What Will Happen to Amazon Storage Limits in 2021?

Easily the biggest issue for all ecommerce entrepreneurs this year has been logistics issues. Sea freight rates are generally 100% higher than what they were at this point last year and Amazon has been rolling out severe storage limits, often overnight.

The latest happened last week when Amazon announced the removal of individual ASIN limits and instead enacted overall account ASIN limits. This was good news for some, but for most sellers, it was bad news. It reflects Amazon's erratic behavior regarding storage limits over the last year.

Amazon Storage Limits Timeline

Let's begin by looking at a timeline of the last 12 months or so in regards to Amazon's continuously shifting policy on storage limits.

- July 13, 2020 – Amazon announces ASIN restock quantities for nearly every seller and product.

- July 13, 2020 – Amazon announces that the Inventory Performance Index minimum was moving from 400 to 500 in order to keep unlimited storage capacity.

- December 15, 2020 – Amazon announced that the IPI score will be lowered to 450.

- March 4, 2021 – Amazon announced severe storage limits on Amazon.ca accounts effective immediately and with no advanced warning.

- April 22, 2021 – Amazon announces the removal of ASIN limits and instead an overall cumulative ASIN limit on accounts effective immediately and with no advanced warning.

As we can see, Amazon has been extremely volatile over the last 6 to 12 months regarding storage limits and ASIN limits for sellers.

Why Has Amazon Been So Erratic Regarding Storage Limits?

So why has Amazon been so erratic regarding storage limits for sellers? The reasons are largely fueled by the following:

- Net sales increased 37 percent in 2020, far higher than forecasted and more than recent historical average (compared to 20.45% and 30.93% revenue growth in 2019 and 2018 respectively).

- As per Amazon, maintaining social distancing measures at fulfillment centers has impacted productivity.

- COVID outbreaks have resulted in delays at fulfillment centers or even outright closures.

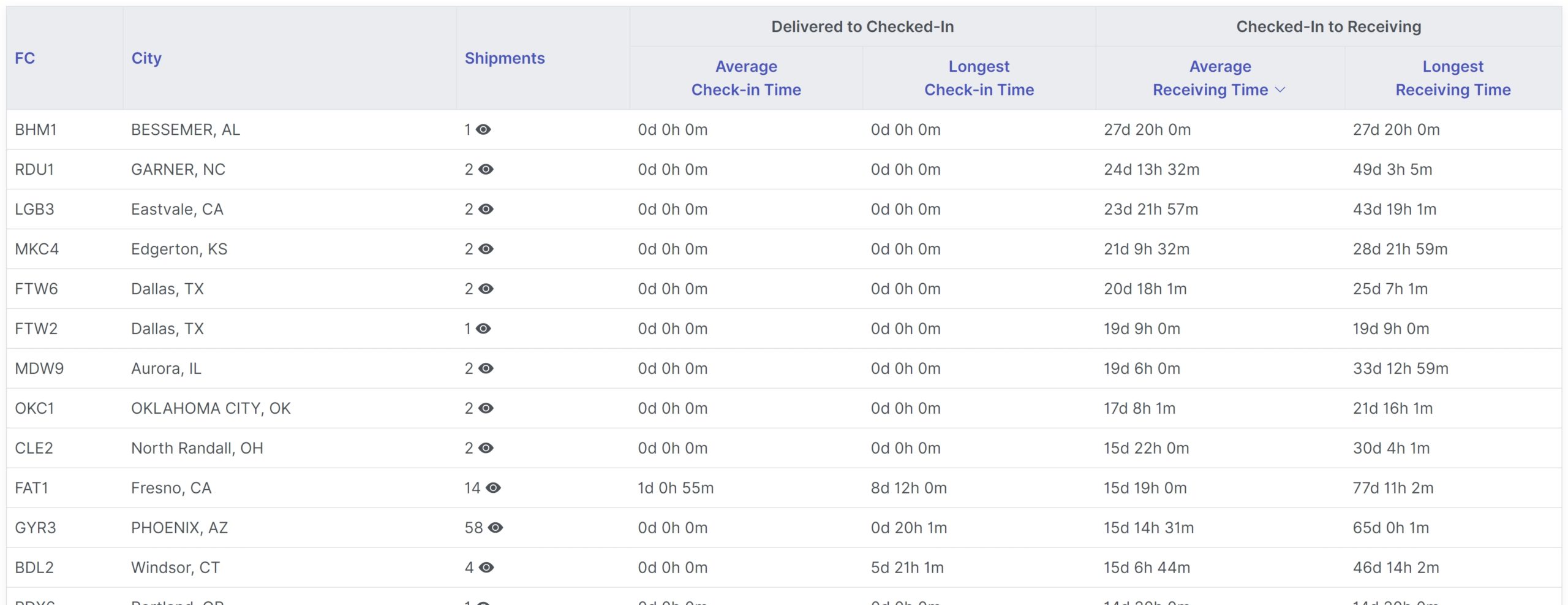

Basically, Amazon has been hit with a double whammy of a huge surge in unforecasted demand along with negative impacts to fulfillment center efficiency due to COVID-19. The net effect is that Amazon is facing severe problems getting items received into stock.

