E197: Predictions for the Future – State of the Merchant Report with Andrew Youderian

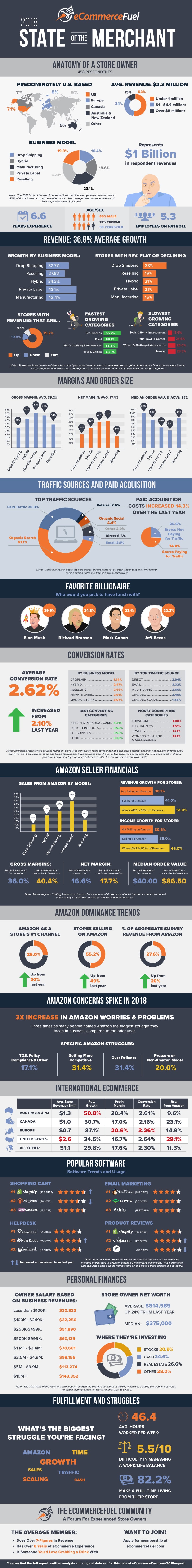

Every year Andrew Youderian of EcommerceFuel surveys hundreds of store owners to better understand the trends in the ecommerce industry.

Today Andrew and I review the report of last year's survey and make predictions for the future of ecommerce based on this data.

If you're also an ecommerce store owner, we'd like to invite you to help us better understand the ecommerce landscape by answering next year's survey.

Why participate?

Andrew is shamelessly bribing you and me to participate in the survey–called State of the Merchant–by giving one lucky participant a roundtrip plane ticket to anywhere in the world. Last year's winner used his ticket for an epic 15 day, 6 country trip to Europe.

More importantly though, you'll be participating in a research that's not done anywhere else. Your participation will give us a much clearer insight into what really goes on in the ecommerce jungle.

Predictions for the future

Below are predictions, some pretty bold, about the future of ecommerce based on this year's State of the Merchant data:

- Amazon will lose its spot as the number 1 go-to place for online shopping

- Facebook ads will get more expensive as more and more users leave the platform

- Conversion rate for dropshipping will decrease

- UPS and FedEx will offer Sunday deliveries for Amazon

- Amazon will launch their own delivery service to rival UPS and FedEx

- There will be a major legislation about sales tax

Full Report

You can view the full report in the infographic below.

Click here to participate in next year's State of the Merchant Survey.

Thanks for listening to this episode! Until the next one, happy selling.

Full Audio Transcript

Intro: This is Mike, and welcome to episode number 197 of the EcomCrew Podcast. Hope you guys are doing well today out there in podcast land. Today we're going to be talking to my good buddy Andrew Youderian from Ecommerce Fuel forums. It's a private community for six and seven, and eight figure store owners. There's some eight figure store owners on their now which is really cool. He runs also a live event once a year and an amazing podcast. You should go check out Ecommerce Fuel. Today we're going to be talking about the State of the Merchant survey that Andrew started a couple of years ago, maybe three years ago now.

So it's become this thing that a lot of ecommerce insiders look forward to seeing every year. We're going to be talking a lot about last year's results, talking about how you can participate in this year’s survey making some predictions for 2019 as well. I think if you're already an ecommerce store, even if you're not, you'll find a lot of the information in here really interesting. At least if you're a numbers guy like me, and an analytical guy, talking about conversion rates, and how much of the percentage of business is typically someone using Amazon, and how much people find Amazon frustrating or how much businesses are selling internationally, and which platforms they're on, all kinds of other stuff that are part of the State of the Merchant.

So before we get into that, I do want to make a quick plug about EcomCrew Premium real quick. Just another reminder that EcomCrew Premium will be reopening over the Black Friday, Cyber Monday timeframe, and it will be the last time of 2018 that we're going to be launching EcomCrew premium. So, definitely go over to EcomCrew Premium, which is EcomCrew.com/premium to get on the waitlist. Again, there's no obligation to get on the waitlist. And if you're not at a point where you feel like you're ready to pay for the premium service, go check out EcomCrew.com/free and sign up for all of our free information which is available to anyone with no commitment, no credit card or anything like that. All right, let's get into the intro and start talking to Andrew about the State of the Merchant.

Mike: Hey, Andrew. Welcome back to the EcomCrew Podcast.

Andrew: Hey, thanks for having me on Mike.

Mike: It's take two. We won't talk about the first take. But I want to tell people just little bit about you for those of you don't know, who don't listen to the EcomCrew Podcast much. But we are fan boys of Ecommerce Fuel forums. It's a community that I've been a part of since basically the beginning of my ecommerce journey and it's helped me so much. And one of the things that you do that I really want to talk about today, I'm so thankful that you came on to talk about this is the Ecommerce Fuel State of the Merchant survey that you guys put out every year. And it's time to do that again.

