How to Lose Your Home Buying a Frozen Yogurt Franchise or Ecommerce Business

“HUGELY POPULAR froyo business for sale!! Over $500,000 in revenue in it's very first year! Owners completely absentee and management in place that runs the store completely by itself. Low cost of goods and massive cash flow for this booming business that is a steady cash cow- get it while it's hot hot hot!”

– Pitch of every frozen yogurt broker

If you're on a service like BizBuySell as often as I am, you'll inadvertently run into a listing like this just about every month it seems like. Nowadays, I have to imagine the consensus is that the once unstoppable froyo train has finally derailed and is in the stages of consolidation in most regions. It's the classic tale of a consumer buzz, that turned into a fad, that turned into an over-hyped pyramid, which all came tumbling down when the all-too fickle consumer decided that froyo was so last year.

Now while this could read as a lesson on why you shouldn't invest in frozen yogurt, the true lesson as it ties into ecommerce is that if you plan on buying into a trend, you will pay a premium valuation while taking on increased volatility – the worst of both worlds.

Even now, when I speak about froyo to prospective business owner, I'll often hear something along the lines of, “Frozen yogurt is a great business! My wife and her friends go all the time! It's such an easy business and it's so clean.”

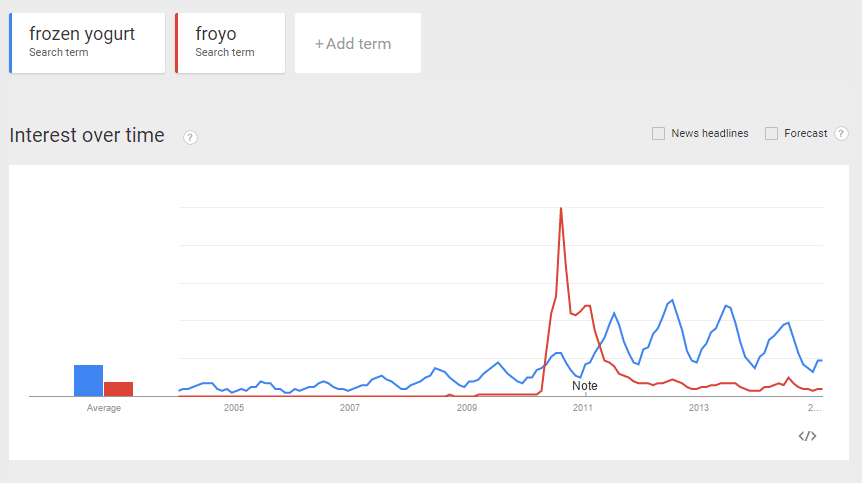

That's when I don't say a word and pull up this trusty little website called Google Trends. Then I just sit and wait for their reaction.

Seeing this graph is usually the coming to Jesus moment that makes people realize, maybe I shouldn't mortgage my home for a frozen yogurt franchise. Of course, hindsight is 20/20 and for someone who was getting in right around 2012 or even 2013, “frozen yogurt” may have been as popular as ever, if you listened to the internet chatter and saw the soaring revenues for existing stores.

In my neck of the woods out in Seattle, a friend in the know told me around 2011 that an independent shop in one of our highest grossing malls was pulling $800,000 in sales in the first year with $300,000 in profits. Total build out and tenant improvement? A mere $250,000. A yearly return on investment of over 100%. A different frozen yogurt shop, north of Seattle, which was a popular up and coming franchise that rhymes with “crunchy”, was grossing upwards of $1MM in it's first year. After running an estimate through my spreadsheet, I put the profits at that store around $400,000 per year. When I researched the franchise and walked the store, I put the total first year investment at $400,000 on the nose as well, for another 100% industry.

My first reaction was “Wow!” followed closely by, “I wonder how many other people know this?”

