Well kids, pop some popcorn and get ready to take a front row seat into my thought process of how to buy an ecommerce business. Not only am I going dive into my entire thought process, I'm going to use a real world example of a site I recently purchased. This is part one of a multi part series.

In this part I will cover the following:

– How to find ecommerce businesses for sale

– What a typical business listing looks like

– What to do after you find a listing you're interested in

– Evaluate ways you can improve the business

– Find red flags / reasons not to buy

How To Find Ecommerce Businesses For Sale

There are a handful of high quality “Business For Sale” marketplaces on the Internet. Perhaps the most well known is BizBuySell.com. It just so happens to be, that's where I found my most recent ecommerce site to purchase. BizBuySell.com is very reputable, has been around for years, and has thousands of listings at any one time.

Of course you will have to sift though listings for gas stations, restaurants, storage units, and other retail stores, but there are dozens of ecommerce websites on there at any one time.

One trick is to use the keyword Online, Internet, or Ecommerce while searching to narrow things down. However, I find that sometimes the juiciest deals are the ones where people aren't smart enough to put those keywords in their listing.

In addition to BizBuySell.com, here are a few other sites you might want to check out:

– EmpireFlippers.com

– Bizquest.com

– Flippa.com's Deal Room

– Latonas.com

– BusinessBroker.net

A Typical Listing

The vast majority of listings will be quite vague. Most of sellers are worried about sharing too much information with the general public; there is a lot of sensitive information that needs to change hands.

The listing I ultimately ended up purchasing was titled “10 Year Established Online Webstore”. Other examples of listings currently on BizBuySell.com are “Online Sports Collectible Business”, “Amazing Niche Online Internet Business”, and “Dropship Website Paintball Niche”. As you can see by these titles, they are typically a bit vague. So, you need to dig in and read the listings themselves, which often times do nothing more than wet your pallet.

Over 90% of the businesses being marketed on these Business Selling Marketplaces are represented by a broker. Brokers are basically sales people who specialize in buying / selling businesses. The reason most people hire a broker is a) to leverage their contacts b) run interference between those inquiring c) help with negotiations when it comes time for that d) help with escrow services. Brokers will normally take 10% – 15% of the sale for their services; the buyer doesn't pay any fees.

The other 10% are sellers who decided to take on the challenge of marketing their website themselves. In the end, I don't have a preference in the way I like to work. There are positive and negatives to both.

The site I ended up purchasing was listed by the seller himself and he included a lot more information than the typical listing; he even included the name of his site. Here is a copy of the listing I ended up purchasing. As you can see from the listing, the site is IceWraps.com and IceWraps.net. I will get into why this was the business I ultimately went with as we continue along though this post.

Again, the listing I ended up purchasing was atypical and had a lot more information than you're normally going to get. For reference, here is a more typical listing. As you can see, you typically get some vital information like the asking price, gross income, cash flow, when the business was established, number of employees, and a basic write up about the business. It's pretty rare to get any real meaty information from the listing, and even more rare to get the actual site name. However, there should be enough information here to know if it's not worth your time at all, or something you aren't interested in at all. For instance, you might open up a listing titled “Amazing Niche Online Internet Business” and find out they are in the ballet shoes niche. If you have no interest in ballet shoes, you can just move on.

I Found Some Sites I'm Interested In – What Next?

I typically click on / read 5-10 listings for every one I ultimately inquire about. Sometimes I'm interested because it was a well written listing and I want to know more. Other times the listing is so vague I need to inquire just to get some basic information.

All of the business listing sites have a slightly different procedure, but in general you fill out a form and wait to hear back. From there, you almost always need to fill out a NDA (Non Disclosure Agreement). The NDA basically says you won't tell anyone else about the sensitive information you are about to receive. Some of the brokers are more sophisticated than others; some make it easy with electronic signatures while others require print, sign, scan to get the job done.

