Amazon Announces Lower FX Currency Exchange Fees

Amazon recently announced new lower foreign currency exchange fees for sellers using their new Amazon Currency Converter. This is new service can potentially save sellers who operate outside of their domestic markets a lot of money.

In this article, we'll review who should be using this service, what it does and doesn't do, and how much money it can save you.

What is Amazon's Currency Converter?

If you sell in a marketplace outside of your home country, e.g., a Canadian selling on Amazon.com or an American selling on Amazon.co.uk, then you will accumulate a balance of funds in a foreign currency.

Unless you have a bank account in that local market, a bank account within the United States (if you're selling on Amazon.com), or a bank account within the UK (if selling on Amazon.co.uk), Amazon will convert those funds to your local currency before you can withdraw them from your local bank account.

The major downside when Amazon does this is that they apply a very unfavorable currency exchange rate. Previously, it was around 1.5% above the spot rate.

The spot rate is the currency exchange rate you see quoted on the news. No one ever gets the spot rate when doing a currency exchange. However, there can be a very big variance between exchange rates you get.

Now, Amazon is offering to exchange money at a rate of 0.75-1.5% above the spot rate.

What about if I have a foreign currency bank account in my home country?

Many sellers have bank accounts in their home country in a foreign currency. For example, many Canadians have US dollar bank accounts within Canada.

Unfortunately, you can only withdrawal currency from Amazon into the home currency of your home country. For example, CAD to Canada, USD to America, GBP to the UK, etc. This means any foreign funds will be automatically converted by Amazon to your local currency.

How much will Amazon charge to exchange your funds?

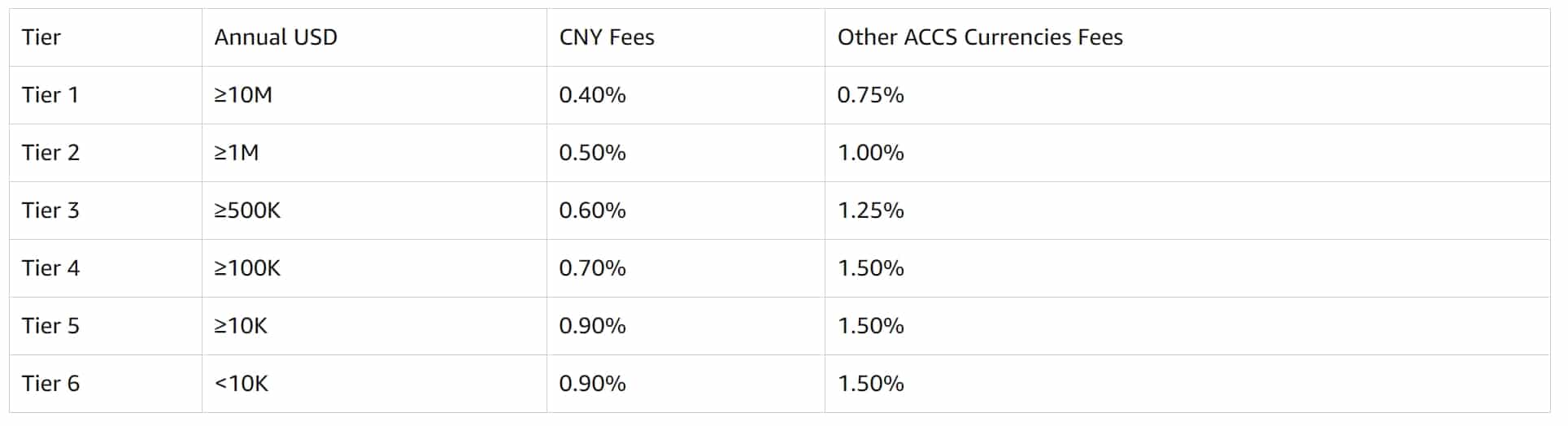

Amazon is now offering a tiered exchange rate depending on your total processed volume (TPV) over the last 12 months.

If you sell under $100,000 per year, you will get a flat 1.5% exchange rate above the spot rate. In other words, the effective exchange rate will remain the same for you. For volumes greater than this, you will get between 1.25% and 0.75%. If you're withdrawing using Chinese currency (CNY), you will get a rate of between 0.9%-0.4%.

How much money will you save with Amazon's Currency Exchange?

If you sell under $100,000 annually, you're not going to reap the benefits of Amazon's new currency exchange rates.

However, if, for example, you sell $1,000,000 annually, then you will essentially save 0.5% on exchange fees, or $5,000 (1.5% normal exchange rate minus the new rate of 1.0%).

A $10,000,000 seller would save 0.75% or $75,000 based on $10,000,000 annual sales.

The savings would be even more for Chinese sellers (and there's a lot of them).

How do you use the New Amazon Currency Exchange?

If you're currently having funds exchanged into your local currency, they will be exchanged at the new rates automatically.

Why is Amazon doing this?

It's unclear why Amazon is being generous in lowering the exchange rates. Apparently, the new rates remain either the same or are decreased.

Possibly, with foreign sellers being so critical about Amazon's marketplace, it's an attempt to pass savings to these sellers in the hopes that they pass these savings onto consumers. Also, Amazon is being extremely aggressive in recruiting new sellers to expanding marketplaces like Australia, Singapore, etc., and this may be an attempt to make international expansion even more attractive.

Happy to comment on this blog.very helpful and good Knowledge