Let me tell you, my “friend in the know” who managed sales accounts? He actually learned this information from a regional sales manager. That sales manager, was friends with the owner, who went to the same sports club. Yes, that sports club, where guys with $500/mo memberships can talk business with other business owners. By the time “the secret” got to me, I might as well been getting gossip from the valet drivers. It was safe to assume that anyone with a hair of interest was already looking into owning a frozen yogurt business at this point.

Regardless, the endearing trait of most entrepreneurs isn't “Why me?” but “Why not me?” myself included. So by next week, I was deep in FDD (franchise disclosure documents) trying to ascertain whether or not I should try my hand at serving bags of colored goo for the “discerning health conscious consumer”. (For those curious, you don't have to sign up with a franchise to get the FDD, you can always purchase one if you aren't interested in going through dozens of qualifying hoops). I did my Google trends research, ate at every yogurt store I could and got a feel for things and truth be told, it seemed like a was a fantastic business model. It had low cost of goods (sub 20%), the labor cost was low (two cashiers, one goo engineer), build out was under $400,000 and the cash on hand of $100k – $200k needed was far less than a “normal” franchise. If I ran an independent shop, I would even be able to get my total cost below $200,000 if everything went to plan. (To put it in context, the minimum to even think about a McDonalds franchise is a cool million).

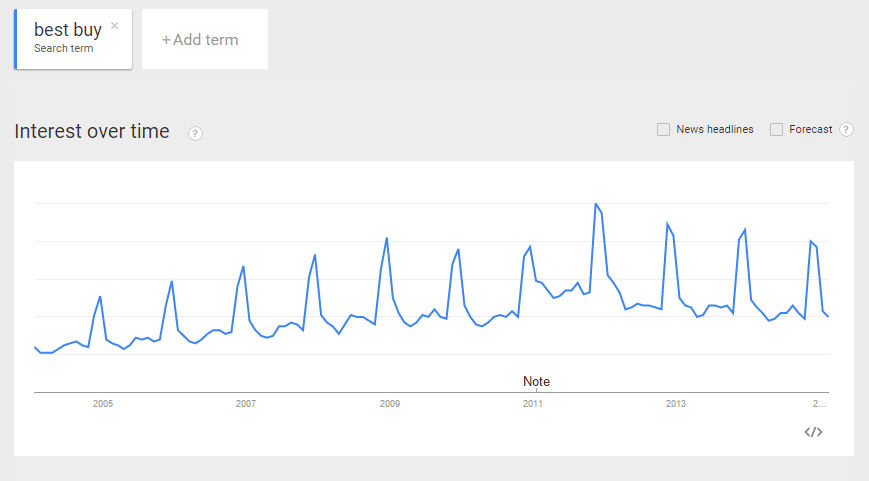

And that's when it hit me: everyone and their mother is going to be opening a froyo store. Why? This was too lucrative and the secret was out. Of course there was store owners in the system gushing about making barrels of cash, because those lucky few were positioned to catch the windfall when the trend came their way. Sound familiar? It should, because this is a repeated tale in business that repeats all the time. It's what happened in the early days of eBay, when PowerSellers were raking hand over fist when customers were streaming online and companies like Best Buy were laughing about why anyone would purchase something online of all things. We know how this story turns out.

A fun fact, Mike got his start as an eBay Power Seller, dealing in movies and collectibles on eBay. Yet if you look at the landscape now, if you try to buy DVDs to sell them on eBay now, I wish you the best of luck, because chances are you'll go broke before you even began to develop a clue. Why? Because this is a saturated market with extreme amounts of competition. It's hard to keep a secret and the competition will come.

One of the partners in my franchise asked my opinion about investing in froyo and I told him my thoughts. After some deliberation, the trigger was pulled.