But I just want to take a quick second to mention, we've been talking about SEO a lot internally, and also as a part of our community. And this is the type of stuff that you want to be doing. So I would definitely encourage you to go check out Ecommerce Fuel State of the Merchant report. The last year's report is out; the new one will be coming out soon. But if you're writing content that everyone in the space is talking about, that's the type of content I think that it takes these days to really rank and to do well. And I'm sure that this type of report generates tons of back links for you and those types of things.

But I don't want to get too off topic on that. Someday we can maybe do an SEO discussion about that. But before digging into this too much, let's tell people where they can go sign up to participate in it because I'm hoping that people after they listen to this episode are going to want to go sign up — not really sign up, at least filling out a survey. So how do they do that?

Andrew: Yeah, thanks. So if you're listening and you own or you run an ecommerce store, that's really who this kind of the study is targeted around. And why should you go, if you listening to this, why should you spend time to go find survey and fill it out? I'd say two reasons. The first one is I'm going to shamelessly bribe you with a shot at winning a round trip ticket anywhere in the world. So last year, the winner Brand Maggard, he went to Europe, went to like six or seven countries and came back all on my dime. So that's the first reason.

The second reason is it's data and research that isn't getting done a lot of other places for merchants in that seven figure range. So a long way of saying I would love to have you involved in the best way to get is to head on over to it and fill out the — participate in the study is Ecommercefuel.com/2019. That'll take you to the page to get involved.

Mike: Excellent. And I think what I'd like to do with a good chunk of this episode here is dig into some of the stats that come out of this. So, what do you think, starting at a high level or starting with some of the individual stats?

Andrew: Yeah, we need to start at a high level and if you want, we can maybe just work our way straight down. There's a big infographic. I don't know if that works for you. But we can maybe work our way down the infographic and talk about things as they make sense to you Mike.

Mike: Yeah, absolutely. I actually had that in front of me here. So let's talk about things on high level. I mean, just talk about where things were in 2018 and maybe through those we can predict some of the puzzle where 2019 might fall out.

Andrew: So at a high level, we track a bunch of different things Mike. You look at the store owners, and more than two thirds are US based, average revenues, a little over 2 million, pretty even mix of models, from drop shipping to manufacturing, to private label to strictly selling. And so that's kind of the anatomy of a store owner. And if you look at the revenue growth last year, on average, people grew about 37% year over year, which is pretty phenomenal for a group this size. So that's cool. If you look at margins, average gross margins, about 39%, net margins about 17 and a half percent. And we look at things like traffic sources. The most popular, the top traffic source for most people, which this has always surprised me, I keep thinking this is going to change over the paid traffic. But it's organic search by a pretty wide margin, with paid traffic coming in the second place, but quite a ways behind.

Paid traffic went up quite a bit last year, about 14% year over year. The average conversion rate is about a little over two and a half 2.62%. And Amazon last year, like you would probably expect, really saw a ton of growth. So, the number of people that listed Amazon as their number one channel was more than 25%, 26%, more than a quarter of stores depend on Amazon as their number one channel. And that grew from the previous year. More than half of stores that we surveyed sell on Amazon, 55%. And the percent of revenue that stores are seeing from Amazon was also up 20% year over year. We also saw a huge increase in the number of people complaining about Amazon being a real pain this year, compared to the year before.

Mike: That's how you know that I took the survey.

Andrew: We noticed that you filled it out like 20 times. I know you tried to get that free ticket and keep on Amazon. But yeah, so those were some of the — we can talk about some software trends if you want as well, or maybe some international stats. But at a high level, those are some of the big numbers that stood out from last year.

Mike: Cool. Yeah. So let's break down a couple of things. I'm kind of curious what you see happening here moving forward and where we've come from. Let's talk about the drop shipping thing first because you made a name for yourself, obviously, as a drop shipper and had a great business doing that. And I did some drop shipping as well. I didn't have as good of an experience as you. But I think that if you have a more defensible content site and a community, etc, that you can still survive in that space versus if you're just shipping commodity type products where everyone else is kind of selling them and you don't have a good content add, it's just going to become more and more difficult. But what have you seen as far as the trend line goes here because it looks like 16.4% of businesses were drop shipping in 2018. Is that up or down from 2017, and where do you think it's going in 2019?

Andrew: I think it was maybe down a touch from the year before but not by much. But I would suspect, the trend line is definitely down a little bit modestly. But I think we're going to see that continue to go down if not accelerate. It's just getting so much harder to do this. Like you said, I mean, there are some niches that you can make this work in 2018 Still if you've got a — maybe you've got exclusive agreements with suppliers, maybe you've got a world class informational site, you can make it work, but it's just so, it's just difficult. And so, I would be surprised if we did not see anything but a drop in terms of the number of drop shippers that are reporting on the survey this year.

Mike: Yeah, I think it's probably heading the same way. And the one that I think that's going to go up here as a part of this pie is probably the private label thing. It just seems like whenever you're on Facebook, and you're being inundated with how to sell private label products, that it's probably going to continue to grow. At some point, it'll have a spectacular demise, I think. But I still think that that category is growing.

