Rebuilding a Million Dollar Brand: 3 Year Update

It has now been an entire three years since I launched this series tracking my progress in launching a brand straight from scratch. In this post I'll give a breakdown of my revenue numbers for the month of June 2020, how that compares to 2019, and a summary of my wins and losses for the year.

We have an episode about this subject on the podcast. If you'd like to listen, you can find the episode by clicking here.

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 24 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 18 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 12 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 6 month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 60 Day Update

Revenue Update

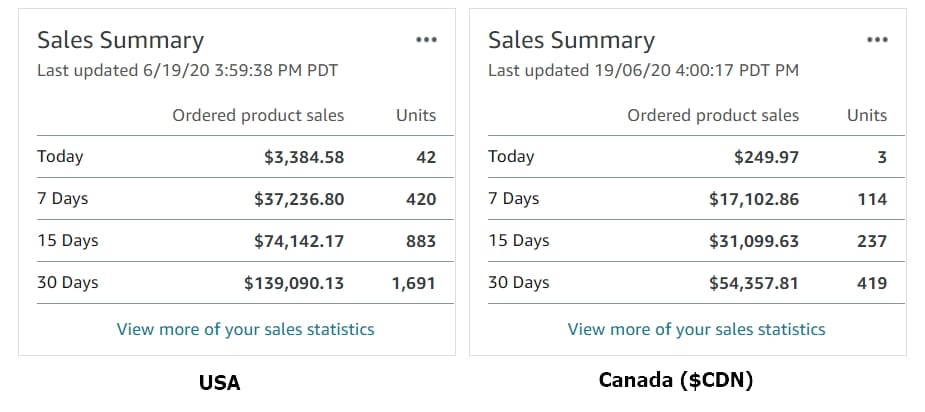

After three full years since starting my brand, revenues were just over $200,000 per month. This is just over 100% more than the same time 2019 and is roughly a $2.4 million/year run rate.

| July 2017 | April 2018 | July 2019 | June 2020 | |

| Amazon.com | $10,788 | $32,237 | $76,710 | $155,957 |

| Amazon.ca | $1,180 | $12,145 | $21,700 | $41,405 |

| eBay.com | $994 | $554 | $0 | $1,074 |

| Shopify | $552 | $629 | $2,469 | $4,230 |

| Total | $13,514 | $45,565 | $100,879 | $202,666 |

I often put June 2017 as day 0 for this brand as this was when inventory finally got into Amazon warehouses and available for sale (of course, I had spent a ton of time before this working on developing and sourcing the first products).

Above are the sales figures taken from my primary Amazon account. I also operate a second Amazon account that does around $15,000 a month in it.

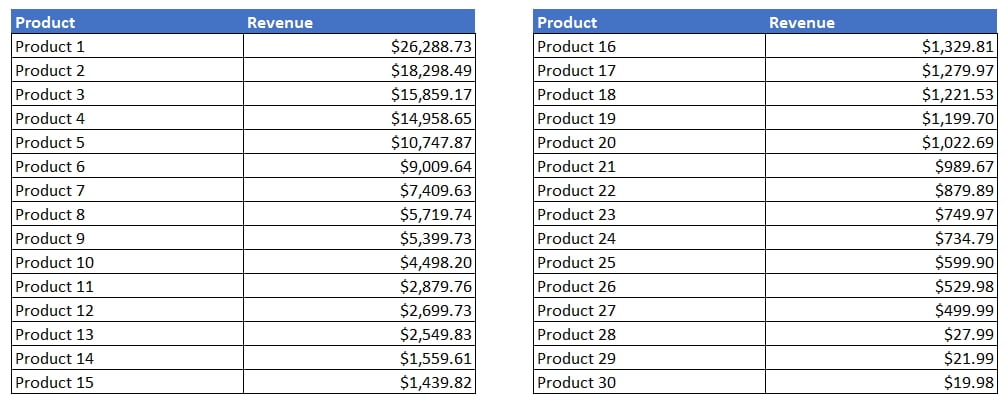

I now have approximately 20 products, though this is closer to 50 actual products if you take variations into account. Quite a few of these products ran out of stock during the month of June and my sales continue to follow the 80/20 rule as shown below, with a small number of products accounting for the majority of revenues.