Once the NDA is completed you should get a packet of information from the seller / broker that really gets into detail. You should expect to receive the following at this point:

– Name of the business

– P&L Statements for the business for at least the trailing 12 months

– A Questions and Answers statement from the owner

– Synopsis of the business written by the owner or broker

– Reason for selling the business

– Basic terms of sale

– Ways the owners sees to improve the business

At this point I end up eliminating about 90% of the businesses I receive information packets for one reason or another. One thing to keep in mind is that most sellers are very proud of their business and totally unrealistic as to what they can get for it.

It doesn't cost you anything to request the information and look it over and don't feel bad doing it. You're preparing to plunk down a large chunk of money and you should continue looking for the best deal and something you feel very comfortable with. I always say that if your gut tells you it's not the right opportunity, then it probably isn't. I looked at over 100 information packets before making this purchase.

How To Evaluate Information Packets You Receive

Now that you have an information packet, or if you're like me, you have dozens of information packets… what's next? Well, I could write an entire post about how to evaluate a business, or even a series of posts. However, I want to address a few keys here that I think are really important. Here are some things to be thinking about:

What Valuation Are They Looking For?

There are a few ways to look at the valuation of a business, but the one I care about most is looking at how many years it would take to make my money back. This is often referred to as a multiple of earnings. So, if you are paying 2.5x earnings that means it would take 2.5 years to make your money back from the investment of the business.

The way this number is calculated is taking gross revenue (all the income of the business), then subtracting all the business' expenses. The money left over is referred to as net income. That net income number is what is used to calculate the earnings multiple.

So if a business is making $100,000 a year in net income, and they are asking $250,000 for the business, then you are looking at paying 2.5x for the business. I personally don't like paying more than 2x-2.5x for a business because there are almost always hidden issues that come up. These issues can quickly inflate this number and make it turn out to be 3x or more.

Evaluating businesses that are asking for 3x or more earnings are very risky to me for a myriad of reasons, mostly that 3 years is an eternity in the ecommerce world and you are just taking on too much risk at that point.

Are There Ways For Me To Improve The Business?

After I establish that the business is selling for 2.5x or less, I look for ways I can improve the business to get that number down. While I'm willing to pay a business owner up to 2.5x for a business, I want to pay more like 1.5x in actuality. Let me explain… Lets use a fictitious business as an example. Lets say this business is generating $300,000 a year in sales, makes $100,000 a year in net profit, and the owner is asking for $250,000 (2.5x) for the business. Here are some basic things I look at in terms of improvements for the business to get my effective multiple down:

Website design / conversion rate

I love looking at websites that have decent sales numbers, but look awful. After years of experience, I can look at a site and generally tell “I can improve conversions rates by x% or more”. The uglier the site, the better. It just means that people are willing to buy in spite of a horrible design and is a very good sign. In my estimation, I can increase IceWraps.com's conversion rate by 25%. Using the example above, this would increase top line revenue by $75,000 and the bottom line by $25,000. Just this one improvement would decrease my payback period from 2.5x to 2x.

Lowering Expenses

The next thing I do is comb over the P&L statement and look for ways to cut expenses. With IceWraps.com there were so many expenses that just made me cringe and could easily be eliminated.

Things such as $595 per month to manage their Google Shopping campaign – GONE.

$400 a month to manage PPC – GONE.

Over $500 a month in useless SAS services for an antiquated Yahoo store – GONE.

$150 a month for Microsoft Exchange email – GONE.

Ok, you get the idea… All told I was able to add up over $3,000 a month in useless expenses. Using the example above again, this additional $36,000 a year that would go towards the bottom line by reducing useless expenses would lower my payback from 2.5x to 1.8x.

Economies Of Scale

The next thing I look for are additional savings I might be able to obtain by assimilating the new business into my own. For instance, I already have a warehouse I pay rent for and have additional room in. I already have full time employees that do support and pick / pack. I already pay for SAS services that allow me to add unlimited channels. So, in terms of IceWraps.com, I was able to discount the rent they were paying along with two full time salaries that were unnecessary for me to continue with.

Lowering COGS

At this point I start asking questions about how the business sources its inventory. Are they buying in bulk and getting discounts? Are they paying cash and getting discounts? Are they asking for free freight? It's taken quite a bit of work, but I've been able to lower my COGS (Cost Of Goods Sold) by 5% – 10% with IceWraps.com by implementing several tactics I talk about in this blog post.