Andrew: Yeah, do you think manufacturing grew up? Because I mean, pure manufacturing, when you're creating your own proprietary stuff is most defensible. It's also the most difficult to do. So what do you think Mike? Like I would predict, probably it will probably increase a touch, maybe not crazy quickly. But thoughts there on what will happen with that next year?

Mike: Yeah, I see that going up as well. And I can tell you firsthand, the thing that's on my mind more than anything these days is building defensible products. I think that that is the future of at least us in ecommerce. And there's always going to be other people out there that are doing their own thing. But I like defensible business models where I don't have to focus or worry about people just straight up copying everything that we're doing, or the barrier to entry, at least for that would be much higher. So I think that other people get that. And I do think if there's a couple of things on this pie that shrink, inevitably, something else has to grow. So, I do see that continue to grow, but probably not as quick as private label because it is definitely more difficult.

Andrew: Yeah, makes sense.

Mike: Cool. So let's talk about a couple of these other stats that you mentioned. One of them I kind of interrupted you, I apologize, but the people having problems with Amazon and how quickly Amazon is growing as a part of percentage of business. So what were those numbers and let's kind of discuss those real quick.

Andrew: Yeah, so if you look at the Amazon numbers especially on the growth side, Amazon as a store's number one channel, 26% of the people that reported said Amazon was their number one channel meaning that was the top channel that they sold through. And that was up 20% from the year before. So definitely seeing a lot more people depending on Amazon, stores selling on Amazon, over half of them did, 2017 report was 49% up to 55% in 2018. And I think the one that's most telling is the percent of aggregate revenue from Amazon. So, not just much about what percentage of your revenue mix comes from Amazon versus say from your own store or maybe from third party marketplaces, Jet, eBay, and things like. That was 27.5% and also up from the previous year.

So I on these Mike, I’ll throw a couple of predictions out, interested to hear your take especially given you have much more firsthand experience than I do with Amazon. But I think we'll definitely see more people list Amazon as their number one channel. So the people that are selling on Amazon I think they're going to — pretty safe bet to say they're going to see Amazon making more of their revenue percentage. I'm going to kind of go out on a bold prediction here and say that the stores selling on Amazon, I would be surprised if we — I'm going to say we're going to see probably it stay about the same, maybe even drop little bit, and pretty bold because I could be very wrong here.

But I've seen from a trend starting last year with that just really steep increase in people complaining about it to this year where I feel like it's getting a lot noisier. It's getting really difficult and a lot of the hassles with Amazon are becoming more widespread, more widely reported. And I feel like I've heard a lot of people even saying like, hey, I'm going to take a break from Amazon, or I'm not even going to go. We had a thread in the forums…

Mike: I was actually in that thread. It's an amazing thread.

Andrew: Yeah, where the person was just like, hey, I have a great business, should I go list on Amazon? And a lot of people were like, no, don't do it. So, I would be totally probably be wrong here. But I think there is a very good chance we see that stay flat or decrease. But yeah, what do you think Mike?

Mike: So I think in 2019, we're going to see people's percentage of their sales from Amazon increase. I think the number of sellers are going to increase, and I think that the number of people reporting that Amazon is their number one source of income is going to increase, which is not a bold prediction. It's the — I think it's going to stay on this same trajectory. Now, the bold prediction — it's interesting you made this bold prediction. My bold prediction is similar to yours but I think it's a little bit further out. And I think that — I actually think that Amazon will lose its dominance as the number one marketplace at some point. And I think that's more of like a three to five year timeline.

But you see this happen in history over and over again as these big dominant companies just get this all around them of like, we're number one, you can't touch us, the arrogance level increases. So, the way that they treat all of their partners, their customers, etc. And typically what ends up happening is the court of public opinion shifts at some point. And you kind of saw what happened, I think it was a big driver of why Amazon raised their minimum wage, and they were able to do that relatively quickly and get ahead of that story and move on.

But what happens when stories come out about how they've destroyed businesses, destroyed small business owners, and stuff for like the practices that they do with some of the things where they shut down accounts unfairly or listings without throwing caution to the wind, without you're guilty until proven innocent kind of on Amazon. I think that will continue to squeeze sellers with the fees and stuff that they charge. And I think at some point, the natives get restless kind of thing. And there'll be some revolt to that and could potentially knock them off that top peg.

And I think one of the first signs of this is Amazon always used to be the cheapest place to buy online, that was kind of their thing. But that isn't really the case anymore. And so people are starting to look elsewhere already for better pricing and stuff like that. And I think, I don't know, I think it can happen quickly. I think that it's hard to predict what will be the trigger point. But I do think everything is cyclical. I don't think Amazon; 100 years from now will still be the King of the Mountain. Sears just went bankrupt. They probably felt the same way at one time. And it's hard to — if you talk to my grandparents, it would be like hard for them to imagine a situation where Sears didn't exist. And I can see something like that happening to Amazon where like, they just get too big for their britches.