And let me tell you, the frozen yogurt business went clinically insane for the next 24 months. First it was the Yogurtland, then the Menchies, then the CrazyBerry, then the PinkBerry, then the dozen or so indy shops, then even TCBY – the original frozen yogurt franchise that disappeared in the 90s when (gasp) the frozen yogurt fad died twenty years ago. Whereas once there were stores with a comfortable 5-10 mile operating radius, there were now 3 stores on a single street. The Seattle market was sustaining (and this is my estimate, not hard data, mind you) about $3.5MM in frozen yogurt sales in early 2011 across about 5 stores, when it suddenly blew up to 14 stores. That means demand would need to increase 200% in order to sustain the current profit margins. Now look back at that Google trends graph. Does that look like a sustainable 200% increase to you? What do you think happened? We'll come back to that.

The Longevity of Trends and Its Role in Ecommerce

If you think you can predict trends, then I applaud you, because I'll be the first to admit that I cannot. I would never ever guess that a Twilight fan fiction softcore eBook that sold for $1.99 on Amazon could go on to be a world wide phenomenon. If you told me fat Korean guy in horse pants would be the most watched video on YouTube, I would have rolled my eyes. I suck at spotting trends. That's why I use all the data than I can.

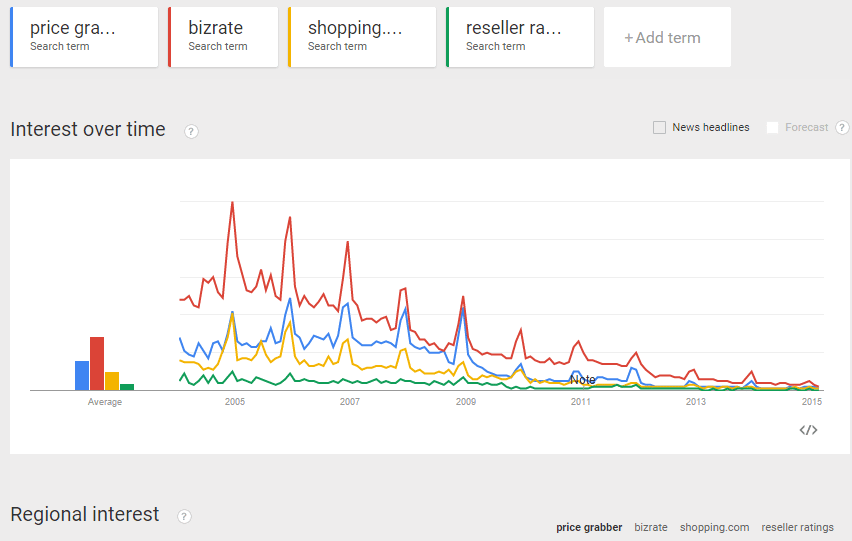

For example, a lot of web veterans are probably aware of price crawlers like Price Grabber or BizRate. Lots of retailers had great success utilizing these platforms to push their products. That means you should have great success too, right?

For about 5 years, these sites were probably killing it in their niche and someone is going to swear to you that it's been their modus operandi for success forever. This is the same guy that is explaining how to be rich, who is also peddling you a $19 eBook on how to be rich. See the dichotomy here?

This is not some sleight against Price Grabber. This is myth busting the idea that ecommerce is magically steady and consistent cash flow enterprise. If anything, ecommerce is more vulnerable to trends than a traditional business.

“Ecommerce is more vulnerable to trends than a traditional business.”

One of the main vulnerabilities that an ecommerce company faces is that you are literally at the whim of Google and the other search engines. As a franchise owner, when I wake up in the morning, I can be assured that unless there was a natural disaster or it's Christmas, people are coming to my store today. As an ecommerce owner, when I wake up in the morning, I hope to god that I didn't fall off the face of the planet in my search rankings. Me and all of my competitors, that is.