Additional Channels

Is the business leveraging all the available sales channels such as eBay, Amazon, shopping feeds, etc? If not, then there is an opportunity for growth here. It's easy to list items on Amazon or eBay when you already have relationships with vendors and the items in stock. Additional channels such as these can add up to 5% – 50% of your business depending on the industry.

Are There Any Red Flags?

Now that I've stroked my ego and looked at ways I can improve the business, I think it's important to start looking at red flags. I approach any purchase with the thought process of “Why I Should NOT Buy This Business” and not “Why I Should Buy This Business”.

At first it will seem very exciting to buy a business, it's a very natural feeling. It's not unlike going to the mall and buying some clothes, or buying a new car. It just feels all warm and fuzzy inside. However, once the reality of running the business sets in, it feels “less good”.

I'm not saying that you should evaluate yourself to death and thereby never being able to make a decision, but I strongly encourage you not to be over eager at the same time. Here are some things I always look for:

Profit and Loss Statement

I mentioned above that I like to comb the P&L to see ways I can improve the business, or make more money. However, the P&L is a great place to look for red flags too. Here are some things that scare me:

- No P&L – If the seller can't provide a P&L that scares the crap out of me. It makes me wonder what they are trying to hide. Oftentimes it makes my BS-Dar alarm go nuts.

- Round Numbers – I also get really nervous if the P&L I'm provided has a bunch of round numbers on it. That almost always means that the owner is just guessing and they aren't real numbers.

- Basic Test – I like to run some basic litmus tests to see if the numbers make sense. Are their gross profit and net profit margins in line with reality? If not, WHY???

In the case of IceWraps, the seller couldn't produce a P&L originally and finally was able to come up with one that had nothing but round numbers. It was definitely a major red flag and something I was able to ultimately get comfortable with in the due diligence process. This is by far the exception and not the norm though.

Traffic and / or Penalties

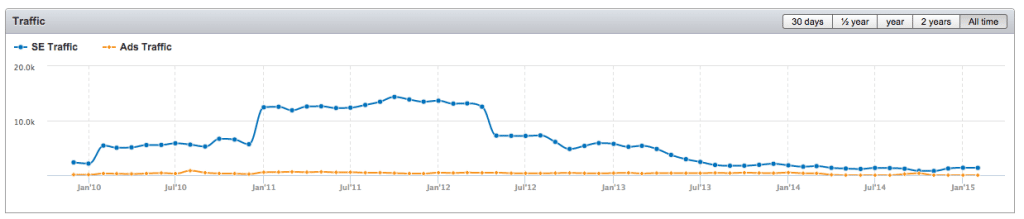

I want to look at the traffic stats both via SEMRush.com and Google Analytics. With SEMRush is't a third party that can help verify what's going on before even looking at analytics. I like to see an upward trend in traffic and get really scared when I see big drops in traffic around 2012, when Google Panda came out. If I see a drop like that my toes curl up and I don't get comfortable again until I'm 100% sure they weren't hit with a link or manual penalty.