Andrew: Yeah, that's interesting. And I think you're right, Mike. I would say probably, I would probably put that out further than three to five years, I would maybe say 10 plus years. But I do think an interesting one to look at, maybe more in the short term is looking at Facebook. I feel like I’ve started to see more and more of my friends — and I'm not young, I'm 35 years old. But more and more of my friends start to just not be on Facebook. They just took off their account or they moved on to something else. And you look at the generation millennials, especially in their 20s, a lot of them don't even have Facebook accounts or closed to down in favor of other platforms.

So I see that some signs with Facebook of that platform, one of those big four, if you kind of follow Scott Galloway and that kind of he lumps them together. I would say Facebook is probably the most likely to succumb to losing their number one purchase in their respective field. But I agree with you, I think on Amazon's front, I think it'll happen too. I think if I to bet though I would probably say that would be more of a five to 10 or even touch longer than three to five.

Mike: But if it was 10 years like you, then it wouldn't be a bold prediction like mine was.

Andrew: Good point, good point.

Mike: So talking about Facebook, I think that's a good segue into maybe some advertising stats. Are there any advertising stats to glean from in here as far as paid traffic and things like that?

Andrew: Yeah. And so the two ones and I did more this year in terms of one thing that I was really curious about was return on ad spend. And that's a new stat for this year, as opposed to what I asked last year. One thing that kind of little sidebar, all these things we ask, everything is anonymous. And you can still enter the contest for that international plane ticket anonymously. So obviously, a lot of sensitive data here, we give you the ability to be part of the survey without giving up your store, so just a little sidebar there.

But yeah, in terms of the paid traffic and acquisition, the biggest thing we tracked last year was just the increase in acquisition costs. And year over year, we broke it down, a quarter of stores were not paying for traffic at all, they were doing completely organic. And about three quarters of stores were paying for traffic. And they reported that year over year; CPAs and advertising costs went up about 14%. So, if I had to bet this year, I would say definitely CPAs are up, and I'm going to say they're up even more than 14% on average. I would guess more to the like the high teens to low 20s range for what we've seen year over year as a guess. Mike, what do you say from someone who buys a lot of traffic?

Mike: Yeah, I mean, it's a little unfair for me to answer this because I do buy a lot and I'm also in a group with a lot of other people that buy a lot. So I feel like I have my finger on the pulse of this pretty well. And without a doubt the prices are going up. I think it's a combination of, you hit the nail right on the head earlier, there are people that are leaving Facebook, and Facebook being a public company had to disclose this the first time ever, they had a decrease in subscriber rate. I'm one of them. Like, I still use Facebook every day for business. I think it's an incredible tool for us. It's the most amazing way to advertise in the history of the world.

But on the personal side, there's a lot of studies that talk about how the more you use social media like the more miserable you're, you’re only showing that the happy thing is on social media. So you're in this world where you're seeing everyone else be happy about things all the time. But that's not really the reality. And people also go out of their way to do things that they wouldn't normally do, they post on social media. It also has a tendency to make you want to compare yourself to other people, all really bad things that end up happening from a psychological standpoint. And even though I think I'm pretty strong minded when it comes to that stuff, when I started thinking about it and being honest, I realized I was sucked into some of that.

So I didn't close my Facebook account, like some of my friends just completely got rid of it but I spend very little time on it. And I haven't personally posted anything on there. And it's been six months or a year; I forgot how long it's been. It's been quite a long time. So I think that if the trend — if more and more people feel that way and the trend heads that way, they're going to continue to lose more people, which is bad for supply and demand on the other side of my life on the on the business side, because that means that there's less eyeballs, but more and more people have figured out that Facebook advertising is like the Holy Grail.

And so there's more people vying for less eyeballs and that's not where you want to be as a business owner for sure. And so I've seen our costs go up, everyone else that I know as soon as their cost go up, I don't know of anyone that's decreased their cost over the last 12 months. So I think that that trend is going to continue.

Andrew: Yeah, it's a brilliant — I mean, Google AdWords I know works on the auction basis. And being much less familiar with the inner workings of Facebook ads, I believe it's an auction basis as well. But kind of not when you bid on, I guess you can do. Of course, you bid on the ads, correct me if I'm wrong, Mike. But it's such a brilliant model to do it that way because over time it allows the platforms just suck all of the excess margin out of — they're able to charge the maximum price for people competing until it just doesn't make sense anymore. So I mean it's a bummer for people going out there looking to buy profitable traffic over the long run. But it's a pretty brilliant model from a business standpoint.

Mike: Yeah, I mean, Facebook, that's the reason I own their stock. It's an incredible business model. And what people hadn't realized, I think, until more recently I think, which is why the trend of ads going up is that, like I said, I think it's the most amazing form of advertising in the history of the world. I mean, if you think about the old way of running an ad, you would run an ad on a night time TV show, on a sitcom or just on TV in general, or in a magazine. Whatever it would be, the vast majority of the audience that's watching that ad doesn't care about your ad.