So while a frozen yogurt owner has to worry about froyo no longer being hip, an ecommerce owner like Mike and I have to worry that Google suddenly doesn't like “X”, whatever the heck “X” is. I've been doing this over a decade, so let me give you a true, from the trenches, of what “X” has meant over the years:

- Links from “unrelated” websites

- Paying for links

- Getting too many links aka Being Too Popular

- Linking to the “wrong people”

- Linking back to people linking to you

- Links from directories

- Being paid for links but not disclosing said paid links

- Linking at the bottom of your page

- Linking from the side of your page

- Putting too many keywords inside a link pointed to your page

- Not having fresh content

- Having fresh content, that isn't good

- Having good content, that nobody shares

- Having good content that is shared by everyone, except Kanye West

The last bit is facetious, of course, but it highlights the madness of trying to appease an ever changing game of rules that is set by Google. In this “game” however, the rules aren't published and when they change, you often find out when you wake up to your revenues being cut at the knees because Google decided their algorithm needed changing. And this shift happens about every 18 months if history is a good indicator.

Want even more fun? Remember that time when people used a search engine other than Google? What was that site called, Yahoo or something? While I don't believe Google is going to be knocked out anytime soon, I also don't think anyone at Microsoft thought Apple and it's little iPod MP3 player would come back to dominate the computer market. Technology changes, fast.

“Grant, seriously, I get it, things change. Who stole my cheese, great book, you don't have to repeat it to me.”

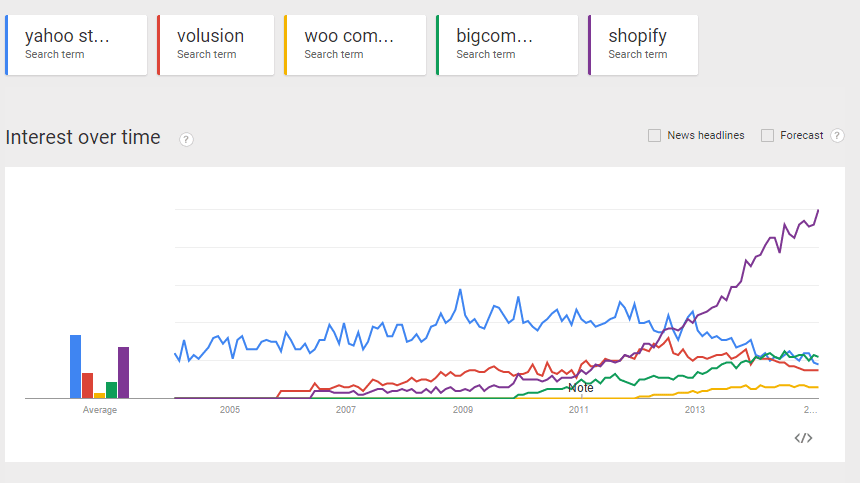

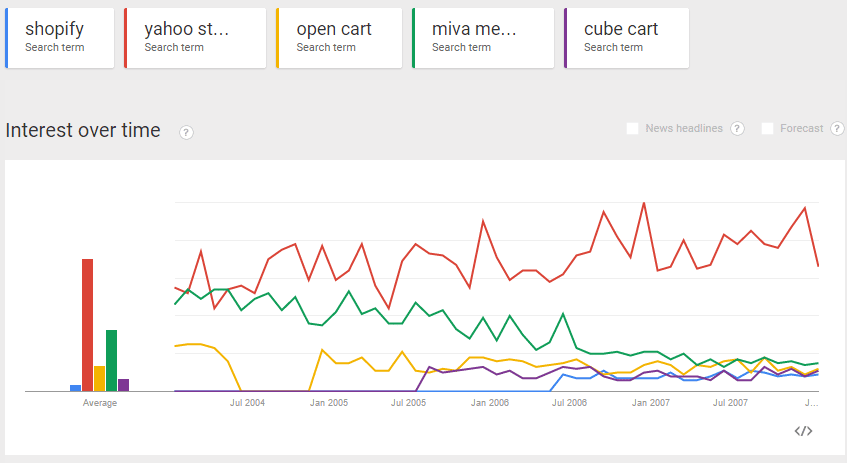

Are you sure about that? Let's examine the utmost basic question of ecommerce: what platform are you going to use to sell? Volusion, 3D Cart, Magento, BigCommerce, Shopify? Do you have any idea which one is going to have a plugin for the next big marketplace or accounting software, let alone survive the next technology shift? If you don't, you're going to be in for a bad time. Let's take a look:

This is a graph of major players on the ecommerce cart business. I listed Shopify twice as context, since they are the most popular. Now if you had not looked at this graph and wanted to make a decision, you could have potentially had 10 (and realistically more) choices to chose from while researching which cart to use. Let's say you had a nice chat with a web studio and they insisted you use Yahoo stores because they know it inside and out. You then spend a few thousand bucks for a design, a few thousand for a coder and otherwise invest in your website. Things are going good, then Yahoo announces one day they're going to upgrade to the next version of their store and phase out all old stores. Too unrealistic? Tell that to the 11,000 Magento Go store owners who were told their stores were going to be deactivated in seven months by parent company eBay, because they wanted to refocus.

Easy choice then, don't use Yahoo, just use Shopify since they're the biggest, right?

That's the exact same line of thinking someone probably had around 2007-2008 when they decided to build a high-tech Yahoo store and poured money into PriceGrabber. Just one year later, Magento would completely surpass Yahoo, then two years later, Volusion and Shopify (among others) would begin the ascent to eventually take over Yahoo. If you plan on selling trinkets and lamp shades, it probably won't matter what ecommerce platform you plan to use. But if you have goals of moving to a mid-sized business that is selling on omni-channels and having the latest and greatest plugins and tools available to you, chances are you will be completely out of luck on half of these carts in about 3 – 5 years.

For Mike and myself, 3 to 5 years in the technology industry is a millenia, because we know how fast things change. In brick and mortar, you're lucky to get recoup to cost of your investment in 3 to 5 depending on the business model. Gasoline stations and big name franchises can be upwards of a 7x multiple to purchase. Small stores, restaurants and new franchises will usually hover between a 2x to 4x multiple, depending on how much sweat equity the owner has to put in. Yet when you look at most ecommerce businesses for sale, many of the listings are asking for a 2x – 4x multiple. Ponder about that for a second: what are the risks of purchasing an ecommerce store when technology shifts at a 5 to 7 year cycle. What are the implications when you're buying at a 4x or (gulp) higher multiple?

Let's take a look at some live ecommerce business listings pulled from today.

Analysis of Couponing Business

Couponing is a phenomenon that took the internet community by storm a few years ago, probably through sewing clubs and at home moms with lots of free time, a need to save money and the glee of getting stuff for pennies on the dollar. TLC even came out with a TV show dedicated to the topic and would follow ladies with shopping carts full of diapers, toilet paper, cans of food and supermarket clerks pretending to be happy by the reams of coupons being dumped in their face. Niche blog sites that were part of the social trend became giants that would even be courted by the retailers and as you see, make enough money that the owners of said sites trying to save pennies were the ones making out.

From our trusty trends graph, we see that couponing had a spike in popularity around 2011, then petered off rapidly. Why? Because for all the hoopla around couponing, big businesses decided that enough was enough and clamped down on their coupon policies right around the middle of 2011. While couponing still exists, a cursory glace at the blogs and sites that are still active give the indication that the bonanza deals that were once commonplace have been replaced by mundane deals of $10 to $20 off a total cart. This was a trend that was on the verge of blowing up, but was then tamped down and controlled by the forces that be. So when I see a listing selling couponing sites, it makes me leery of trying to buy a business that is not in a growing industry.