Wins

- Photography overhaul & increase in Conversion Rates: Earlier this quarter I dedicated dozens of hours to totally revamping our photography and graphics design. This meant a few things:

Photoshop Retouching. Paying serious money for serious Photoshop retouching. Almost all of our products are difficult to shoot photos of. I spent close to $100 per photograph to have them retouched and the results were AMAZING.

VIP/Influencers Program. Heavily recruiting ‘influencers' for media. Most people utilize influencers to get them talking about their products. We use influencers primarily to get them to share pictures and videos of them using products in action on their 4x4s. We've had some incredible contributions which is fantastic for social proof.

3D Modeling. I employed a 3D modeler to do some creative shots showing the benefits of our products (i.e. a 3D model of how our fabrics are constructed). The results varied from great to poor. - Development of Some Custom Inventory Projection Tools: Stock outages have always been one of the Achilles heel of my brands as my strategy involves a high number of SKUs. Subsequently, I've developed some custom forecasting tools using Amazon's MWS API which have been big game changers in re-ordering inventory accurately and on time.

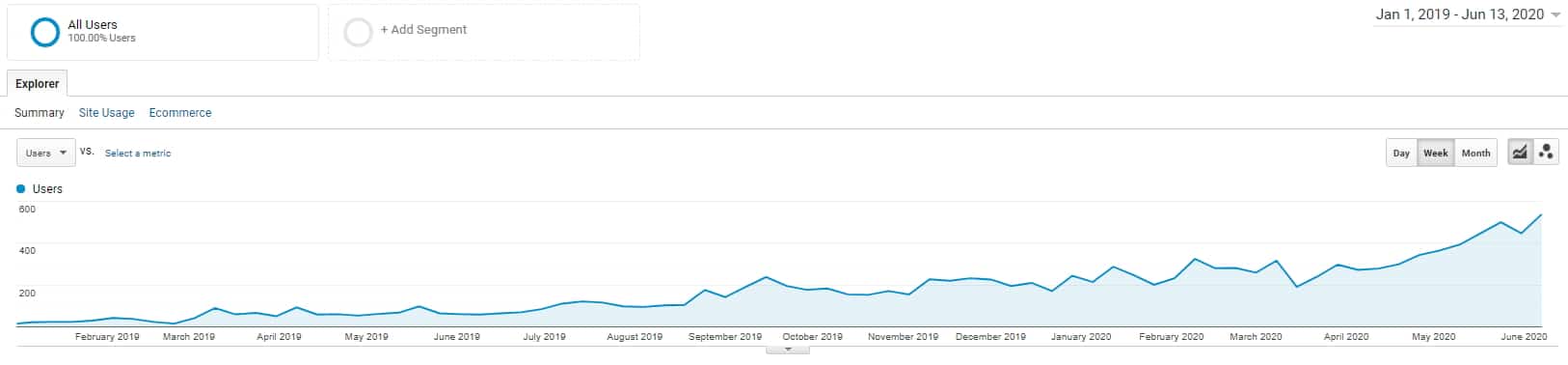

- Authority blog continues to grow: After launching at the end of 2018, my authority blog is continuing to get exponential growth. It's getting around 2000 organic visitors a month which isn't amazing but this is still free traffic which not only helps to promote my product brand but also helps to generate diversified affiliate income.

It's now generating $600-$1000/month in affiliate income which is pure profit. This is relatively small compared to the $200,000/month revenue that the product brand is bringing in, but it helps support the product brand sales in non-measurable ways, this revenue will continue to grow with minimal work, and content management and creation is a great entry level job for employees to begin at. - Lots of Additional Funding: Many ecommerce companies have benefited significantly from COVID and I've been one of them, specifically in terms of government funding. I've gotten 6 figures of either interest-free or low-interest loans from the government of Canada.