It might be a car seller or a manufacturer but you might not be in a mood to buy a car at that moment. Or maybe it's for beer, but you're not a beer drinker. Or maybe it's a female kind of hygiene product or something, well, half the audience isn't watching is male, or vice versa, maybe it's shaving cream, or whatever it is, the vast majority of people that are looking at the ad, don't care about that product. But in Facebook, you can target it like hyper targeted to where basically, almost every single person looking at the ad is a potential customer of yours. Such a potential customer, they're like ready to — they can pull out their wallet and buy it like immediately. And obviously, it depends on the type of product.

But as an example, I can target people that have an interest in coloring books, and advertise to them a coloring book. And so, I'm not running an ad to people who just don't care or a tactical type product to someone who likes hiking or camping. I mean, so the hyper focused targeting is incredible. So you see these incredible results because of it, and it becomes infectious within your company and you want to spend more and do more with it. But the problem is, just like you were saying, it is an auction system. So, behind the scenes in a fraction of a microsecond, Facebook is putting up the ad that's getting done the most amount of money at that exact moment to that person.

So, if you got multiple people selling that type of product, or you have multiple products going to someone that — because everyone has more than one interest, the cost of that becomes higher. And there is a component where they're trying to look at conversions and stickiness of the ad like likes and shares and stuff, because they want to serve up stuff that people like. So they do give you kind of a multiplier for that where you have an ad that's performing well. It will cost you less, but everyone has that same multiplier.

So over time, as you were saying, it's like the perfect business model. It will shake itself out perfectly, probably to the point where businesses will be slightly losing money on cost of acquisition because there's always people that don't quite understand the full cost. So, the ultimate place that's going to end up at is like a negative percent or two or five or whatever return on ad spend. I think that that's kind of where things are going.

Andrew: Yeah. Do you want to talk about conversion rates at all Mike and dive into some of those kind of some of the sub segments there and get some predictions on those?

Mike: Sure. Yeah, I'd love to.

Andrew: Yeah, so one thing we looked at was conversion rates by business model. And it was interesting; it took a pretty expected breakdown in terms of what you would guess. But I'll just rattle these off for drop shippers. The average overall conversion rate was 2.62. But when you break that down by business type, it goes from 1.74 on the drop ship side, which is the easiest in terms of sourcing products to 3.07, close to doubling on the manufacturing side, which I thought was — I would have guessed they would have been bigger, but that was a pretty big jump.

And then traffic sources too. We looked at conversion rates by traffic sources where in terms of what people reported as their top traffic source. And direct was the number one in almost 4%, email unsurprisingly, came in at 3.32, paid traffic 2.66, organic was 2.4 and organic social was at the bottom of the heap with 1.5. But I thought it was interesting and maybe you can lead us to predictions. Any thoughts on conversion rates what we'll see this next year overall, and by channel?

Mike: Mm-hmm, that's a tough one. I don't know that there'll be too much of a shift here. I don't know, it's hard to imagine how the landscape will change too much here. I think that drop shipping conversion rates will probably continue to go down a little bit. I think that manufacturing private label probably will stay about the same. The reason I think the drop shipping one will drop is because there's more competition of the same thing constantly cropping up. I don't know that too many people are going to suddenly have an epiphany of I need to work on conversion rate optimization over last year. So, I don't know that'll change too much. But I think the reason that there's a disparity between the drop shipping model and the manufacturing model is the manufacturer probably has something unique that you can't find anywhere else.

Andrew: Sure.

Mike: And people will make less of a comparison shopping decision in that scenario, versus the drop shipper who's probably selling something that hundreds or thousands of other ecommerce stores are selling and they're just looking for the best price at that exact moment, and that's all they care about. And I think that the other interesting thing here to point out, I mean, these are the types of numbers that really shape my long term business decisions and reinforce the things that I've been thinking about. Because you see stuff like the manufacturing conversion rate being higher, you see things like direct being incredibly high, which is obvious, but also email, which you know that we're big email marketing people.

And so that it reinforces that you have to have something unique, something that's defensible, a crowd, an audience of people that are loyal and interested in what you're doing. And if you can build that crowd, you have them to email or market to, and you can do that over time. And it's much different than some of the other types of things. It's less pressure, it seems easier to me to be able to be in that lane. And it seems to be, again, the long term for me. So I don't really see much changing here, just kind of reinforcing making good business decisions moving forward and trying to be in those lanes that are going to continue to over perform the other industries.

Andrew: Yeah, it makes sense. Yeah, I'd say that I think the channel breakdown probably in terms of the differences between the different channels was going to stay pretty close to the same. I think overall, we had, I think if I did to guess that, they would see a slight drop, just because things are getting more competitive. Amazon is eating more into that margin, especially pronounced if people are drop shipping or reselling as opposed to, like you said, with manufacturing people have some little – it’s more defensible. So I hope not, but I wouldn't be surprised to see a slight drop here for this year.

Mike: Of the conversion rate just overall.

Andrew: Exactly yeah.