We can see by the fantastic Amazon FC scorecard from ShipmentMakerPro, receiving times are well over one week for almost all fulfillment centers.

Despite many sceptics, Amazon's interests and sellers' interests are overall aligned when it comes to storage and receiving times. Amazon wants to ensure they the products customers want in stock. Sellers not stocking enough products and running out of stock is neither good for Amazon nor for the sellers.

The individual ASIN limits Amazon imposed had a significant drawback—a sellers' best selling products we're disproportionately hurt relative to their less popular products.

For consumers, this basically meant there was a plethora of products nobody wanted and a shortage of popular products. The cumulative ASIN limits helps fix this, although it has caught many sellers with their pants down with an overstockage of slow-selling items.

Also, despite what many may think, as one of the largest and fastest growing companies in the world, Amazon presumably does have some half-intelligent people in management in charge of making these policy changes. The flip-flopping between IPI scores, individual ASIN limits, and cumulative ASIN limits is seemingly the result of them trying to decide on a “least-worst” option.

What Could Happen to Storage Limits for the Remainder of 2021?

This brings us to the predictions for the rest of 2021 and moving forward.

Relative Certainties

- Creating warehouse space is a long-term effort. More capacity will come online, but likely not to the level needed to support the surge in ecommerce.

- Social distancing measures will ease, increasing efficiency at warehouses.

- As COVID restrictions ease, more discretionary income will be spent on services and experiences such as dining in, travel, etc. and less on retail purchases.

Questions to Consider

- Can retail sales continue strong in 2021 (they grew at 6.9% in 2020) or eventually do people start spending their money on experiences rather than things?

- Can the economy continue to go strong or eventually does the ‘COVID bill' become due resulting in a myriad of hits to consumer income such as increased taxes, increased inflation, etc.?

- Do consumers continue to shop even more online or do they get “online fatigue” and turn back to shopping malls and brick and mortar spending?

- Does Amazon decide that it makes better business sense to reduce the amount of time that sellers store inventory at their warehouses for?

My personal feeling is that Amazon will be playing catchup in regards to warehouse capacity well into 2022, and ASIN limits will be the new norm for the rest of 2021, although they may increase the ASIN limits.

The only thing that could change this more quickly would be a massive decrease in online spending, either through changing consumer habits and/or a recession which would put sellers in the crummy position of being able to store as much as they want at Amazon warehouses but having no customers to buy those items.

What do you think will happen to storage limits for Amazon sellers for the rest of 2021? Do you think they'll remain as is or that Amazon will loosen them significantly? Let me know in the comments section below.

Hi Dave,

These changes are not sustainable and I have pulled my stock and closed some of my best listings as a result. It is impossible to manufacture in bulk and “drip feed” stock to Amazon. The whole point of FBA is to avoid stock warehouse management so I think they are killing off their own business by not being consistent with policy. I will find another way to sell as this is becoming too expensive and impossible to navigate. I don’t want an Amazon warehouse in my lounge and I don’t want to pay for storage each time an Amazon office employee comes up with a new bright idea using me and my funds as a guinea pig. They have no appreciation for how difficult it is to navigate their ever-changing rules if they keep moving the goal posts sellers can’t win. I do not think my goals and their goals are aligned at all.

I don’t think Amazon wants it either because ultimately the added costs will come through on prices on Amazon and hurt them. Unfortunately, more FCs take a lot of time to build :(

Hi Dave,

Great article! Question: I am launching a new product in the small, oversized category. Ideally, I would ship FCL via Amazon Global Logistics (AGL). However, I cannot do that now due to restock limits. First, are you guys using AGL anymore (if so, how do you make it work with restock limits) or are you now shipping directly to a 3PL warehouse which then restocks FBA? Second, what 3PL warehouses to you recommend? Waiting to become a prime member!

Shane

Yes, still using AGL but it depends on our storage limits. Mostly we use it for our really large and expensive items (re: $1000+) that don’t take up a lot of inventory utilization. 2. It really varies depending on your situation but check out shiphero.