items, that you mentioned, is there a chance, like making some extra by paying less 11% (paypal instead of 15% collected by amazon instead.

Brand registry and usually name brands does not authorize small-scale resellers to use their brands and there is another risk here, that is multiple “authorization” might trigger alert and those resellers might end up with lock up for good.

n addition, there’s just been continued competition from other resellers and Amazon price-matching to other retailers and suppressing the Buy Box.

-darn, right, there are placements for the same ASIN but as long as they got access to the item, the competition is kinda tough.

So my question is that what if, I mean what if we can resell those items

Yes, Amazon charges 15% but there’s always a marketing cost involved. Is it lower than the 15% of Amazon? Maybe – but there is A cost if you sell off of Amazon.