Mike: Cool. So let's talk about some high level macro stuff. I’m kind of curious where you see things going in 2019 and beyond.

Andrew: Yeah, I think so. It was fun; I did kind of a prediction episode of our podcast and had a few of these. So with your permission I hope you don't mind if I refer to a couple of them. But I think one thing on the marketing side we're talking about, we just got done talking about how CPAs are going up, a lot of existing marketing channels are getting more crowded and more expensive. And one channel that hasn't been tapped very much that I feel like has been kind of under the radar but I've seen from talking to a lot of merchants get decent results with, to great results, and seem to be talked about more recently is direct mail. So I think 2019, we're going to see direct mail have a pretty major resurgence.

Drew Sanocki just launched or just purchased rather a direct mail SaaS app that he's rolling out. And I think it's not a super crowded space. I think we might go full circle here all the way back to direct mail. So I could be wrong, but I think that's one of my predictions for the next year.

Mike: That's an interesting one. I mean people still obviously go to their mailbox. I mean but my mailbox is like so full of crap already. How do you stand out in that crowd?

Andrew: I would say because a lot of the direct mail that's going is retargeted stuff, imagine doing shopping cart abandonment, but with direct mail. And when most of the direct mail I get, not always, but a lot of times it's stuff that is not really timely. It's just mailers that go out; it's a catalog that I bought something from like four years ago. It's not timely, and it's not as interesting. But if you can get something — I look at almost everything, even if it's junk mail, I usually will look at it for three or four seconds before I toss it. And imagine being able to do that, get in front of somebody with something tactile they can hold in your hands for something that has a frequency associated with it. You were just on their website. I don't know, to me that seems like it's a little bit a level above just mass shooting people catalogs from L.L. Bean when somebody bought there four years ago.

Mike: Yeah, no, I think it makes a lot of sense. We actually did some postcard mailing. There was an app for Shopify that did this. It does it still; we just stopped doing because we weren't seeing the results. But maybe there's a more effective way of doing it. I'm excited to see where things go. What's another good prediction you have?

Andrew: Another prediction, I think we'll start seeing UPS or FedEx start offering Sunday delivery to Amazon at a normal or significantly cheaper prices than they do now. USPS offers Sunday delivery, and if you see one of those trucks post office truck rolling around on Sunday, then it's almost all the boxes in there if not all of them, almost all of them are all Amazon stuff. So it just — with everyone else trying to catch up with where Amazon is, I know that Wal-Mart is offering free two day shipping on just about everything now. I think Target is starting to do that too. With the ever increasing expectations of people just getting higher and higher, I'd be surprised if we didn't see that rollout maybe starting next year. But I'm surprised that Amazon hasn't negotiated with them to start seeing more of that from those two carriers.

Mike: Yeah, I definitely think Sunday deliveries are coming. Let me throw another prediction here of Amazon just like launching their own FedEx or UPS. What do you think the chances of that happening are?

Andrew: Yeah, that's a good question. So when you say that, they're obviously building out some of their own infrastructure, like the cargo planes, they've got the flex delivery kind of people that set up their own delivery things. So I think that's there. But do you mean more along the lines of like a full scale assault on like UPS with almost like an independent, like they do with AWS, you can rent the AWS infrastructure which they developed for their own, do you mean like a full on Amazon carrier that you could potentially walk into a store and ship something Amazon just like you could FedEx?

Mike: Yeah, I think I think that they're in a position to be able to do that. They've already kind of shown that they have a propensity of doing that exact kind of business model as you just laid out with AWS with like Fulfillment by Amazon, multi channel fulfillment, they built the whole infrastructure of warehousing around the country. They already have the backbone, as you mentioned, with the airplanes and they have some local delivery. I think that they've been USPS or UPS and probably the post office, but definitely UPS and FedEx like over the barrel to the point where they're probably losing money on the Amazon accounts.

But they do it to have the infrastructure to be able to make money on the other accounts. And if they were to basically drop them, UPS and FedEx would either go bankrupt, or go through a really difficult time of restructuring, have to raise their prices significantly to the rest of the world. And it could put Amazon in like really competitive advantage position. I don't know if like this would pass antitrust or any of these other things but it seems like Amazon is pleased to do this. And I could see them doing it within like, really within like the next two years.

Andrew: Yeah, that's an interesting one. And so I'll preface my answer with saying, this isn't something I've thought a ton about. And so I don't have a prediction. I’ve given a lot of thought to it and really confident about, not that you're comfortable about any predictions but my gut leans toward no, and here's why. If you're Amazon, obviously Amazon is, they can go after just about anything and have, but if you are Amazon right now, you've got these two massive giants who are competing against each other for your business that you can pit against each other for the business, right? And you also have the leverage of saying, hey, if we get into this space, we're going to pretty much drop one of you two guys, and you can get even more concessions.