While it's possible that it might be “mature” in consistent cash flow over the last few years, you are almost guaranteed a cap on your return and limited upside, with much potential downside. At a 2.5x valuation, I am essentially gambling that in in 2017, whatever is left of the couponing industry will still be consistent and that I will not have dropped in rankings, traffic or margins in order to recoup my original investment. While these sites are generating revenue via adsense (or so claimed in the posting), it's certainly not a passive money machine either. I've got to spend cash on SEO, content, social marketing and other facets that are going to take up a lot of my time. Spread out over 18(!) sites, I have to imagine that this owner is using very thin or similar content across the entire network to keep things under control.

Without looking at the actual site themselves, jumping onto the end of any fresh down trend seems like a highly risky decision.

Analysis of Electronic Cigarette Businesses

Unless you're a hermit, you'll have heard of the ecigarettes or ecig trend of electronic cigarettes that vaporize liquid filled with nicotine and often an assortment of flavors. Touted as “healthier” versions of cigarettes due to the lack of tar and other trace elements being burned and inhaled, electronic cigarettes have exploded in popularity. Whereas internet dealers and niche stores were the only sellers, I even stumbled across Blu (a leading brand that was acquired by Lorillard in 2012 for $135 million) in my local Costco. Let me tell you, when Costco is carrying your product, you can be assured that you do not have a distribution advantage. I was once part of a business that supplied poker chips and when I went to Costco and saw them selling an otherwise identical set of chips for $20 less than, that was my cue to get the hell out of dodge.

Another sign that you might want to turn tail and run, is when the FDA comes out and says something like this:

“We have an open investigation into this issue,” FDA spokeswoman Rita Chappelle tells WebMD. “What is happening right now is FDA has reviewed several e-cigarettes, e-cigars, and e-pipes, and have refused entry of these products into the country. We acted because these products appear to require FDA approval for marketing, and have not been reviewed by the agency.”

Early ecigarette sellers were importing liquids and devices from China in containers and selling for 500% markup, making a killing. But much like what I said with frozen yogurt, people talk and once word gets out that there's margins to be made, Big Tobacco came a knocking. With their established distribution channels, leverage and political clout, they are slowly working toward realizing their monopoly on the nicotine trade. Good for them, but what to do for your small time niche retailer? Sell sticks of Blu when Costco and every store on the corner has them for the same price and available immediately? What happens if 20 out of 50 states end up banning online sales of cigarettes? Or worse, a federal level law comes down? Is the seller of this business going to provide a 40% discount on the possibility that you'll end up with zero sales? While the trend is still strong, the acceleration has fallen off and the trend is now flat or even decreasing.

At a 3.0x valuation for the first listing, this business seems incredibly stretched, although with $925,000 in revenues, it's possible that this business is selling their own devices or has some sort of niche in high end products that aren't readily obtainable. That would be the only type of saving grace in this industry, because there's nothing, and I mean nothing from stopping every single vape or ecigarette store out there from slapping together a Shopify store and selling the exact same product as everyone else.

The second listing is far more reasonable at a 2.2x valuation, although it is also a retail location and internet location combined. At that cash flow though, it's known as a “why bother” because if you'll be paid $56,000 and working a full time job, you might as well try to find a job that pays similar that doesn't require a $125,000 upfront investment. For that risk to reward ratio, you're better off not competing with Costco and pushing their carts for $18/hr and making a guaranteed $36,000 with benefits. At least Congress won't regulate cart pushers!

Analysis of Paintball Website

Last but not least, let's talk about the dropship paintball business. Paintball is an extreme sport played often by bachelors at parties, corporate outings or just grown men with an affinity to inflict pain on their fellow man. This trend graph shows that paintball has been on a steady decline over the years and paintball fields and arenas have been slowly shuttering over the country. Field owners and players have lamented the fact that regulars are still interested in the game, but casual players (the bread and butter) have all but vanished. Why people have grown disinterested is often debated, but at the end of the day, never discount that humans are fickle and enjoy novelty. I mean, why pay $100 to run in mud and get shot at, when you can get electrocuted and burnt instead for the same price?