Losses

- April revenues down 50%. April was a terrible month with the extensive Amazon delays. Revenue was down 50% in April.

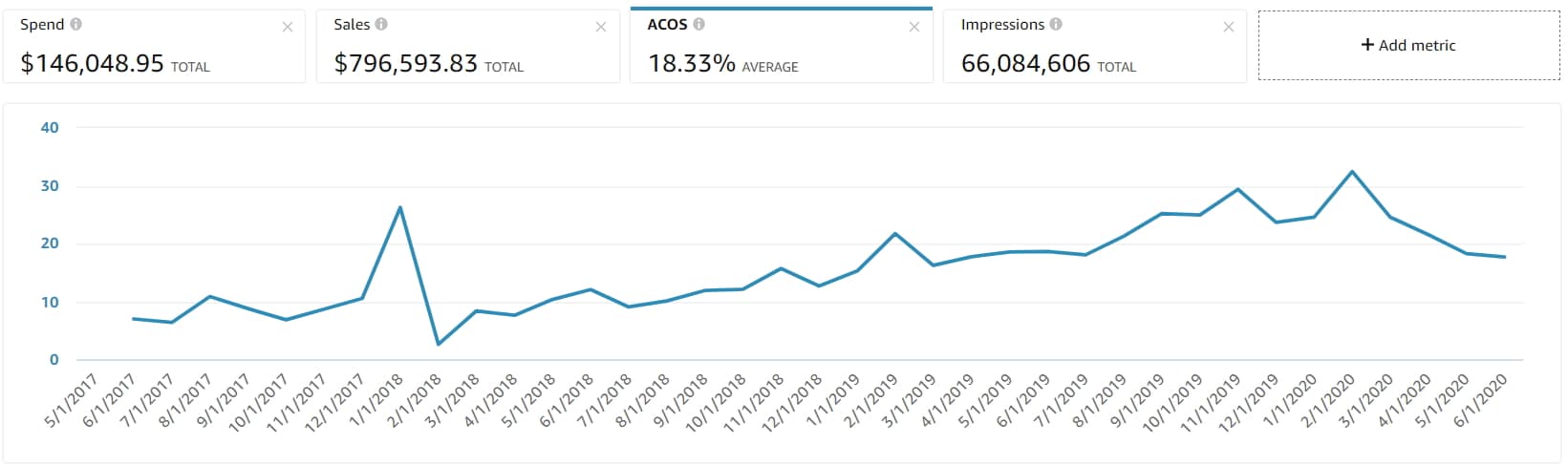

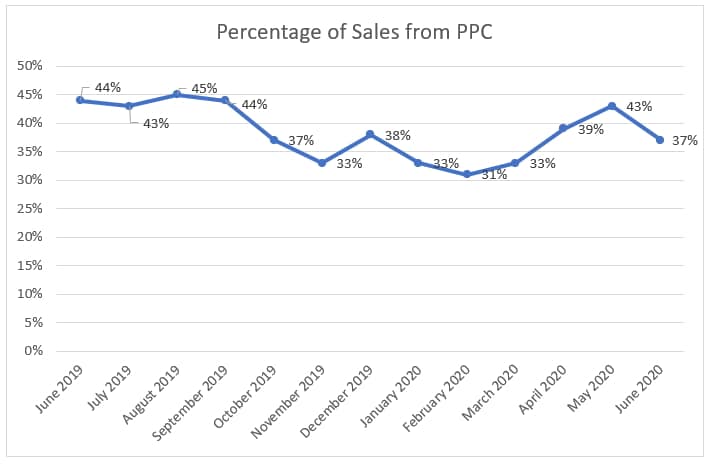

- PPC costs rising. Like most people, our PPC costs are continuing to rise. After COVID hit, I made the impetus to trim our PPC costs and our ACoS has been going down.

- Net profit margins are only about 10%. This is the net margin on my tax returns – the only truly comparable metric IMO. Duties are the major culprit here. Without the additional 25% duties we would be closer to 15-17% net margins. Without higher margins, it makes it difficult to invest in some other expansion plans I have (which involve hiring and leases, see below).