You even mentioned that FedEx and UPS maybe even be doing this at a loss potentially to service Amazon. So why if you can get someone else to run a business for you at a loss that you need and you can get incredible pricing, you have incredible negotiation power, why would you get into that market for yourself? It's less messy. The other thing too is you think about things, the consumer aspect side. FBA, you're dealing with business customers, which are going to be a little more sophisticated than just straight consumers shipping a package.

AWS, you're dealing with technical people, you don't have to provide a lot of customer service there at least person to person. It's more scalable because it's all electronic. You get into shipping packages for Uncle Harry and Grandma Jane, that just — I mean, that's a different ballgame. So not to say Amazon doesn't do a great job with consumer support on the sales side with just retail, but I don't know, totally up for being wrong here. But for those reasons, I incline to think they might have reasons to leverage the existing infrastructure as opposed to build out their own on a full like form military assault style here.

Mike: Yeah, I think I should rephrase my assault kind of thing on that. I think it would just be as far as like, they would only do it for delivering their own packages. So it wouldn't be like, they open up Amazon, like UPS Store type things where people come and drop off their mail with their packages. I think it would be more just to service their own infrastructure delivering to their customers.

Andrew: I see. Okay, that makes a little more sense. And I would say, I think what would really push them over the edge is if they want to start, let's say, doing Sunday deliveries, or let's say they want to start doing drone stuff. Where they want to start delivering to customers in a way that FedEx and UPS as legacy carriers are not set up to do, then at that point, I think it makes a lot — it's a much more compelling case for them to say, okay, let's build out our own infrastructure to do something these guys can't, because that's a huge competitive advantage. But I don't know, with the existing infrastructure, I think there's a little — they've got a little more room to milk I would guess.

Mike: Yeah, and I think that your assessment is like dead on with if someone else is willing to do it under cost, why would you pay more basically do it yourself? That's actually a really good way to think about it.

Andrew: Yeah.

Mike: All right. Let's do — we're running out of time. Let's do one last prediction.

Andrew: One last prediction, I would say, does it have to be ecommerce related, they're going to be macro kind of just US 2019?

Mike: It’s just going to be like a Steve Chou prediction then.

Andrew: We’ll keep…

Mike: Okay, so it's not that.

Andrew: I’ll keep it ecommerce related. So I’ll do one, I think we're going to see, and this is a little more on the bold side, because I think I'll make the prediction that we're going to see debate on the floor of Congress, US Congress for a national sales tax bill by the end of the year. And a little bold because I think this is inevitable at some point, definitely within five years, very likely within three, pretty bold within one. But I'm going to throw it out there that we’ll at least see some major legislation introduced and hopefully vigorously debated in the Congress by the end of next year. So it's I mean, Mike this is something that we've talked a lot about. I think people probably know your stance on this pretty well, the sales tax debacle; the sales tax debacle is just a nightmare.

And we haven't seen the full pain I think of the rollout. I don't think states have started really sticking their claws out or taken advantage of the Supreme Court ruling. But I think that's going to start happening soon. And if we don't get some kind of national sales tax bill or some way to collect this at a high level and distribute it, it's just going to be an absolute nightmare.

Mike: Yeah. This is exactly why we started Online Merchants Guild, plug for that, go over to Onlinemerchantsguild.org and sign up to help support us fight some of these issues. I don't think it's going to happen next year. I want it to, trust me. I painfully really want that to happen next year. I think it's going to take the repercussions of what the states are trying to roll out, and the stories to filter through, have a significant number of business owners getting squeezed going out of business, just crying bloody murder. And I think that that's going to like states don't operate fast enough to be getting letters out and demand letters of you need to start filing or you lose this money for back taxes or whatever it might be. I think that that's going to take a little bit more time to develop. And I think it'll happen the following year because I do think that there'll be a mass outcry.

We looked at as a part of the Merchant Guild like going this route, this lobbying route and trying to push it that way and realized that we're probably going to have more success through the courts, which is something we're working on right now. I can't disclose exactly where we're at with that, but we're working towards that. But just because I have kind of an insider's perspective of trying to go that route, it's really difficult. It's hard to get lawmakers’ ears right now. I mean, unfortunately, the country is I think just in a bad spot.

This is lame but I do think that this is like one of these issues that isn't a red or a blue issue and should be easy to get through. But it doesn't seem like that's the way that things work right now and I think because that's going to take extra time as well. But hopefully by 2020, we can see a resolution of this because what I can say is that I don't believe that ecommerce can exist in the current way that sales tax is setup with the new reality that we're facing. I think that the reality is that it will cost you more to comply. I mean, if you're talking about the average store owner I think in your survey was 2 million, is that right? Is that the average…

Andrew: Yeah, just a touch over 2 million.

Mike: A touch over 2 million. I think that when you're at that size, like you're at the biggest possible disadvantage because you're just big enough that you're tripping these economic Nexus rules, like just tripping them. And then the cost to comply per state is quite high because it's not just the collection of sales tax that becomes the issue, but depending on the state, they demand filing with the Franchise Tax Board or business operation tax, or having a business license or whatever other stuff that we've been hearing about happening, and filling for income tax. And just the cost of filing one return per state is let's say $5,000, and that might be more than the profit that you're making in that state having the cost of comply.