The interesting thing with paintball is that while its popularity has dropped significantly from its highs, the rate of decline is slowing. A sharp drop-off would be highly unexpected because this is a mature industry that is over 10 years old. Coupled with the fact that this business is selling at a 2.0x valuation on the nose, the risk level is far lower than the other businesses above just on that factor alone. I don't have the details of the business of course, but I have to imagine that much of the industry has consolidated over the last few years so that the remaining sellers offer either distinct services, have a loyal following or posses some type of competitive advantage that separates them from the likes of Amazon or Wal-Mart.

In a true twist of the absurd, there's an inflection point at which a decrease in popularity actually helps, because shelf space is expensive and if a retailer pulls out, that's a huge competitor that an ecommerce site no longer needs to worry about. While most people are enamored with the idea of buying the shiniest and newest business, there is a certain degree of risk-mitigation when buying into an industry that has consolidated.

Which leads me to….

Froyo: The Third Act and Final(?) Act

Unfortunately, the story of a trend often ends in tragedy. As of time of this writing, there are 394 yogurt businesses listed for sale on BizBuySell, the vast majority of which are under $200,000 and in reality, half of which look like asset sales.

This sample of frozen yogurt store listings is collateral damage on the scale of which has not been seen in a long time. People put real money into these businesses; into yogurt machines, leases, employees, plus their own sweat equity. There's no way that anyone will be able to tell me that the majority of these people didn't work hard either. As a business owner, you fight for your business almost like you would your own child, because often, that is what is at stake. So seeing this type of loss is never easy.

My business partner that pulled the trigger? They sold their name brand franchise, at a loss.

Total start-up cost: $400,000.

Sale price: $80,000.

Me? I narrowly avoided that disaster, though I'm not about to toot my horn on it. There is no joy in this story, only a cautionary tale. Ironically, if you asked me now if I would buy a frozen yogurt store, I think it's a far safer bet than it was years ago. Why? Because the industry is in the throes of a massive consolidation. Weak players that are trying to liquidate or exit will eventually close or find even weaker buyers that will then close. Owners that are sitting on adequate cash reserves will likely be able to sit through the storm and remaining standing when the dust has cleared. Once that happens, they'll soak up the remaining sales from the closed stores and regain much of their original territory back.

In fact, remember those three stores on a single street? This time, I had a real inside line (not just the club gossip) that informed me that all three were for sale. Each was looking just shy of a six-figure offer and grossing around the mid-six figures range. In my head, the answer was that three stores in competition were barely profitable, but one store would be highly profitable. I would need to negotiate the purchase of one store and financially persuade the last two owners to close in order to make a viable business. Alas, I was a bit late when I called the broker, as someone had already put down a letter of intent for the full list price of one of the stores.

Either this guy had the exact same idea that I did and wanted to execute fast and hard… or it's the continuing story of not understanding trends in business.

To recap this post, here is what I hope you took away:

- If you don't understand the trend, you have no business being involved

- Trends tend not to repeat, but history does

- Ask yourself honestly – do you really have a competitive advantage?

- Be able to identify the forces outside of your control which are an existential threat to your business

- If you're buying a high risk business, you do not want to pay a high valuation premium

- Technology is inherently risky

- Don't bet your home

What do you think is the latest trend that is going to flame out? Or better, what do you think will outlast the fad and stick around? We would love to bounce ideas with you!

Fantastic article. Great information and perspective there, saving folks time and money!

Grant, what do think of a “smoothie vending machine” that serves 16 ounce smoothies made from 100% real fruit pure’e with no sugar added, non-GMO and gluten free for $5 with no water connection or on site refrigeration storage required? I cannot find any competition so far.

Valerie scroll up.

I was around when froyo was big the first time i.e. TCBY and saw it crash and burn after everyone jumped on the bandwagon. I suppose that’s why I figured it wouldn’t last this time either. Besides it’s a crappy product I have regretted spending my money on each time someone dragged me into one of these places. I understand that it’s a kid thing with all the toppings, but I never understood why any adult would prefer it over custard or gelato.