Goals for 2021

For the one or two people in the universe who have followed this series, they'll recall that in year one I was unsure if this was a brand that I would look to hold on to indefinitely or look to sell a few years down the road. I'm now pretty strongly in the boat of ‘hold and don't sell'.

More specific and short term goals for the next year include:

- Get revenues up to $300,000 per month: This will include the launching of at least two fairly unique new products I'm spending a generous amount of time and money developing.

- Potential physical location: I'm continuing to play with the idea of launching a physical location for both a show room and installation facility. This probably doesn't make a ton of sense from a business perspective but would fulfill a deep seated personal desire to have a physical footprint of the brand.

Conclusion

After three years, my newest brand is now doing roughly the same revenue my previous company was doing. When I sold that company it was sold for approximately a 3x earnings multiple. If you're a believer in market efficiencies, here's further proof that the market makes prices accurately. In summary, if you're debating selling a business for financial reasons, my opinion is that selling for a 3x multiple is never a great financial decision. The truth is though, the decision to sell a business is normally more for personal reasons than financial reasons.

How has your 2020 been so far? Are you up for the year or down? Let me know in the comments section below.

This is the last episode of your second ecommerce brand, correct?

es.

Very appreciative of this Dave. Inspiring to see what is possible in real life (while also running Ecomcrew!). I was curious, it seems you’ve had ~100%+ YOY growth for the past 3 years, while your 2021 goal is $300k (50% YOY growth?). Is that just a short term/baseline goal or a planned natural tapering off of growth rate with size?

Hi Jon,

The issue is at $500k, I had 5 products. To get to $1million I needed 5 more products. To get to $2million this meant 10 MORE products. To get from $2mil to $4m would mean 20 more products (for a total of 40). In short, it’s a lot easier to go from $1m to $2m than $2m to $4m. Also, cash flow and risk appetitive starts to become an issue as well.

great post Dave, insightful and helpful benchmarks for growth. Love seeing the impact from influencers and blog authority as we’re looking at doubling down on the same

Glad it helped :)

can you talk a bit more about getting the money from the Canadian government? you got the forty thousand dollar amountwhat about the rest?you said one hundred thousand dollar.which program was it??what did you have to do to get it?I

It was from BDC.

Hey Dave,

Guess I am one of the two who have been following you since day one! Keep up the great work! And thanks for all the great content you (and Mike) have been putting up over the years. You guys have been my go-to source since I started 3 years ago, and I attribute alot of my success to you guys.

While I haven’t got nearly as far as you in the last 3 years, I am pushing 350k this year, with a 19% net, while working full time.

Glad to see you have haven’t been hit too hard by COVID. Seems like people are out using there 4×4’s again!

One question: How do you deal with the stress of being so heavily reliant on Amazon? Right now, I have my business in ‘profit mode’ getting ready to sell in January. The reason being is that I want buy a different Ecom business not so heavily reliant on Amazon.

Although I would like to keep growing the business, my brand doesn’t really work to well with content (not really a ‘hobby’ product). I lose sleep thinking about what would happen if I got the ‘red flag’ one day, and I lost my last 3 years of work/money.

Maybe this is a similar situation that you were in with your first business? In my situation, would you keep growing the same business? Or ‘pivot’ and try to build up a more legitimate brand?

Thanks!

Cameron

There’ll be channel risk no matter how you sell. If you’re 0% Amazon then you’re almost certainly reliant on Google or Facebook. It sucks but it’s the reality. With Amazon, it’s pretty rare to get a non-recoverable first suspension. Google on the other hand can actually be far more punitive as well as Facebook.

As for dealing with channel risk and dealing with the stress of that, being diversified from an income and business standpoint really helps. I’m fortunate I have a couple of other sources of income (EcomCrew being one of them!). Having some money off the table helps as well. Unfortunately, these all tend to be something that come later in your business life – when I was in my 20s I was all-in with one business and it definitely kept me up at night at times.

Wow you’re such a badass businessman! You’re earning good money!!