So you end up in a situation where small people just have no chance. The $2 million store owner is in a spot where they literally have no chance. And I'd like to think that the United States would fix that problem because it's supposed to be a small business friendly country. And I think eventually, that'll shake out and come to light and it'll take a lot of outcry before it happens. I think it'll take some time before that comes to fruition unfortunately.

Andrew: Yeah, one of the interesting things, new for this year that we're tracking in the study is one, how many states do US sellers have Nexus in, and then how many states are they actually collecting sales tax in? So that's one thing, and the other thing too is how many — are you selling on Amazon FBA, and if so are you actually collecting sales tax for all the places you have FBA inventory? So, it'll be really interesting to see. Of course, there'll be a divide there and a pretty big gap. It'll just be interesting to see how big of a gap there is for this next year.

Mike: Yeah, excellent man. So just a reminder to everybody, it's — let me sure I get this right Ecommercefuel.com/2019 to go fill out the State of the Merchant survey. As a reminder it's completely anonymous. I've already filled it out. The questions that are on here this year, I think are provocative. I can see like where this is going because of something you've just mentioned the sales tax thing was a part of that this year that I remember wasn't there last year. I can't wait to see the results. We’ll get you back on to do a follow up when that comes out. Is that going to be in February or March when does that come out?

Andrew: Yeah. This will come out, so I'll probably wrap this up pretty quickly here, it will be Q1 2019 is when it will come out. And quick question for you Mike given you already filled it out, obviously a lot of stuff in there. You probably don't necessarily want to dive into given a lot of personal details, but one question I am curious about is the every year I put a funny question in, kind of a random crazy question. Last year is your favorite billionaire, and this year is what would you rather have? And there are four options, one, a 300k income for life you don't have to work for, secondly a private jet that you can use at your beck and call for your lifetime, third the ability to have a lunch date with anyone in the world, heads of states, famous musicians, anyone, once a month, or the fourth one your own private island 30 acres island with a gorgeous house, Mike which one did you pick?

Mike: Yeah, so I remember that I actually think I spent more time on this question in the survey because it got me thinking. I'm like really philosophical these days. I don't know what the hell is going on. But I actually don't remember, I was back and forth between the 300K and the private jet. And the reason I was like back and forth is I love to travel and being able to basically — a private jet is like 10, 20k a crack depending on like where you're going and how far it is. And I kind of already have the income thing figured out, so like just being able to fly from place to place in a private jet was really appealing.

But then having 300K and not having to worry about the money thing was another really appealing thing, and I honestly don't remember what I ended up selecting and I don't have any way of going back and looking out. But I was really torn between those two things. I was kind of thinking if someone were just to hand me 300K a year which is more than enough for us to live on in this minimalist lifestyle we've come in leading lately, but I enjoy making the money. So if I just kind of had that handed to me, I'm not sure that I would enjoy that as much as the private jet. So I think I might have picked the private jet.

Andrew: Interesting, interesting. Actually the one that I picked was a lunch meeting with someone once per month because those other three you can — those are things that if you bust your butt, you work you can buy, right. They may be expensive, but you can put a price tag on them. But to get — I mean to be able to just summon anyone to a lunch meeting once per month, you can't buy that.

Mike: Was that once per month? I thought it was just like a onetime thing.

Andrew: Oh no, it was once per month which may be the thing that changes the calculus but anyway.

Mike: It does. I agree with you. That would be pretty out, because there's no one person than I like care that much about. But if you could do it like every month where you can like pick a world leader one time or pick up a business person another time, or if you're trying to get your product launched some place like being able to just talk to them and say, I want you to look at my product. You have to sit here and have lunch with me. That could be a whole another world. Yeah that'll be pretty cool. I definitely did not picked that one, but now that you mention it, I think that that's — I don't remember it being once a month. I guess I didn't read it careful enough. I was so sucked in with a private jet maybe to read far enough along.

Andrew: Well, this about the answers for all that of course will be I’ll reveal in the write up in Q1.

Mike: Awesome. Let's get you back on and do with that. And until then, have a great holiday season. And we'll talk again in Q1.

Andrew: Yeah, you too Mike. Thanks for having me on. This is fun.

Mike: Thanks to Andrew.

And that's a wrap folks. I hope you guys enjoyed the 197th installment of the EcomCrew Podcast. Just as a reminder, you can go to EcomCrew.com/premium to sign up for the premium package. It's going to be opening back up here at the end of the month right around Cyber Monday. It will be the last time of the year that we're going to be doing that. And Abby wanted me to remind guys one more time to go to facebook.com/ecomcrew, hit the like button, join our Facebook community over there. Obviously no cost to do that and you get updates on some cool content. You can also see some behind the scenes of 5 Minute Pitch, which was really neat. And that's about it for this episode guys. Look forward to doing the next one in just a couple of days. As always, until the next time, happy selling and we'll talk to you soon.