What are your thoughts on the new Fro-yo Bots that have come out? Still not worth the risk and investment?

Grant how do you feel about the Froyo robot/kiosk? Looks like from what franchising info I could find its about 140k investment for 4 machines. It also sounds like this company takes care of negotiating with businesses to get your machine in a high traffic location.

Look, there’s 3 of you guys asking about Froyo robots in the span of a month. That alone should tell you this is a bad idea. It doesn’t matter if robots are serving froyo. It cuts down labor cost, but you still have everything else to worry about, including top line. If some other guy is going to price war with you because his labor % is down, then what are you going to do?

Besides, I could buy a warehouse of Froyo machines at pennies on the dollar right now due to all the bankruptcies. If you’re paying a 140k startup for machines, you’re probably doing it wrong.

Location is the only thing that matters for Froyo.

Hey Grant,

I’m new to all of this and trying create multiple streams of income. What are your thoughts on the Froyo Robot?

Great post!

Hey Grant,

Very eye-opening post. I am novice business learner (I made that whole phrase up), but I am looking to start a Fro-Yo company with a twist in Texas. Thank you for the take-aways. I would love to learn more about trends. Any book recommendations?

Kareem, while I am always the person to say “Go do it!” for a business idea, I would in my most serious possible internet voice, ask that you reconsider your froyo idea. There are many value buys at this moment in the froyo space, but I’ve never seen normalized profits beyond anything that would make it scalable. In other words, vast majority of froyo owners have bought themselves a job. The good ones with solid locations aren’t for sale or are going to be at standard multiples.

As for book recommendations, probably the Nolo Guide to Buying a business or any other Small Business finance 101 type books. That stuff is teachable. Trend spotting and predicing, while some tools exist like I’ve used in the post, is going to be the stuff that separates the elite minds from the norm and isn’t exactly teachable. Either you are a natural at spotting trends or you aren’t. I’m no means a natural and I rely on the hard data.

Hi Grant – what do you think is a good multiple of SDE for a froyo shop in Northern California?

Adam, I have to reply with a similar question: how valuable is a home in Northern California?

There’s a ton of unknown factors here that it would be a total stab in the dark. What are sales trending? Does the location have a lot of foot traffic? How is the competition? Is there management in place? What is your rent ratio? How many years are left in your lease? What is the renewal option? Is it a franchise?

Two shops in Sacramento a mile apart could have a world of difference so honestly if you have to ask, maybe you should be doing a lot more research first.

Great post.

The gold rush made pick and axe manufacturers rich.

Who gets rich on the Froyo boom? Froyo equipment manufacturers?

Who gets rich on the cannabis sales boom? ____________

I can see stores selling cannabis in WA following the same Froyo path. They’re everywhere right now….can’t be sustainable.

The Froyo boom came and went, you can’t predict that very well and it’ll be too late to start in most cases. But in states where business/progress is determined by legislation, you can make decisions based on how it went for other states. Can the cannabis sales boom be *predicted* as it progresses through all 50 states? Can we expect other states to behave as similar as WA/CO have regarding sales and booming? Figure out what cannabis stores are buying for store setup costs and make sure you’re ready to strike when legislation passes in the next state.

Thanks Zach. You’re spot on the money on who really made the money during the booms- it’s always the guys selling the dream.

In Washington, I believe many of the stores can’t accept credit card payments due to the federal law against marijuana. The banks won’t process it, so the vendors are left accepting cash or alternate forms. It makes me wonder if a dispensary would start accepting BitCoins or people are willing to use a direct bank-to-bank wallet transfer service in lieu of credit cards. I’m sure the merchant would be more than happy to not pay the fees so long as these transactions are black listed.

Grant,

Another great post. You & Mike are truly hitting it out of the ballpark with this blog. Very detailed, well thought out, helpful blog posts. This blog has quickly gone to the top of my must reads.