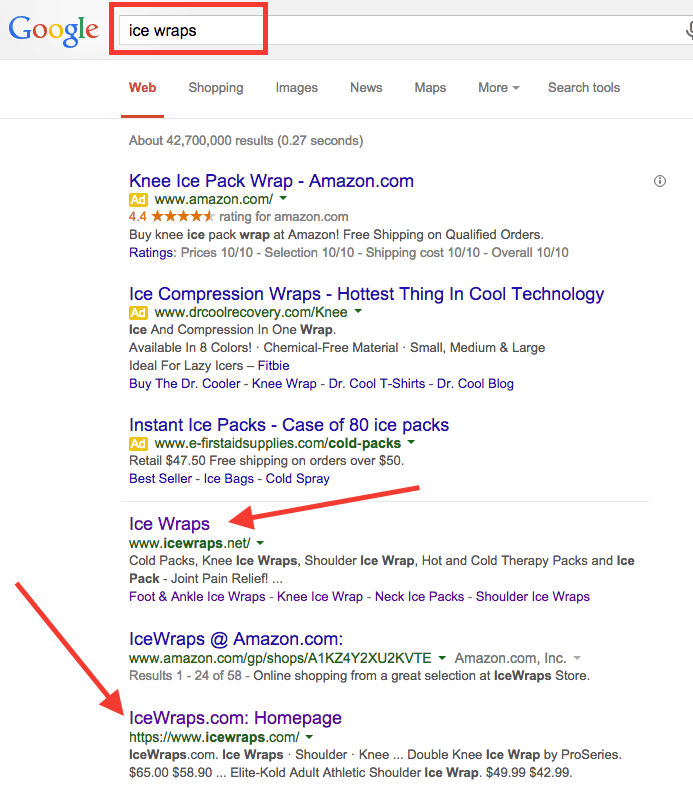

In the case of IceWraps, I could tell by their link profile they never did any blackhat SEO. After reviewing the site, I could tell the issues are algorithmic based on thin content, a slow website, and poor ecommerce platform. Again, it's the exception, not that norm that I can gain comfort here, but I ultimately did. The main reason I was able to get comfortable is because they still ranked number 1 for their main head term – Ice Wraps. That's a REALLY good sign; a site that is manually penalized won't show up in the top 10 pages. Here is IceWraps's traffic and rankings so you can see what I'm talking about.

New Business

I can't tell you how many businesses I see, once I get the info packet that turn out to be less than two years old. I think you would have to be absolutely crazy buying a business this young. I saw a business for sale the other day that is only 6 months old for $600,000. The reason I'm looking to acquire a business is to be sure it's a prooven business model and has stability. If the business is less than two years old, I feel like I'm much better off just replicating what they have done and try to do it better. IceWraps was a 10 year old business with lots of history and juicy historical data – I like that!

Requires Very Little Time To Run

When I see a listing that says “Requires very little time to run”, that's exactly what I do, run the other direction. If you are in this looking for a get rich quick scheme, then you are looking into the wrong business. Ecommerce sites don't run in less than 10 hours a week. If they are really spending that little time, then they don't have a real business. Sure, you could put more time into building it out and doing all things that they haven't done, but you will be taking on all the risk to prove out those ideas.

Has No Employees

When I see a business that has no office or employees I get really worried. Again, those aren't real businesses, or they are “owner operated” businesses. Owner operated businesses almost never account for, or have any salaries on the P&L for the owners. I can't tell you how much of a trap that is. When you take over the business you are going to have to do one of two things 1) Hire someone to help run the business for you (at a cost) or 2) take over the business yourself (congratulations, you just bought a job).

It is not an acceptable answer to me when the seller says “Well, that will be up to you on how to run the business moving forward”. That is true, but I'm going to add in salaries to my projections, which will lower my offer substantially. With the example I've been using of a business that brings in $300k, nets $100k, and is selling for $250k at 2.5x earnings… my calculations is going to change dramatically. I'm going to add a normalized salary back into the mix of say $40,000 a year to hire a support person. Now the business is suddenly netting $60,000 per year ($100,000 – $40,000) and that same 2.5x number comes out to $150,000. That's a far cry from $250,000 and often makes negotiations break down. That's fine, there is always another opportunity and let some other sucker fall in that trap!

With IceWraps they had rent and two full time employees accounted for.

What's Next

This is part one of a multipart series of how to buy an ecommerce business where I used a real world example of a business I purchased. In this part I covered the initial aspects of how to find a business and start evaluating it. In part two I will dive into my exact negotiation process and the questions I asked. I will get very specific and show you the exact numbers I had to do my evaluation.

I came across one of your blogs a couple of days ago, and I just had to read your other articles. They are very informative and detailed. Thank you for sharing your knowledge and experiences with your readers.

I can’t wait to read your Part Two of this article

Thank you!

Excellent information. I have already learned a lot from this 1st article I’m reading on your site. Thank you very much for sharing the information.

Glad you found it helpful Yen. Enjoy the rest of our content and welcome to EcomCrew!

Will you have the part II soon? Thanks.